India achievesIndia’s agriculture sector has hit a historic milestone with record foodgrain production of 3539.59 LMT in FY25, driven by favorable monsoons and robust policy support. This blog explores the implications for agro-based sectors, food processing industries, agri-inputs, and farm equipment manufacturers, along with top companies to watch for long-term investors.

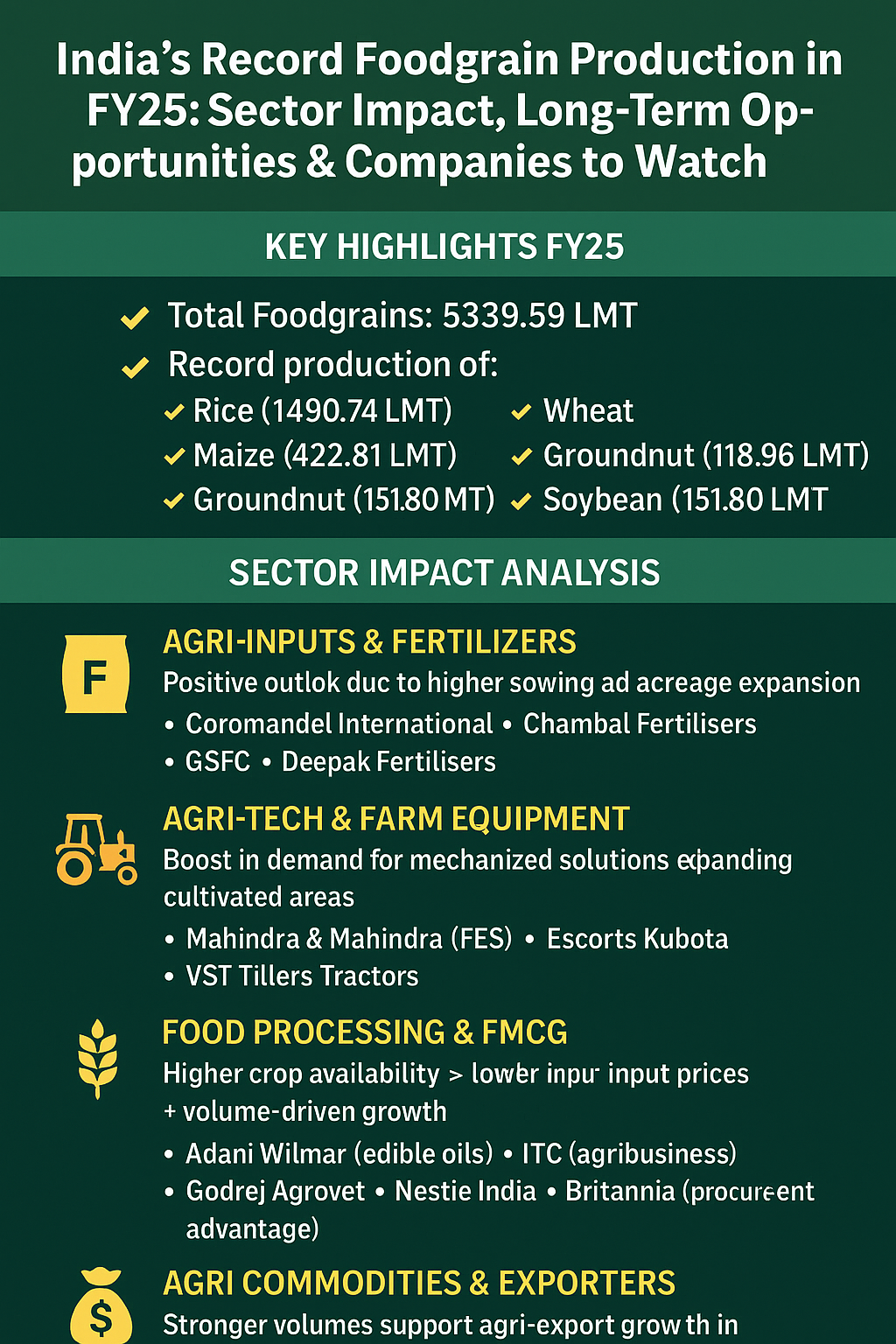

🌾 Key Highlights from the Third Advance Estimates FY25:

| Crop Category | FY25 Production (LMT) | YoY Growth | Notable Records |

|---|---|---|---|

| Total Foodgrains | 3539.59 | +6.5% | ✅ Record High |

| Rice | 1490.74 | +112.49 | ✅ Record |

| Wheat | 1175.07 | +42.15 | ✅ Record |

| Maize | 422.81 | +35.91 | ✅ Record |

| Total Pulses | 252.38 | +9.92 | |

| Moong | 38.19 | +7.16 | |

| Tur | 35.61 | +1.44 | |

| Total Oilseeds | 426.09 | +29.40 | ✅ Record in Soybean & Groundnut |

| Soybean | 151.80 | +21.18 | ✅ Record |

| Groundnut | 118.96 | +17.16 | ✅ Record |

| Sugarcane | 4501.16 | - | |

| Cotton (Lakh Bales) | 306.92 | - | |

| Jute (Lakh Bales) | 84.33 | - |

🏭 Sector Impact Analysis

📌 1. Agri-Inputs & Fertilizers

Positive Outlook due to higher sowing and acreage expansion.

Companies to Watch:

Coromandel International

Chambal Fertilisers

GSFC

Deepak Fertilisers

📌 2. Agri-Tech & Farm Equipment

Boost in demand for mechanized solutions with expanding cultivated areas.

Companies to Watch:

Mahindra & Mahindra (FES)

Escorts Kubota

VST Tillers Tractors

📌 3. Food Processing & FMCG

Higher crop availability = lower input prices + volume-driven growth.

Companies to Watch:

Adani Wilmar (edible oils)

ITC (agribusiness)

Godrej Agrovet

Nestle India & Britannia (procurement advantage)

📌 4. Agri Commodities & Exporters

Stronger volumes to support agri-export growth in wheat, rice, and oilseeds.

Companies to Watch:

KRBL (Basmati)

LT Foods

Avanti Feeds (indirect benefit via soybean availability)

📌 5. Textiles & Cotton Value Chain

Stable cotton output to benefit spinners and apparel exporters.

Companies to Watch:

Vardhman Textiles

KPR Mill

Welspun India

🔍 Long-Term Investment Themes:

Growing self-reliance in agri-production supports food security and export potential.

Focus on Shree Anna (Millets) aligns with global superfood trends – invest in organic and specialty food companies.

Sustained government reforms, irrigation expansion, and digital agriculture will modernize the agri value chain.

📌 Disclaimer:

This blog is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy/sell securities. Investors are advised to conduct their own research record foodgrain output of 3539.59 LMT in FY25! Explore sector-wise impact, top beneficiary companies, and long-term investment ideas for agriculture-related stocks.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)