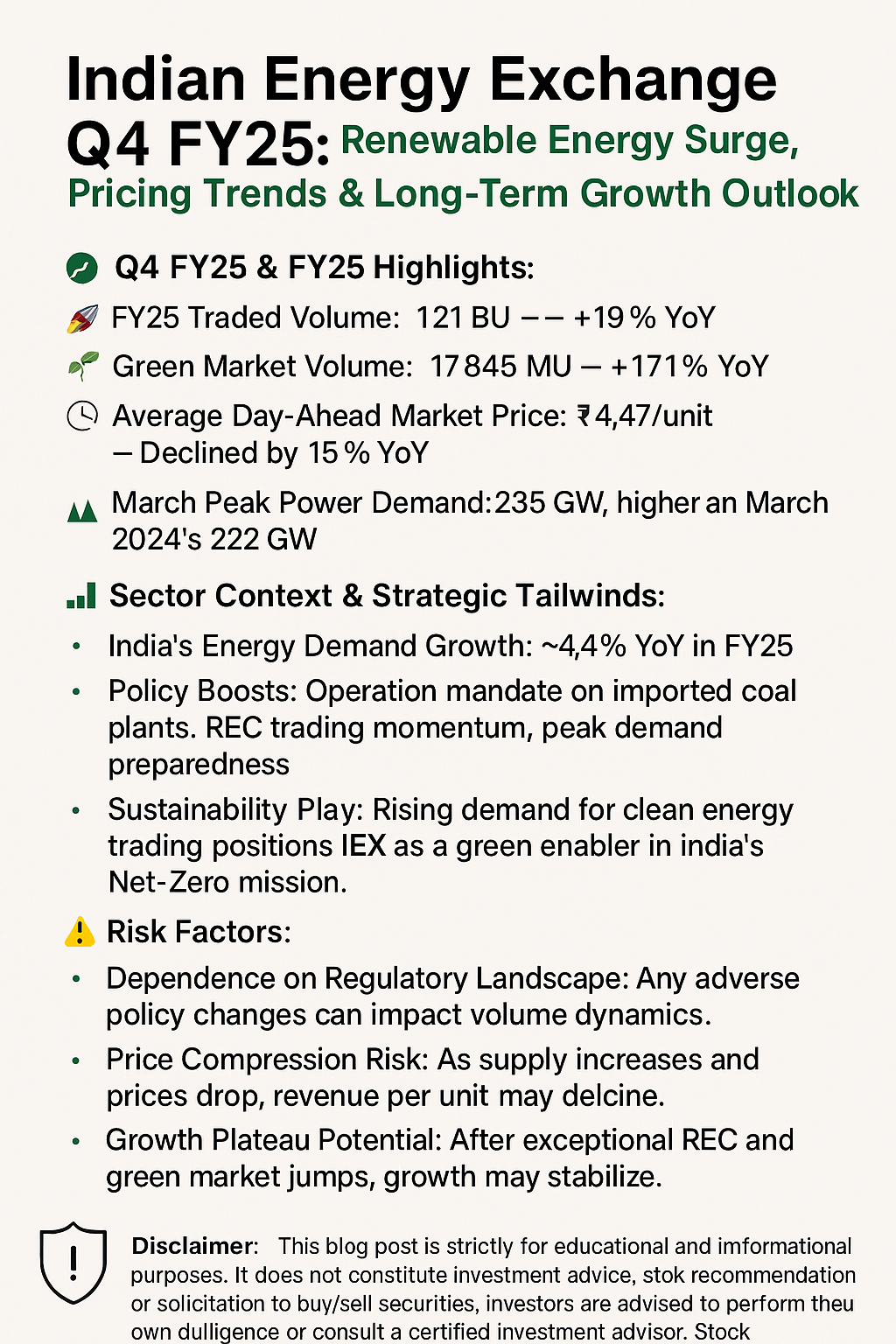

🔎 Q4 FY25 & FY25 Highlights:

FY25 Traded Volume: 🚀 121 BU — Highest ever, +19% YoY

Green Market Volume: 🌿 8,746 MU — +171% YoY

RECs Traded: 178 lakh — +136% YoY

Average Day-Ahead Market Price: ₹4.47/unit — Declined by 15% YoY

March Peak Power Demand: 235 GW, higher than March 2024’s 222 GW

📈 Sector Context & Strategic Tailwinds:

India’s Energy Demand Growth: ~4.4% YoY in FY25

Policy Boosts: Operation mandate on imported coal plants, REC trading momentum, peak demand preparedness

Sustainability Play: Rising demand for clean energy trading positions IEX as a green enabler in India’s Net-Zero mission.

🎯 Investor Benefit Perspective:

IEX operates a Duopolistic digital platform for electricity trading—no direct competitor at scale.

As power demand compounds, volumes on the exchange are likely to surge, leading to margin and scale benefits.

The platform benefits from regulatory enablers like CERC and Ministry of Power reforms, enhancing revenue visibility.

⚠ Risk Factors:

Dependence on Regulatory Landscape: Any adverse policy changes can impact volume dynamics.

Price Compression Risk: As supply increases and prices drop, revenue per unit may decline.

Growth Plateau Potential: After exceptional REC and green market jumps, growth may stabilize.

🧠 Long-Term Eagle-Eye View:

For investors seeking exposure to energy infrastructure, renewable transition, and utility-based cash flows, IEX is a niche, high-visibility long-term compounder.

🛡 Disclaimer:

This blog post is strictly for educational and informational purposes. It does not constitute investment advice, stock recommendation, or solicitation to buy/sell securities. Investors are advised to perform their own due diligence or consult a certified investment advisor. Stock markets are subject to market risk.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025