🔍 Info Edge (India) Ltd. Q4 FY25 & FY25 Results Analysis: Detailed Investor Insights

🌐 Company Overview: Info Edge (India) Ltd., a pioneering force in India's internet-based services, operates leading platforms such as Naukri.com, 99acres, Jeevansathi, and Shiksha. With deep investments in digital-first businesses like Zomato and PB Fintech, Info Edge is a strategic player in recruitment, real estate, education, and food tech sectors.

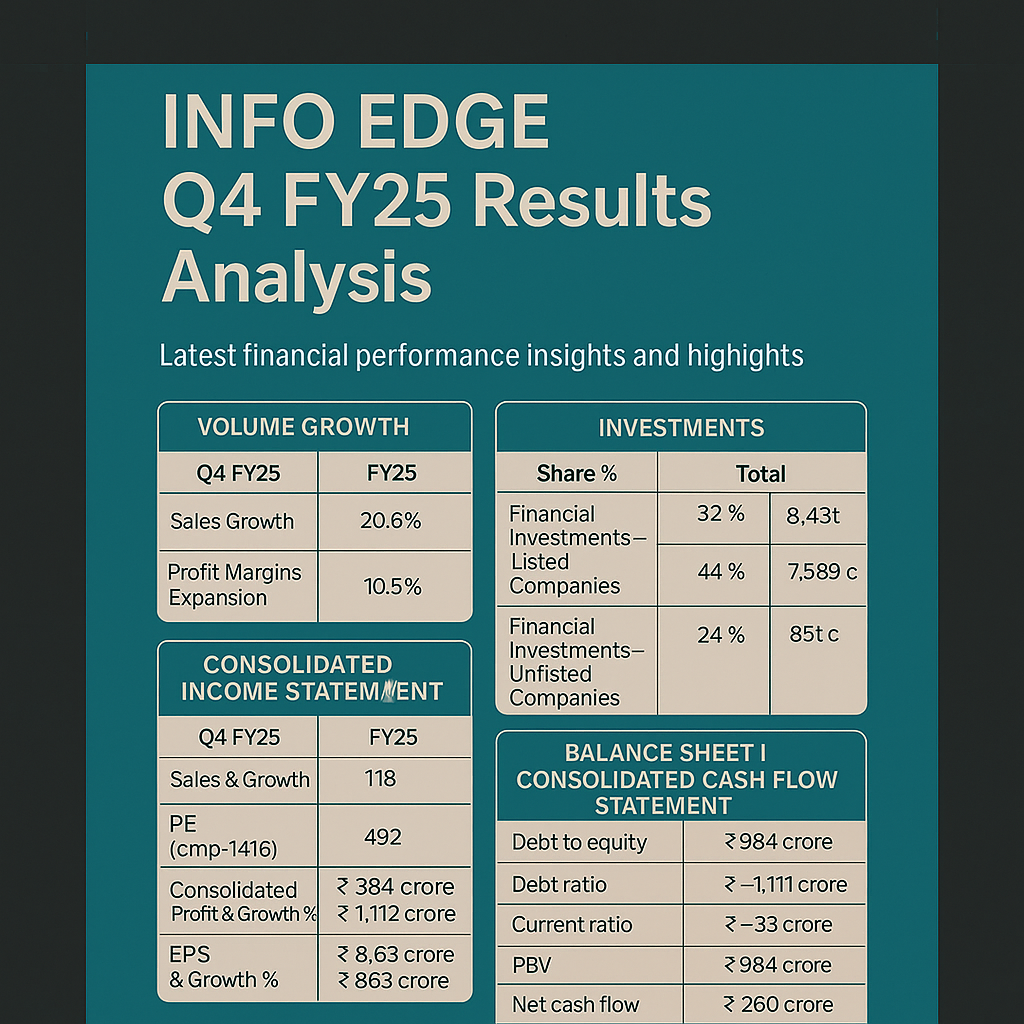

📊 Key Financial Highlights (Standalone & Consolidated)

| Metric | Q4 FY25 | FY25 | Growth YoY (%) |

|---|---|---|---|

| Revenue from Operations (in ₹ Cr) | 6,870.92 | 26,536.13 | 11.4% |

| Total Income (incl. Other Income) | 7,654.59 | 29,673.88 | 12.4% |

| Total Expenses | 4,556.04 | 16,802.84 | 11.3% |

| Profit Before Tax | 3,174.99 | 13,435.11 | 20.7% |

| Net Profit (after tax) | 2,550.65 | 7,734.20 | -7.2% |

| EPS (Basic, ₹) | 3.94 | 11.96 | -7.4% |

| PE Ratio (CMP ₹1416) | 359.39 | 118.41 | - |

| Interest Coverage Ratio | 16.69 | 16.03 | - |

📊 Segment-wise Performance

| Segment | Q4 FY25 Revenue (₹ Cr) | FY25 Revenue (₹ Cr) | YoY Growth | FY25 Segment Profit (₹ Cr) |

| Recruitment Solutions | 5,112.44 | 19,826.18 | 9.8% | 11,164.01 |

| 99acres (Real Estate) | 1,058.00 | 4,107.93 | 16.9% | -475.25 |

| Others (JS & Shiksha) | 700.48 | 2,602.02 | 15.9% | -559.40 |

Recruitment continues to be the core profit engine.

Real estate segment has shown revenue recovery but still reporting losses.

💰 Strategic Investment Portfolio

| Category | FY25 Value (₹ Cr) |

| Financial Investments - Listed | 2,76,139.34 |

| Strategic Investments (Zomato, etc.) | 23,176.93 |

| Unlisted Financial Investments | 11,483.70 |

Investment revaluation loss in Q4 due to market volatility: ₹90,757 Cr

📈 Balance Sheet Highlights (FY25)

| Metric | FY25 |

| Equity Share Capital | ₹1,294 Cr |

| Other Equity | ₹275,719 Cr |

| Total Assets | ₹329,995 Cr |

| Total Liabilities | ₹52,982 Cr |

| Debt to Equity Ratio | 0.00003 |

| Current Ratio | 2.43 |

| Price to Book Value (PBV) | 5.14 |

| Trade Receivables | ₹131 Cr |

| Cash & Equivalents | ₹1,043 Cr |

📊 Cash Flow Summary (FY25)

| Metric | ₹ Cr |

| CFO (Cash Flow from Operations) | 9,844.58 |

| CFI (Investing Activities) | -6,712.05 |

| CFF (Financing Activities) | -3,539.92 |

| Net Cash Flow | -407.39 |

| Estimated Free Cash Flow | ~9,500 |

🚀 Outlook & Investor Takeaways

Recruitment Outlook: With India’s formal job economy expanding and IT/BFSI hiring steady, Naukri is well-positioned for continued growth.

Real Estate Potential: Recovery in property listings is visible; breakeven expected in 1-2 years with monetization strategies.

Investment Book: Strategic holdings may unlock value over FY26-FY27 amid stabilization in public markets.

Liquidity Strength: The company’s free cash flow and cash reserves support further growth and acquisitions.

Leadership Continuity: Re-appointment of Sanjeev Bikhchandani and Hitesh Oberoi strengthens execution confidence.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)