📊 Kajaria Ceramics Q4 FY25 Results Analysis 📈

💡 Recent Insights & Highlights

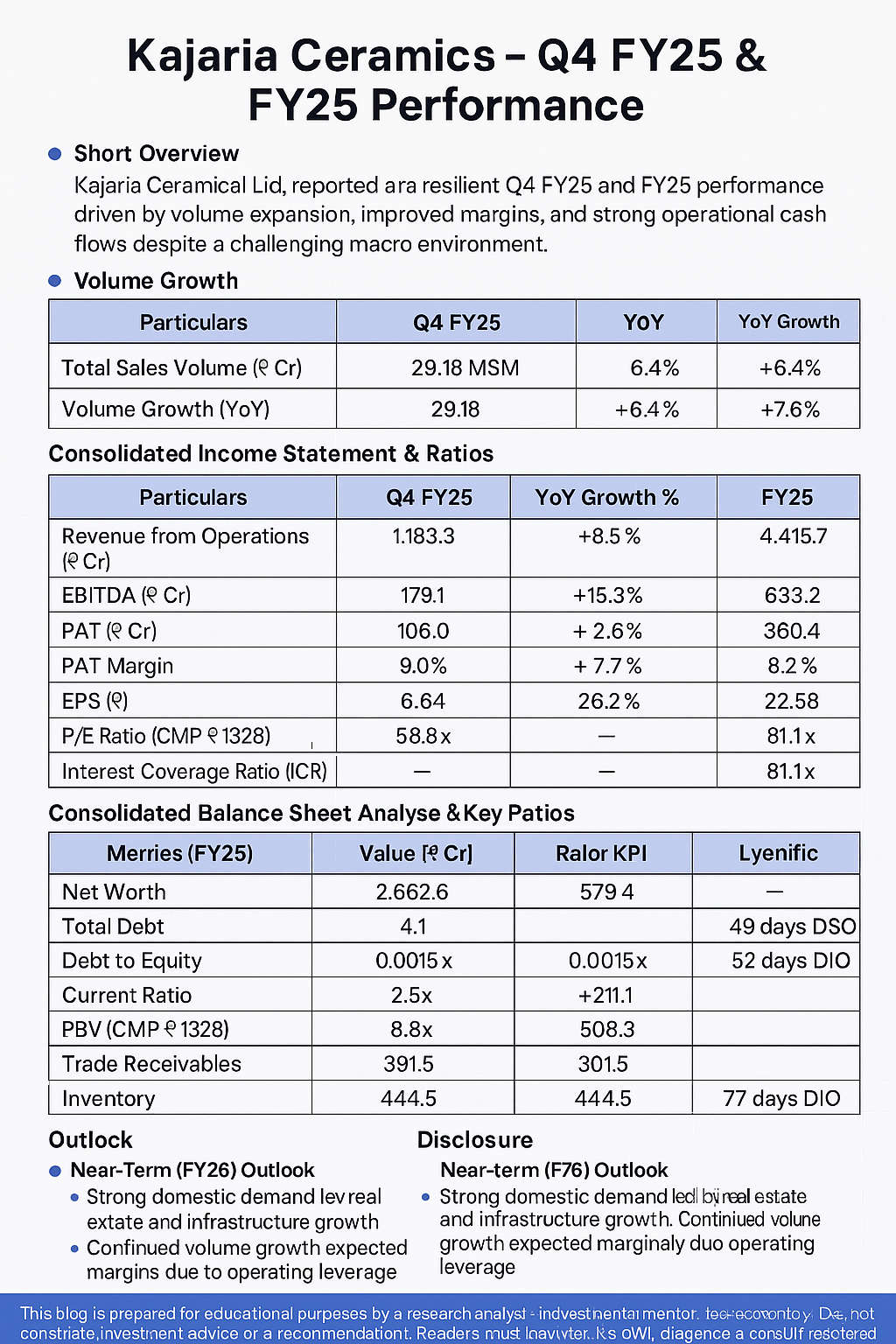

Soft demand 📉: 2% YoY tile volume growth in Q4, 6% in FY25 (115 MSM).

Margin pressure ⚖️: EBITDA margin fell to 10% in Q4 (vs 13.86% YoY) due to bathware losses, UK operations, and plywood provisions.

Profit decline 💸: Consolidated PAT dropped 58% YoY to ₹43 Cr in Q4; FY25 PAT fell 30% to ₹294 Cr.

Plywood exit 🚪: Discontinued operations led to ₹112 Cr exceptional loss in Q4.

📦 Volume Growth

📋 Consolidated Income Statement

📊 Key Ratios

Interest Coverage (ICR) 🏦: 13.46x (Q4), 19.03x (FY25)

PE Ratio (CMP ₹798) 📊: ~43.2x (based on FY25 EPS of ₹18.48)

📊 Consolidated Balance Sheet KPIs

💵 Consolidated Cash Flow Statement & Ratios

🔮 Near-Term & Short-Term Outlook

Cost optimization 🔧: Plans to streamline expenses to improve margins.

Expansions 🏭: Adhesive plant in Gailpur (operational by June 2025).

Subsidiaries 🏢: Bathware expected to turn profitable in FY26; UK operations scaled down.

📢 Disclosure: Forward-looking statements involve risks like demand fluctuations and operational challenges1.

All data sourced from Kajaria Ceramics’ Investor Release (May 6, 2025).

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)