Larsen & Toubro (L&T) Q4 FY25 & FY25 Financial Analysis

1. Key Highlights

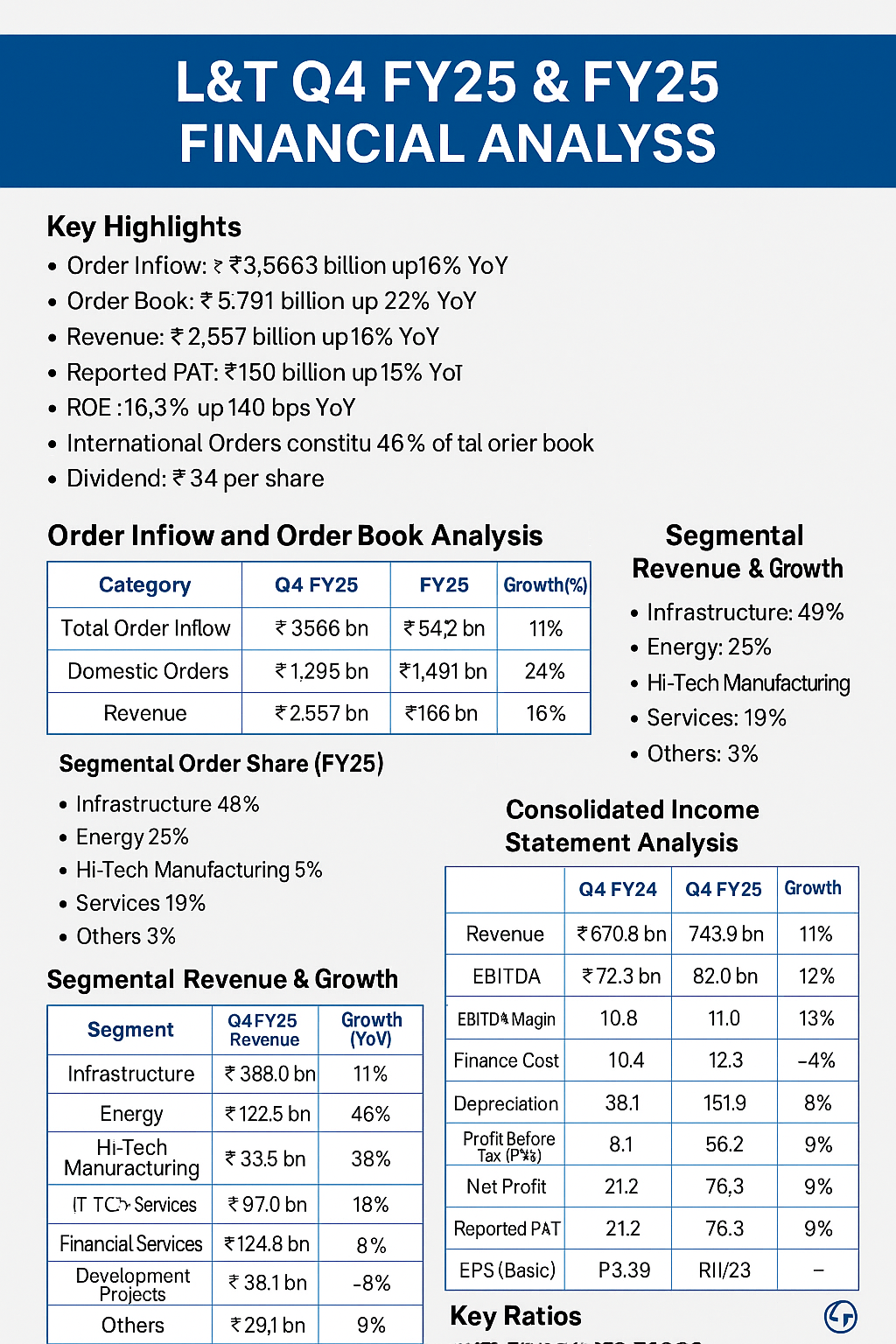

Order Inflow: ₹3,566 billion (up 18% YoY).

Order Book: ₹5,791 billion (up 22% YoY).

Revenue: ₹2,557 billion (up 16% YoY).

Reported PAT: ₹150 billion (up 15% YoY).

ROE: 16.3% (up 140 bps YoY).

International Orders: 46% of the total order book.

Dividend: ₹34 per share.

2. Order Inflow and Order Book Analysis

Segmental Order Share (FY25)

Infrastructure: 49%

Energy: 25%

Hi-Tech Manufacturing: 5%

Services: 19%

Others: 3%

3. Segmental Revenue & Growth

4. Consolidated Income Statement Analysis

5. Balance Sheet Analysis

6. Consolidated Cash Flow Analysis

7. Key Ratios

PE Ratio (CMP: ₹3,320): 22.1x

Interest Coverage Ratio (ICR): 6.5x

ROE: 16.3% (up 140 bps YoY)

Net Working Capital (NWC) as % of Revenue: 11.0% (down from 12.0%)

8. Near-Term & Short-Term Outlook

Strong order book across diversified sectors provides revenue visibility.

Focus on timely project execution and margin stability.

Expansion in renewable energy, green hydrogen, and digital infrastructure.

Emphasis on international growth, especially in the Middle East and Europe.

Dividend policy remains shareholder-friendly with ₹34 per share.

9. Disclosure

This analysis is for educational purposes and should not be considered financial advice. Investors are advised to conduct their own research before making investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)