📍 MapmyIndia Partners with Department of Posts to Power India’s Digital Addressing System

1. Announcement Summary

On 29th August 2025, the Department of Posts (DoP), Ministry of Communications signed a Memorandum of Understanding (MoU) with MapmyIndia–Mappls, a leader in digital mapping, IoT, and geospatial solutions.

Objective: To integrate DIGIPIN, India’s National Digital Addressing System, with MapmyIndia’s advanced mapping APIs and SDKs.

Benefits: DIGIPINs will enable standardized, accurate, and digital addresses accessible through the Know Your DIGIPIN app and the Mappls app.

Ecosystem Impact: Enterprises, developers, and government agencies can embed DIGIPIN into their platforms, enabling Address as a Service (AaaS) nationwide.

2. Strategic Importance for MapmyIndia

Short-Term Impact (0–2 years)

Revenue Visibility: Increased licensing of APIs & SDKs for DIGIPIN integration.

Government Visibility: Stronger positioning as a trusted partner in national digital infrastructure projects.

Adoption Catalyst: Initial traction from government agencies, courier/logistics firms, and e-commerce platforms.

Investor Impact: Near-term revenue growth may remain moderate, but valuation multiples could expand due to higher visibility and market positioning.

Long-Term Impact (3–10 years)

Address as a Service (AaaS): DIGIPIN adoption could become mandatory or industry-standard, embedding MapmyIndia deeply into India’s delivery, fintech, e-commerce, and public services ecosystem.

Scalability: Unlocks massive recurring revenue opportunities from billions of address verifications, navigations, and transactions.

Moat Expansion: Strengthens MapmyIndia’s competitive moat against global players (Google Maps, Here Technologies) by aligning with government-backed standards.

Quantitative Upside:

If DIGIPIN adoption scales to 50 crore active users, even a ₹10 per user annual API monetization could translate to ₹5,000 crore in recurring revenues over time (vs. FY25 revenue base of ~₹900 crore).

High-margin API business could significantly expand EBITDA and PAT margins.

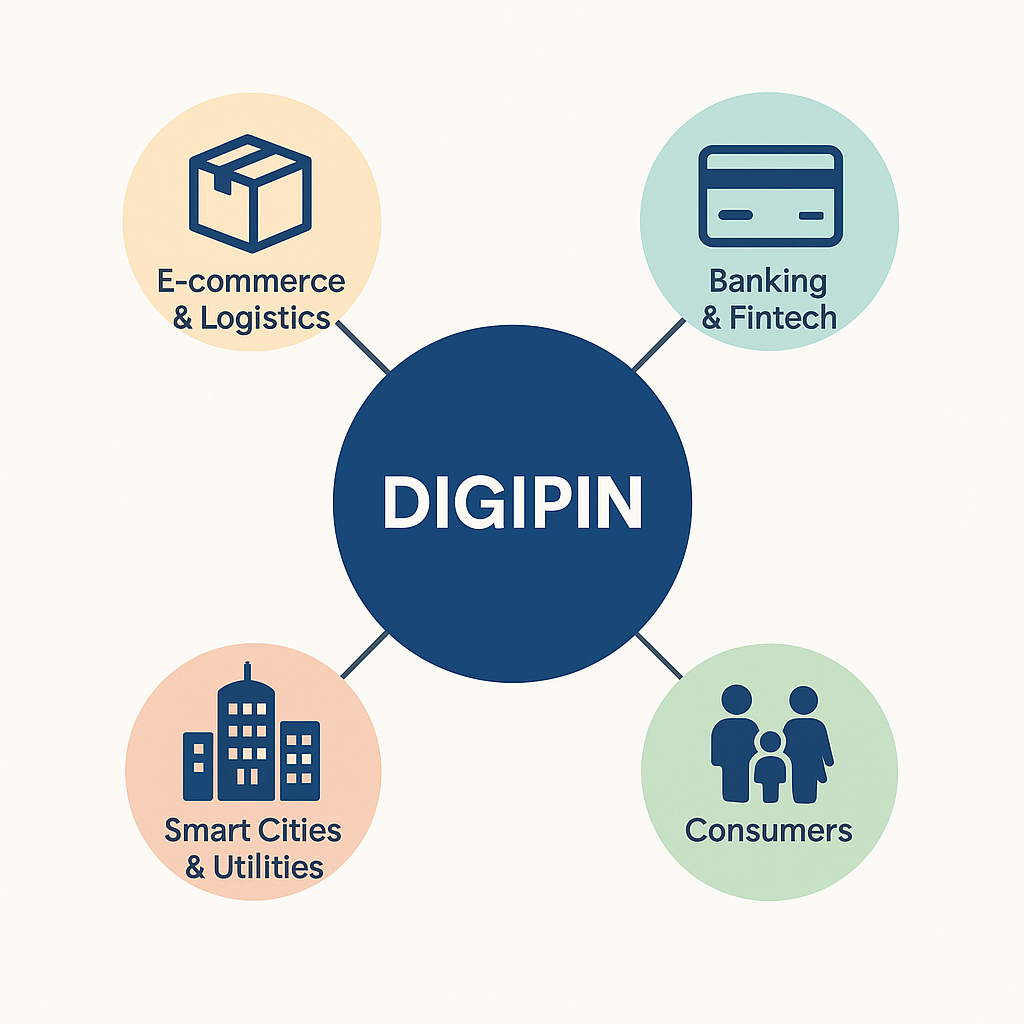

3. Sector & Industry Implications

E-commerce & Logistics: Faster deliveries, reduced address errors, and cost savings.

Banking & Fintech: Reliable KYC, fraud prevention, and last-mile reach.

Smart Cities & Utilities: Location-based governance, emergency services, and infrastructure planning.

Consumers: Easier navigation, service delivery, and inclusion for rural/remote households.

4. Risks & Challenges

Adoption Lag: Businesses may take time to fully shift to DIGIPIN.

Competition: International mapping players could attempt parallel systems.

Execution Risk: Smooth integration and large-scale rollout depend on DoP & MapmyIndia’s coordination.

5. Investor Takeaways

✅ Action for Existing Investors

Hold / Add on Dips: This MoU cements MapmyIndia’s long-term growth visibility. While earnings impact may be gradual, the strategic significance is enormous.

Valuation Premium: Expect market to assign a digital infrastructure premium similar to leading GovTech & digital economy plays.

Portfolio Fit: Best suited for long-term investors looking at India’s digital transformation theme.

⚠️ Short-Term Traders

Stock may see event-driven momentum but fundamental earnings uplift will take time. Trade cautiously.

6. Conclusion

The DoP–MapmyIndia partnership marks a historic step in India’s digital infrastructure journey, positioning MapmyIndia at the center of the national addressing ecosystem. While short-term revenue impact is limited, the long-term potential is transformational, potentially making MapmyIndia a core digital infra play in India’s next decade of growth.

📌 Disclosure

This blog is for educational and informational purposes only. It does not constitute investment advice or a stock recommendation. Investments in equities are subject to market risks.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)