🚢 Mazagon Dock Q4 & FY25 Results: Order Book, Margins, Valuations & Outlook

Mazagon Dock Shipbuilders Ltd. (MDL) has delivered a resilient performance in Q4 and FY25, reinforcing its position as a monopoly player in India’s defence shipbuilding space. From multi-decade profit consistency to a robust order book, here's everything investors need to know.

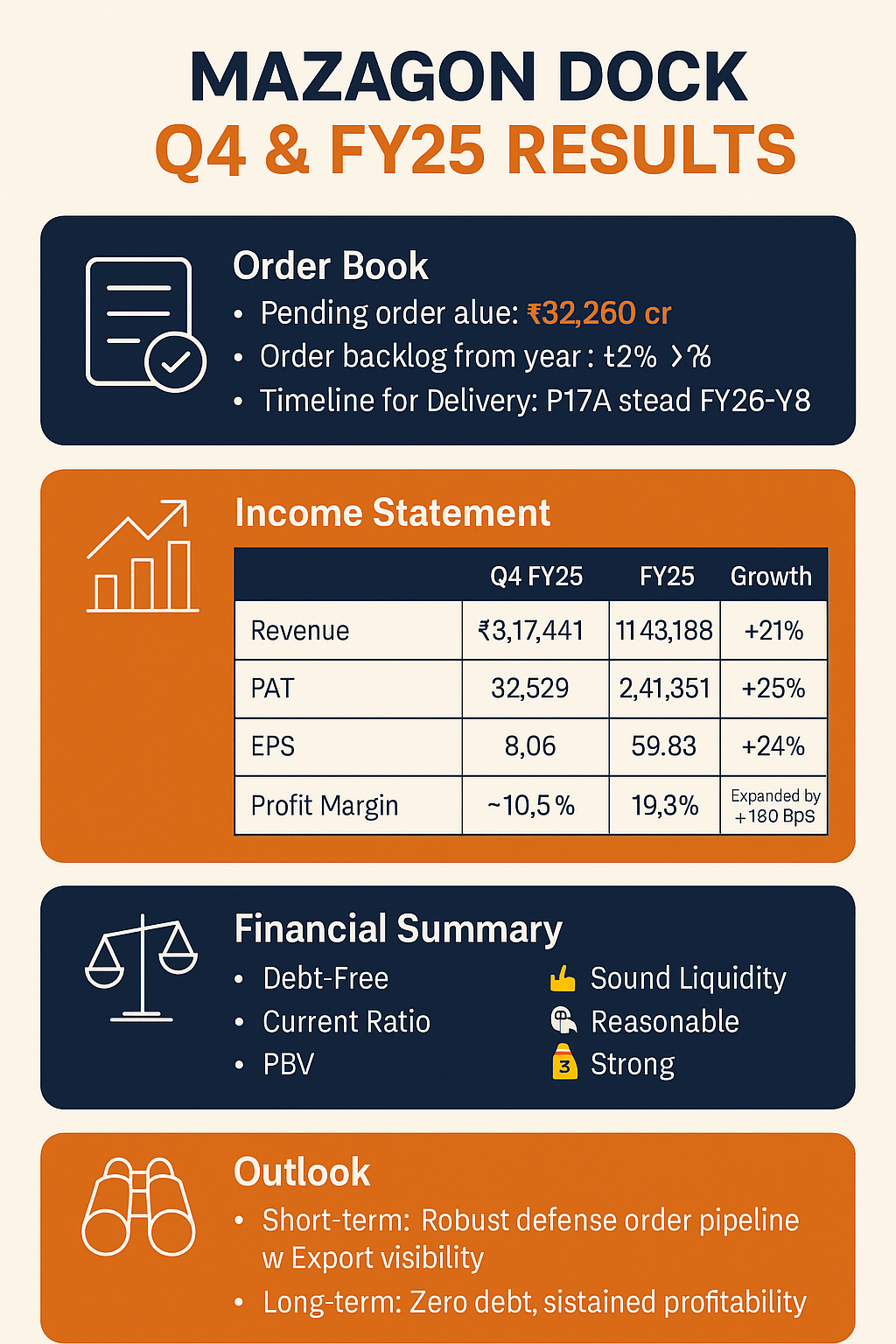

🔨 Order Book Update (as on 31st March 2025)

⏳ Delivery timeline: Stealth frigates and destroyers expected to be completed over FY26–FY28, export orders underway.

📊 Consolidated Income Statement (₹ in Lakhs)

📊 Balance Sheet & Key Ratios (FY25 Consolidated)

💰 Cash Flow Summary (FY25 Consolidated)

📈 Performance Snapshot (Standalone)

🧠 Strategic & Operational Highlights

🇮🇳 Navratna Status awarded in FY25

🛥 Delivered 3 front-line warships on a single day: INS Surat, INS Nilgiri & INS Vaghsheer

🌊 Capacity to build 11 submarines & 10 warships simultaneously

🌍 Export orders secured from Europe — ₹710+ Cr in hybrid vessels

💡 Launched Hydrogen Fuel Cell Boat & Solar-Electric Boat – focus on sustainability

🧾 Dividend History (Declared Basis)

📌 Outlook: What Should Investors Expect?

📆 Short-Term

Healthy execution pipeline across P17A and P15B warships

Strong visibility in export contracts, MRO, and ONGC EPC projects

🔮 Long-Term

Leadership in India’s defence shipbuilding under Make in India

High ROE, consistent profitability, and zero debt = strong fundamentals

New land acquisition + infra expansion = potential capacity boost

📄 Disclosure:

This analysis is for educational purposes only. It is based on publicly available financial reports and investor presentations. Investors are advised to conduct their own due diligence before making any investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)