Economic Tensions: India vs. Pakistan - A Stark Contrast

Recent escalations in tensions between India and Pakistan have brought the economic vulnerabilities of both nations into sharp focus. Moody's Ratings has issued warnings, highlighting the disproportionate impact on Pakistan's fragile economy.

Key Takeaway: Pakistan's economy is significantly more vulnerable to geopolitical tensions compared to India's robust and growing economy.

Moody's Assessment: Pakistan's Economic Constraints

Moody's Ratings clearly states that Pakistan's precarious economic situation makes it unable to afford a war with India. Their assessment is based on several critical factors:

Limited External Financing: Continued tensions could severely restrict Pakistan's access to essential external financial support.

Low Foreign Exchange Reserves: Pakistan's foreign-exchange reserves are critically low, insufficient to cover upcoming debt payments.

High Debt Burden: Pakistan's existing financial resources are inadequate to meet its annual debt obligations. A conflict would exacerbate this crisis.

Economic Shocks: Pakistan's economy is still recovering from the pandemic, inflation due to the Russia-Ukraine conflict, and domestic political instability.

Contrast with India: During the same period, India has emerged as the world's fastest-growing major economy.

Data Point: Pakistan's total foreign debt stood at over $131 billion at the end of December 2024.

Differentiating the Indian and Pakistani Economies: A Snapshot

To understand the differing impacts of geopolitical tensions, let's compare key economic indicators:

Key Observation: India demonstrates significantly stronger economic fundamentals across key indicators compared to Pakistan.

Stock Market Performance: A Tale of Two Markets

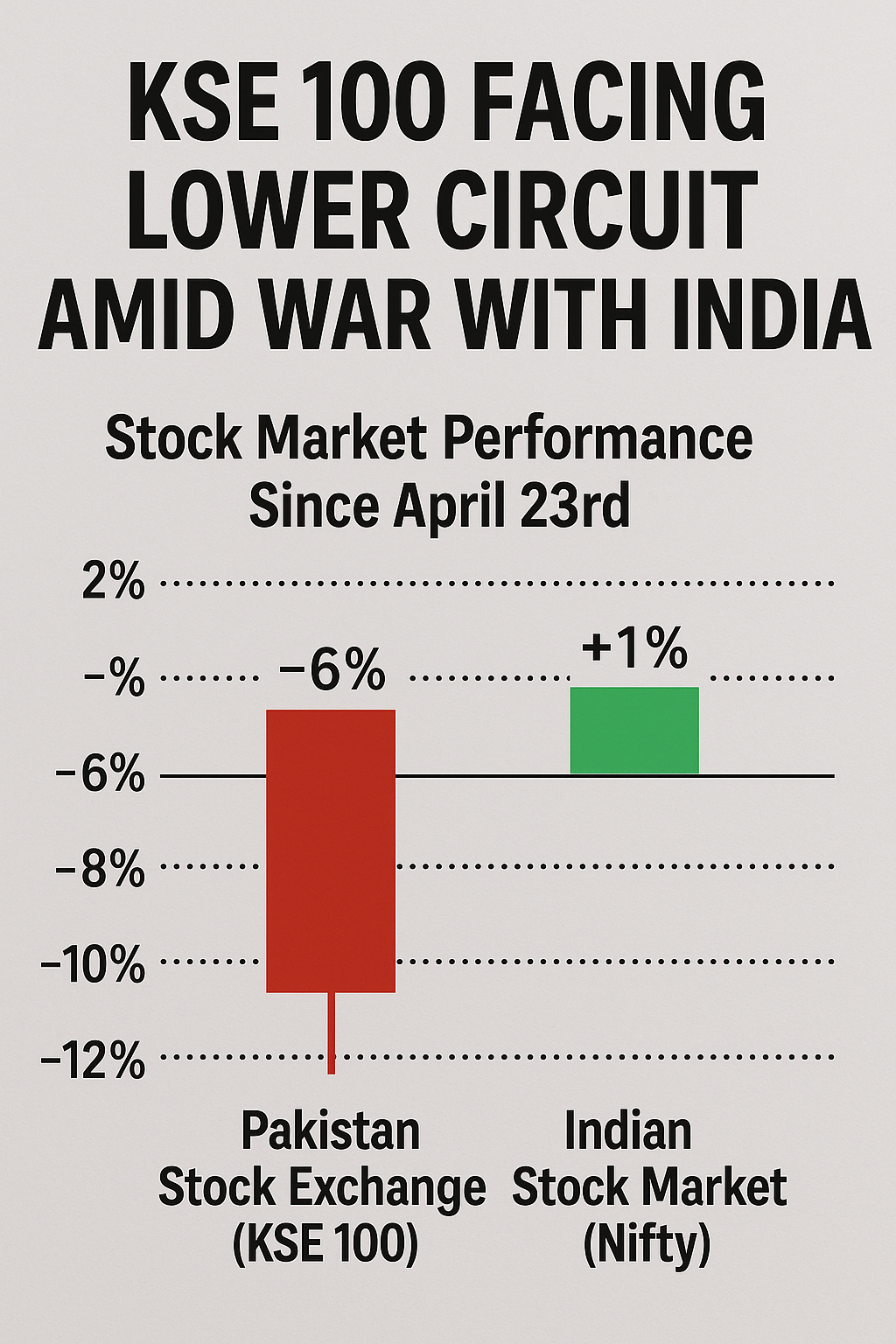

The recent "Operation Sindoor" has highlighted the contrasting reactions of the Indian and Pakistani stock markets:

Pakistan Stock Exchange (KSE 100): Plunged by over 6%, leading to a trading halt. This followed a previous day's decline of over 3%. Since April 23rd, the KSE-100 index has fallen by 9,930 points.

Indian Stock Market (Sensex & Nifty): Showed remarkable resilience, recovering quickly from initial dips and even closing in positive territory. The Nifty has risen by approximately 1% since April 23rd, while the Karachi index has fallen by over 6%.

Understanding Lower Circuits

A lower circuit is a mechanism used by stock exchanges to halt trading in a stock or the entire market to prevent extreme price declines due to panic selling. This can be triggered by significant negative news, economic instability, or geopolitical tensions. The steep fall in the Pakistan Stock Exchange likely triggered lower circuits, contributing to the trading halt.

Impact of a Protracted Conflict (If Continue for 1 Month)

Should the tensions escalate into a month-long conflict, the economic consequences would be severe:

Economic Costs: A prolonged war could cost India upwards of $17.8 billion daily. Pakistan's fragile economy could face hyperinflation and shortages of essential goods.

Trade Disruption: Bilateral trade, already minimal, would likely cease entirely.

Fiscal Strain: Both nations would face increased defense spending, potentially leading to higher fiscal deficits and inflation.

Currency Depreciation: The Pakistani rupee could depreciate significantly, potentially reaching around Rs 285 per dollar. The Indian rupee would also likely depreciate.

Key Takeaways for Investors

Pakistan's Vulnerability: The Pakistani economy and stock market are highly susceptible to the ongoing tensions .

India's Resilience: The Indian economy and stock market have shown resilience, but a prolonged conflict poses risks.

Monitor Developments: Investors should closely monitor the geopolitical situation and be prepared for potential market volatility.

Long-Term Perspective: Focus on the long-term fundamentals of the Indian economy.

Navigating Geopolitical Uncertainty: Recommendations

Avoid Panic Selling: Historically, selling during geopolitical shocks has led to missed recoveries.

Consider Quality Large-Cap Stocks: These tend to offer more stability during uncertain times.

Focus on Domestic-Facing Sectors: These sectors may be more insulated from international tensions.

Potential in Defense and Infrastructure: Increased focus on national security could benefit these sectors.

Diversify Your Portfolio: A well-diversified portfolio is crucial for managing risk.

Stay Informed: Keep up-to-date with reliable news sources but avoid making impulsive decisions.

We encourage you to remain calm and focused on your long-term investment goals. We will continue to monitor the situation and provide updates as necessary.

Jay Hind

PROFITFROMIT

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025