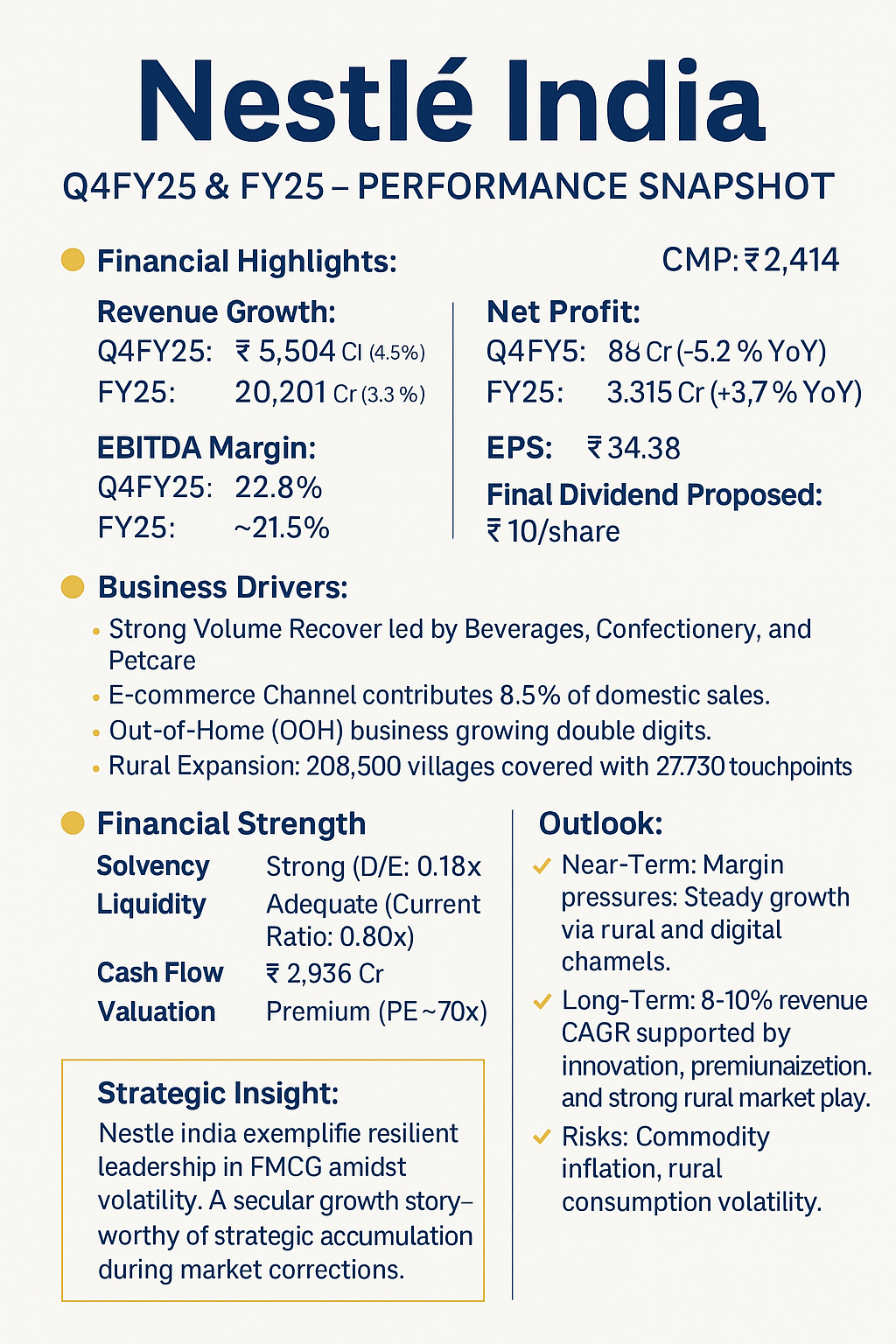

📊 Nestlé India Limited – FY25 & Q4FY25 Results Analysis

1. Key Financial Highlights

Sales Growth:

Q4FY25 Revenue: ₹55,038.8 million, up 4.5% YoY from ₹52,675.9 million.

FY25 Revenue: ₹202,015.6 million, up 3.3% compared to ₹195,633.7 million.

Volume Growth:

While specific volume % is not disclosed, management commentary highlighted "improving volume growth" across categories.

Beverages and Confectionery reported double-digit volume growth; Prepared Dishes and Cooking Aids returned to positive volume growth.

Profit Growth:

Q4FY25 Net Profit: ₹8,854.1 million, marginally down by 5.2% YoY.

FY25 Net Profit: ₹33,145 million, up 3.7% compared to ₹31,962.1 million.

Margins:

Profit margins contracted QoQ due to higher raw material costs (material costs rose from 43.3% to 44.3% of sales YoY).

Segmental Growth:

(Company operates under a single segment: Food)Powdered & Liquid Beverages: Highest contributor (NESCAFÉ Ready-to-Drink segment expansion).

Confectionery (KITKAT): High single-digit value and volume growth.

Milk Products & Nutrition: New CERELAC and CEREGROW launches boosted performance.

Petcare (PURINA): Highest ever double-digit growth.

2. Strategic Business Highlights

Domestic Sales: ₹52,349.8 million in Q4FY25; highest ever in any quarter.

E-commerce: Contributed 8.5% of domestic sales in FY25.

Out of Home (OOH): Strong double-digit growth; launched new B2B products like KITKAT Professional Spread.

Rural Penetration (RUrban Strategy): Touchpoints increased to 27,730 locations covering ~208,500 villages.

3. Industry KPIs

Raw Material Inflation: Cost of materials consumed to sales ratio increased to 44.3% in Q4FY25 from 43.3% in Q4FY24.

Channel Trends:

Quick commerce and organized retail expanding rapidly.

Premiumization (higher value products) accelerating.

4. Solvency, Liquidity, Profitability, and Cash Flow Ratios (FY25 vs FY24)

Valuations:CMP: ₹2,414

FY25 EPS: ₹34.38

P/E Ratio: ~70.2x (at CMP)

Premium valuations reflect high cash generation, strong brand equity, leadership position.

5. Near-Term and Long-Term Outlook

📌 Strategic Conclusion:

Nestlé India continues to fortify its leadership position with a well-orchestrated balance between volume recovery, margin protection, premiumization, and channel expansion. Despite near-term margin pressures, the company’s long-term secular growth story remains intact. Current valuations remain premium, thus any major correction could offer long-term strategic entry opportunities for investors.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)