🔬 PI Industries Ltd – Q4 & FY25 Results Review | Growth, Margins, and Outlook

📅 Report Period: Q4 FY25 & FY25

📈 CMP: ₹3,688

🏢 Industry: Agrochemicals & Life Sciences

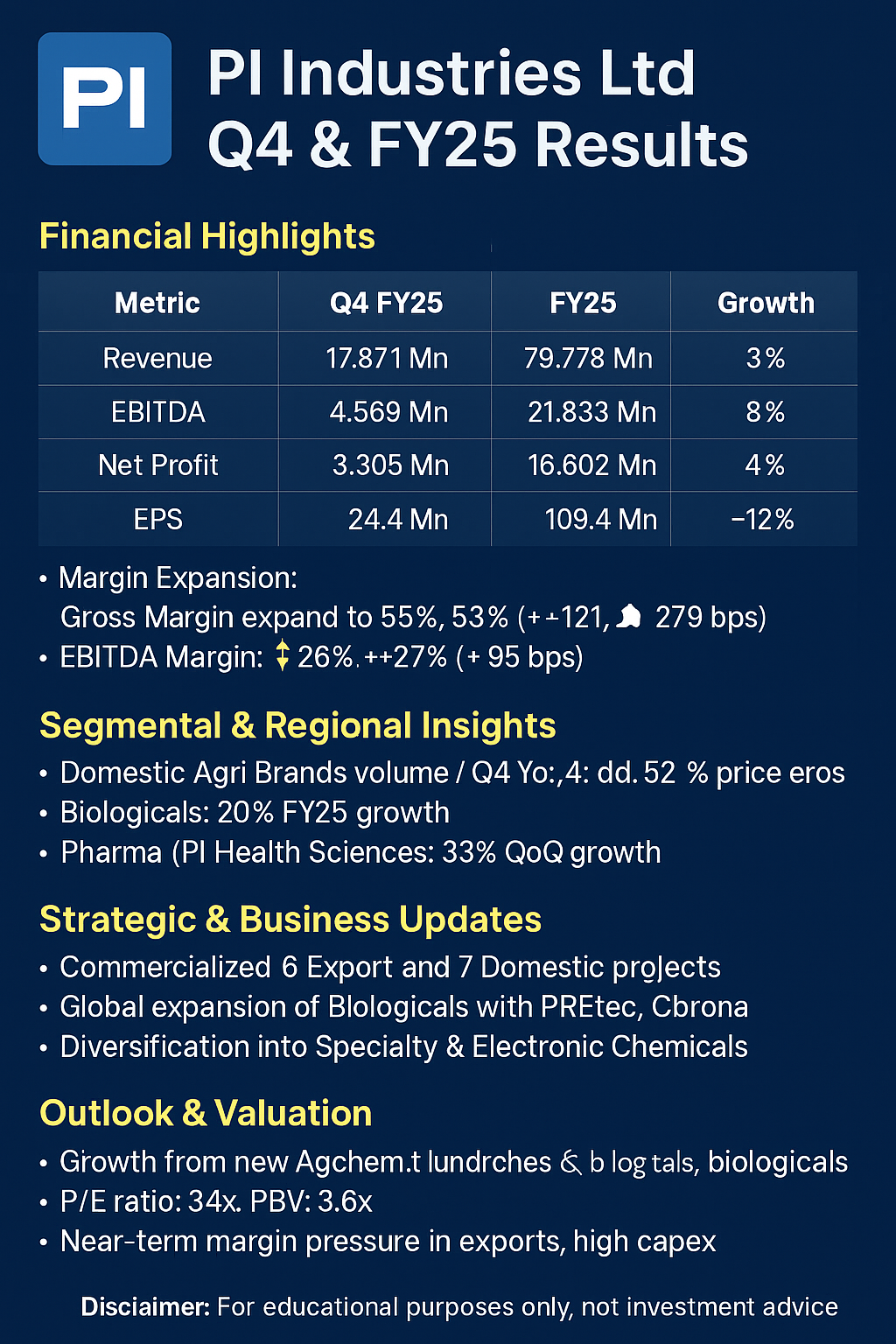

📊 Financial Highlights

Consolidated Income Statement Summary:

🚀 Segmental & Regional Insights

Domestic Agri Brands:

Q4: +21% YoY (Volume +24%)

FY25: +6% YoY (Volume +9%)

Strong growth due to good Rabi season and new launches

Agchem Exports:

Q4: -5% (Volume +7%)

FY25: +5% YoY (New product contribution +31%)

Price erosion due to softening input costs

Biologicals:

Q4: +10% YoY

FY25: +20% YoY

Strong traction with sustainable agri solutions

Pharma (PI Health Sciences):

Q4: 6% of exports revenue

33% QoQ growth

📈 Key Financial Ratios (Consolidated)

💰 Cash Flow Snapshot

📉 FCF decline driven by higher capex for new capacity and R&D expansion.

🧪 Strategic & Business Updates

6 new products commercialized in Exports, 7 in Domestic Agri

Biologicals: Global expansion plan with PREtec, Obrona, Saori, and Teikko in portfolio

Diversification into Specialty & Electronic Chemicals

Strong engagement via 15,000+ distributors and 1.6 Mn farmers

🔭 Outlook & Valuation

Valuation Ratios (CMP ₹3,688):

PE Ratio: ~33.7x

PBV: ~3.6x

Near-term growth supported by:

Continued biologicals expansion

New launches in Agchem and Pharma

Strengthened India distribution

Challenges: Margin pressure in exports, high capex impacting cash

📌 Investor View

🔷 Long-term outlook remains promising, supported by diversified growth engines

🔷 Near-term volatility in profitability due to high tax and input price dynamics

🔷 Investors may accumulate on dips with a 5-year horizon

⚠️ Disclaimer

This analysis is for educational purposes only and should not be construed as investment advice. Investors are advised to do their own due diligence before making any investment decisions.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025