🔍 Key Highlights:

✅ Advances & Deposits Growth:

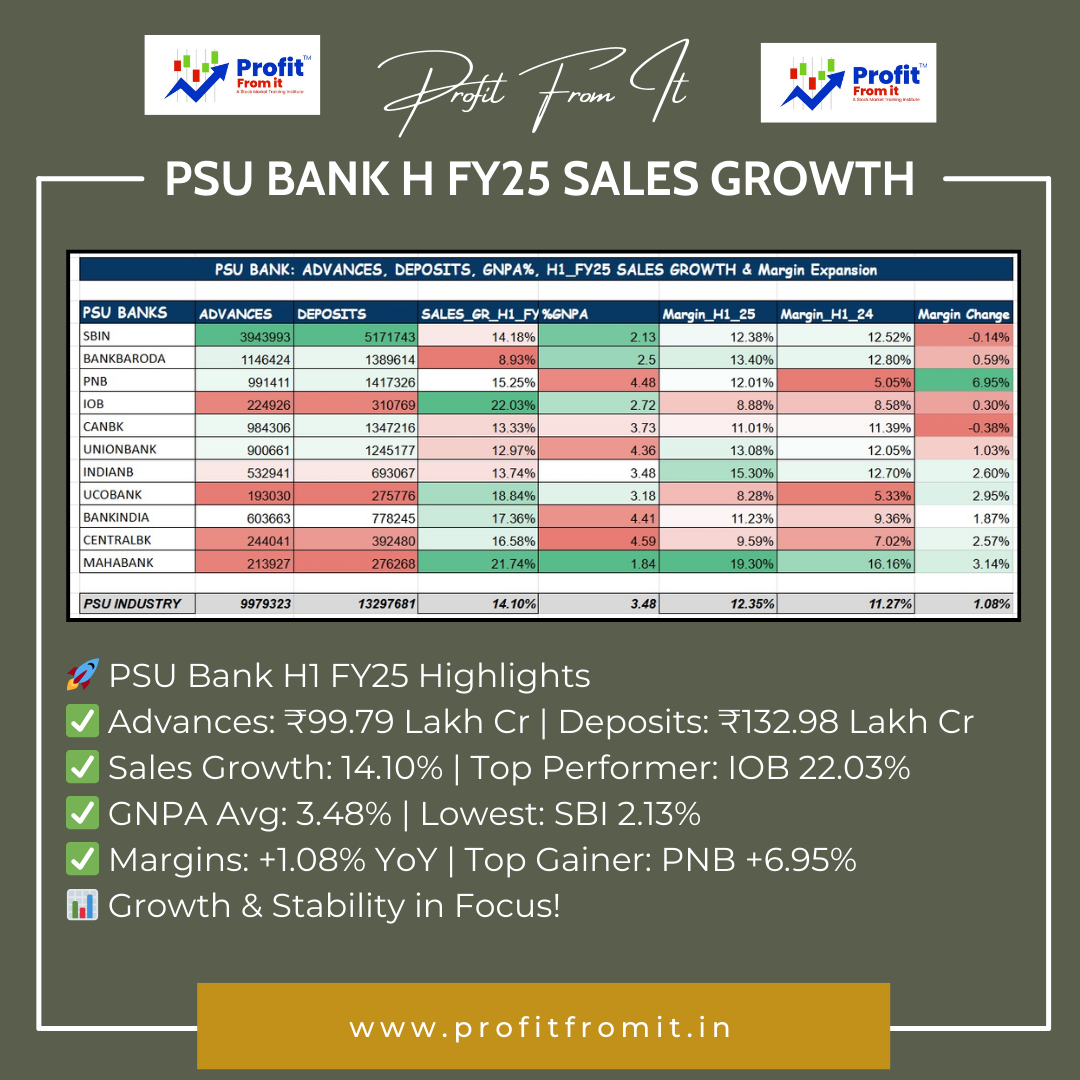

PSU banks show strong figures with industry advances at ₹99.79 Lakh Crores and deposits at ₹132.98 Lakh Crores.

✅ Sales Growth:

Sector-wide H1 FY25 sales growth stands at 14.10%

✅ Margin Expansion:

Average margin improved from 11.27% in H1 FY24 to 12.35% in H1 FY25.

✅ GNPA Trend:

PSU Banks maintained GNPA at a sector average of 3.48%, showing significant stability.

📈 Who’s Leading the Pack?

SBI: Largest contributor in Advances & Deposits with ₹39.43 Lakh Cr & ₹51.71 Lakh Cr respectively.

💬 What’s your take on PSU Banks' performance? Will these trends continue in H2? Let’s discuss!

📞 Get in Touch for Expert Guidance 📞

📌 Toll-Free: 1800 890 4317

📌 Website: www.profitfromit.in

📌 WhatsApp Channel: https://whatsapp.com/channel/0029Va9KwJOId7nV4uqtE81v

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)