🏆 Top Performers: Full Comparative Analysis

Mahindra & Mahindra (M&M)

Market Cap: ₹368,224 Cr

Sales: ₹74,699 Cr

Profit: ₹7,094 Cr

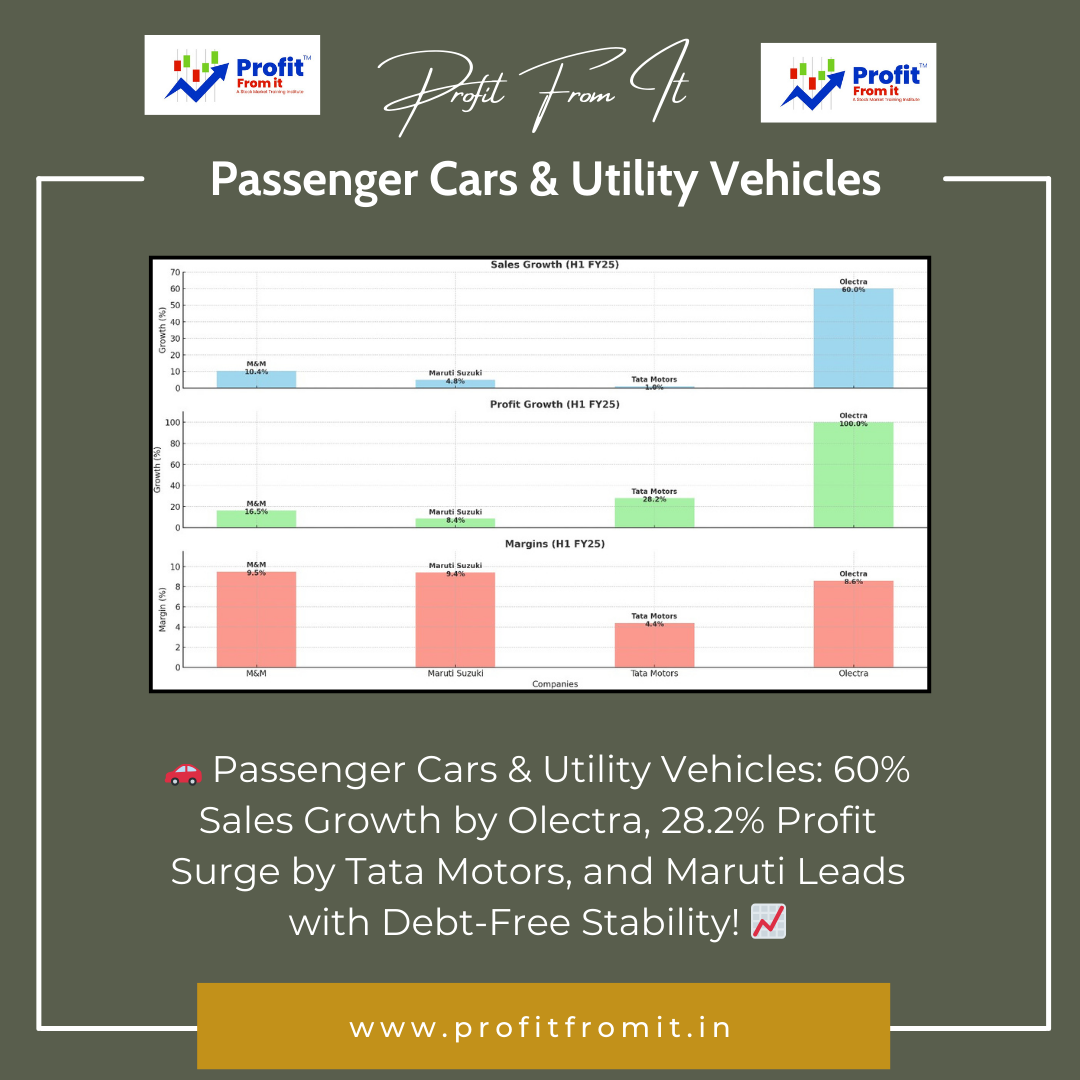

Sales Growth (H1 FY25): +10.4%

Profit Growth (H1 FY25): +16.5%

Margin (H1 FY25): 9.5% (improved by +0.50%)

Debt-to-Equity (D/E) Ratio: 1.66

Price-to-Book Value (PBV): 4.9

Analysis:

M&M holds significant stakes in key subsidiaries such as Mahindra Holidays and Mahindra Finance, adding diversification to its portfolio. While M&M itself has a manageable D/E ratio of 1.66, one of its major holdings, Mahindra Finance, carries a significantly higher D/E ratio, which could pose risk concerns for consolidated financial stability. Investors should weigh the strong operational performance of M&M against the higher leverage risk from its financial arm, Mahindra Finance. Careful monitoring of the group-level debt strategy is advised.

Maruti Suzuki

Market Cap: ₹350,057 Cr

Sales: ₹73,229 Cr

Profit: ₹6,862 Cr

Sales Growth (H1 FY25): +4.8%

Profit Growth (H1 FY25): +8.4%

Margin (H1 FY25): 9.4% (improved by +0.31%)

Debt-to-Equity (D/E) Ratio: 0.00 (Debt-Free)

Price-to-Book Value (PBV): 3.9

Analysis:

As a debt-free champion, Maruti demonstrates steady performance with modest margin improvement. Its conservative financial position makes it ideal for risk-averse investors seeking stability and consistent returns. A slightly lower current ratio (0.87) could be improved.

Tata Motors

Market Cap: ₹290,533 Cr

Sales: ₹209,498 Cr

Profit: ₹9,142 Cr

Sales Growth (H1 FY25): +1.0%

Profit Growth (H1 FY25): +28.2%

Margin (H1 FY25): 4.4% (improved by +0.92%)

Debt-to-Equity (D/E) Ratio: 1.05

Price-to-Book Value (PBV): 2.9

Analysis:

Tata Motors is the profitability leader, with exceptional profit growth due to efficiency improvements. Though its sales growth is modest, strong operational gains drive performance. Its lower PBV makes it attractive for value investors, but liquidity (Current Ratio: 0.94) should be monitored.

Olectra Greentech

Market Cap: ₹13,133 Cr

Sales: ₹837 Cr

Profit: ₹72 Cr

Sales Growth (H1 FY25): +60.0%

Profit Growth (H1 FY25): +100.0%

Margin (H1 FY25): 8.6% (improved by +1.72%)

Debt-to-Equity (D/E) Ratio: 0.19

Price-to-Book Value (PBV): 13.9

Analysis:

Olectra is a rising star, achieving the highest sales and profit growth, reflecting its dominance in a fast-growing niche. Its high PBV indicates strong investor confidence but may signal overvaluation. Ideal for high-risk, high-reward investors.

🌟 Key Takeaways

Best Growth Play: Olectra Greentech – Dominating with extraordinary growth metrics and margin expansion.

Stability Leader: Maruti Suzuki – A debt-free, consistent performer with strong financials.

Profitability Driver: Tata Motors – Exceptional profit growth and operational efficiency gains.

Balanced Performer: Mahindra & Mahindra – Combines stable growth, margins, and a diverse portfolio.

📈 Sector-Level Insights

Debt-to-Equity (D/E): Average at 0.86, indicating moderate leverage.

Current Ratio: Average at 1.04, suggesting stable liquidity.

Price-to-Book Value (PBV): Average at 6.0, reflecting reasonable valuations.

The sector as a whole remains attractive, with opportunities for both growth-focused and value-driven investors.

💡 Investment Recommendations

Conservative Investors: Choose Maruti Suzuki for its debt-free stability.

Growth-Oriented Investors: Explore Olectra Greentech for its high growth potential.

Value Seekers: Consider Tata Motors for its strong profitability and low PBV.

Balanced Approach: Opt for Mahindra & Mahindra, a well-rounded performer.

This detailed analysis offers tailored insights to match various investment styles. Let me know if you’d like this formatted as a social post or presentation! 🚀

⚠ Disclosure

This analysis is based on publicly available data and is intended for informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any stock. Investors are advised to conduct their own research or consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)