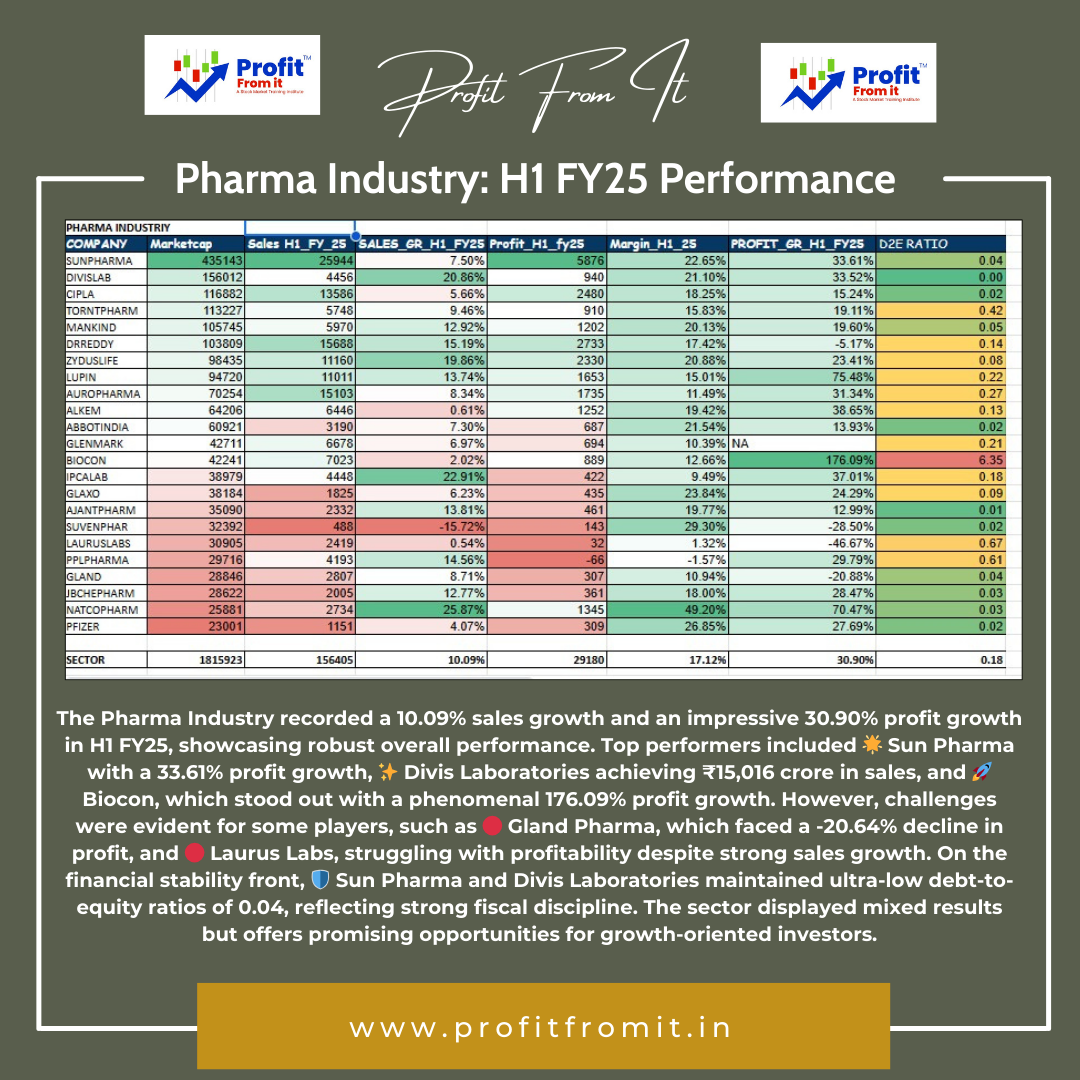

🏆 Top Performers

🌟 Sun Pharma 🏢 Market Cap: ₹4,35,143 crore

🟢 Sales Growth: 7.50%

🟢 Profit Growth: 33.61%

🟢 Margin: 22.65%

✨ Divis Laboratories

💰 Sales: ₹15,016 crore

🟢 Profit Growth: 33.52%

🛡 D/E Ratio: 0.04 (indicating financial stability)

🚀 Biocon

🟢 Profit Growth: Exceptional 176.09%

🟢 Sales Growth: 22.09%

🟡 Margins: 10.39% (slightly lower, but impressive growth)

🏢 Sector Highlights

🌏 Total Market Cap: ₹1,81,59,23 crore

🟢 Overall Sales Growth: 10.09%

🟢 Profit Growth: 30.90% (indicating robust profitability trends)

🟡 Average Margin: 17.12%

⚡ Notable Trends

🔥 High Growth Companies

Laurus Labs

🟢 14.56% sales growth, though profits faced challenges

Gland Pharma

🔴 Negative profit growth of -20.64%

🛡 Stable Players

Cipla, Dr. Reddy's, and Torrent Pharma sustained steady growth with healthy margins (15%-20%)

⚠ Underperformers

❌ Gland Pharma

🔴 Declining profits and a high D/E ratio of 0.56

❌ Laurus Labs

Despite 🟢 strong sales growth, profitability remains a 🔴 concern

💼 Debt-to-Equity (D/E) Insights

🏢 Industry Average D/E: 0.18

💪 Leaders like Sun Pharma and Divis Laboratories maintain ultra-low D/E ratios of 0.04, reflecting strong financial discipline

🔴 Higher D/E ratios for smaller players like Gland Pharma (0.56) could signal leverage challenges

✅ Conclusion

The Pharma Industry continues to show resilience in FY25, with 🟢 strong sales and profit growth overall. Companies with robust financials and innovation pipelines are leading the way, offering promising investment opportunities. However, challenges in profitability for some players call for careful monitoring 🕵♂📉

⚠ Disclosure

This post is for informational purposes only. It is not investment advice. Please do your own research or consult a financial advisor before making any investment decisions 📑💡

💡 Question for You

Which pharma companies are you betting on this year? Drop your thoughts below 🗣📬

📞 Get in Touch for Expert Guidance 📞

📌 Toll-Free: 1800 890 4317

📌 WhatsApp Channel: https://whatsapp.com/channel/0029Va9KwJOId7nV4uqtE81v

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025