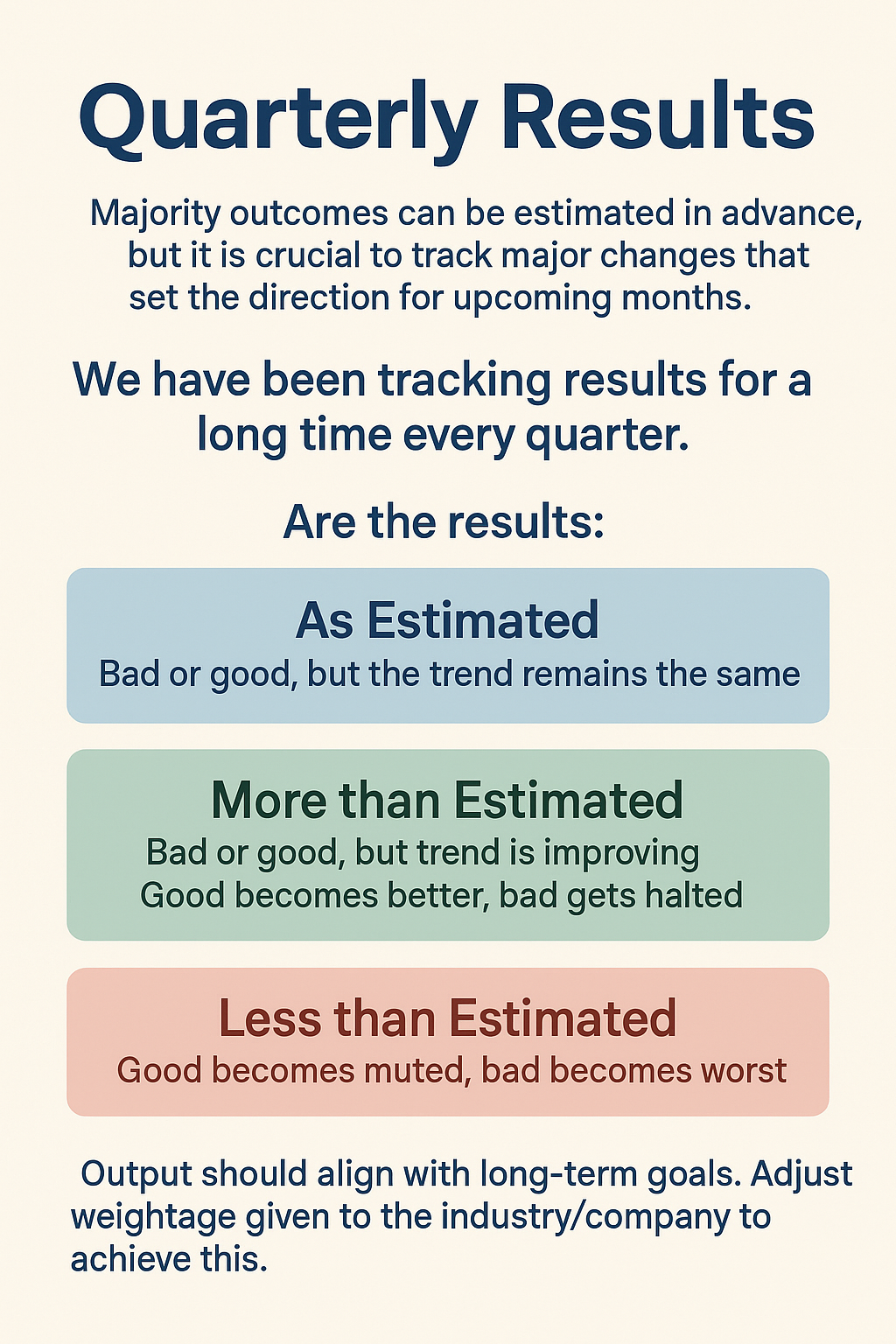

📊 Quarterly Results: Navigating the Path Ahead!

Quarterly financial results set the strategic direction for investments. While approximately 75% of results can be anticipated, critical shifts can significantly influence market trends.

🔍 What We Look For:

📌 As Estimated: Trend remains stable (Good or Bad).

📌 Above Estimates: Positive signals emerge (Good becomes Better, Bad stabilizes).

📌 Below Estimates: Negative trends intensify (Good weakens, Bad worsens).

✅ Aligning Results with Long-Term Goals: Strategically adjusting industry and company weightage based on quarterly outcomes ensures alignment with our long-term investment objectives.

📈 9MFY25 Recap (Nifty 500):

📌 Sales Growth: 7.9%

📌 Profit Growth: 5.5%

📌 Profit Margins: Slight drop from 9.4% to 9.2%

Given these modest figures compared to a PE of 25, we recommended prudent cash management, selective investments, or doubling SIP contributions during market corrections.

🚀 Q4FY25 Early Insights: Initial results from 15 companies reflect:

📌 Sales Growth: 10.7%

📌 Profit Growth: 10.9%

📌 Profit Margins: Marginal increase from 15.03% to 15.06%

This improvement, primarily driven by Finance & Renewable Energy sectors, is promising—but broader conclusions await results from at least 100 companies.

📝 Q4FY25 Results Published (Tracked Regularly):

TCS | ICICI GI | IREDA | HDFC AMC | HDFC Life | Tata Elxsi | HDFC Bank | Havells | AU Bank | Waaree Energies | Bajaj HFL | Tata Consumer | LTTS

⏳ Pending Publications:

Hindustan Unilever | Nestlé India | IEX | Supreme Industries | Maruti Suzuki

📌 Many more company results will follow shortly, with updates published within 48 hours of announcements.

📌 Meanwhile IMF decreased the GDP Growth estimates of the World, India & China should be contributing 50% Growth for calendar year 25 & 26.

Stay tuned!

Warm regards,

Profit From IT Team

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)