RBI Monetary Policy Statement - December 2024

1. Monetary Policy Overview

📌 Key Decisions:

Repo Rate: Unchanged at 6.50%.

Standing Deposit Facility (SDF): Remains at 6.25%.

Marginal Standing Facility (MSF) & Bank Rate: Maintained at 6.75%.

Policy Stance: Neutral, balancing growth and inflation.

2. Economic Insights

🌍 Global Outlook:

Stable global growth, but slowing due to geopolitical tensions.

Financial market volatility driven by uncertain trade policies.

🇮🇳 India's Growth Projections:

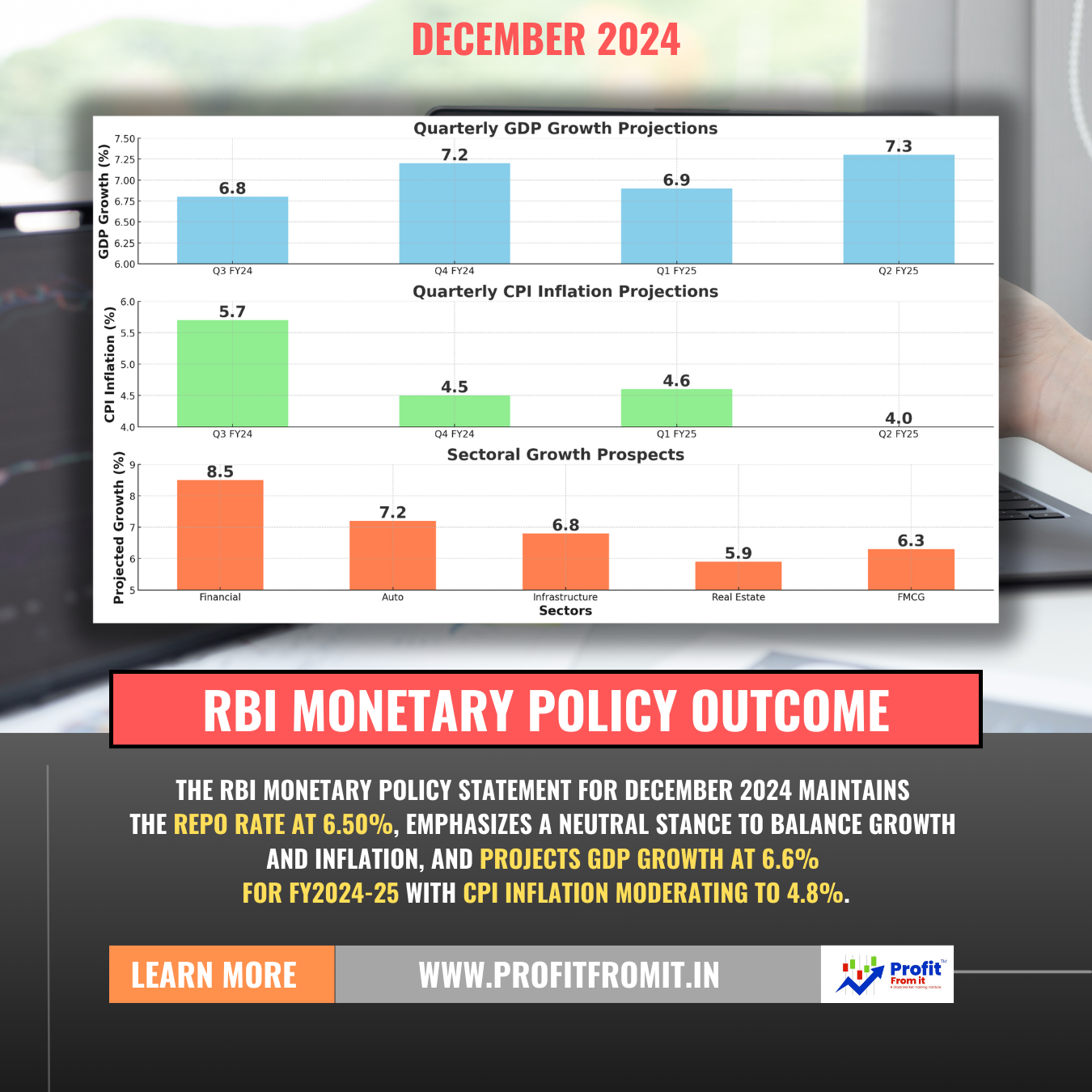

FY2024-25 GDP Growth: 6.6%.

Q3: 6.8%, Q4: 7.2%.

FY2025-26 GDP Growth:

Q1: 6.9%, Q2: 7.3%.

📈 Inflation Projections:

FY2024-25 CPI Inflation: 4.8%.

Q3: 5.7%, Q4: 4.5%.

FY2025-26 CPI Inflation:

Q1: 4.6%, Q2: 4.0%.

⚠ Risks to Growth and Inflation:

External Risks: Geopolitical uncertainties, global commodity price volatility.

Domestic Risks: Adverse weather events, rising input costs.

3. Beneficiaries for Investors

🏦 Financial Sector (📈):

Banks: HDFC Bank, ICICI Bank, Axis Bank.

NBFCs: Bajaj Finance, M&M Financial.

Steady credit demand and reduced NPAs expected.

🚗 Auto Industry (🚘):

Affordable EMIs boost demand for companies like Maruti Suzuki, Tata Motors, Hero MotoCorp.

🏗 Infrastructure (🔧):

Beneficiaries: L&T, GMR Infra, Adani Ports, driven by government capex.

🏠 Real Estate (🏘):

Housing demand expected to rise, benefiting DLF, Prestige Estates, Godrej Properties.

📦 Consumer and FMCG (🛒):

Rural income growth supports FMCG players like ITC, HUL, Avenue Supermarts.

4. Key Takeaways

📊 Growth Outlook:

Economic activity is expected to improve in Q3 and Q4 FY2024-25.

Services and agriculture sectors remain key growth drivers.

🎯 Inflation Management:

CPI inflation expected to stabilize near the target range of 4% ± 2%.

📉 Risks to Watch:

Geopolitical instability and commodity price volatility remain potential disruptors.

5. Recommendations for Investors

Focus on banks, NBFCs, and housing finance companies for steady growth.

Explore opportunities in consumer-driven sectors, including FMCG and retail.

Monitor risks in commodities-dependent industries due to global price fluctuations.

6. Disclosures

Risks:

Geopolitical uncertainties and financial market volatility could disrupt projections.

Domestic weather-related adversities may pose risks to food inflation.

Transparency:

The RBI remains committed to transparency, with meeting minutes to be published on December 20, 2024.

Data Sources:

All data and projections are derived from the RBI Monetary Policy Statement - December 2024.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)