Reliance Industries Limited – FY25 Results Update

Strategic Insights and Segmental Highlights for Discerning Investors

Executive Summary

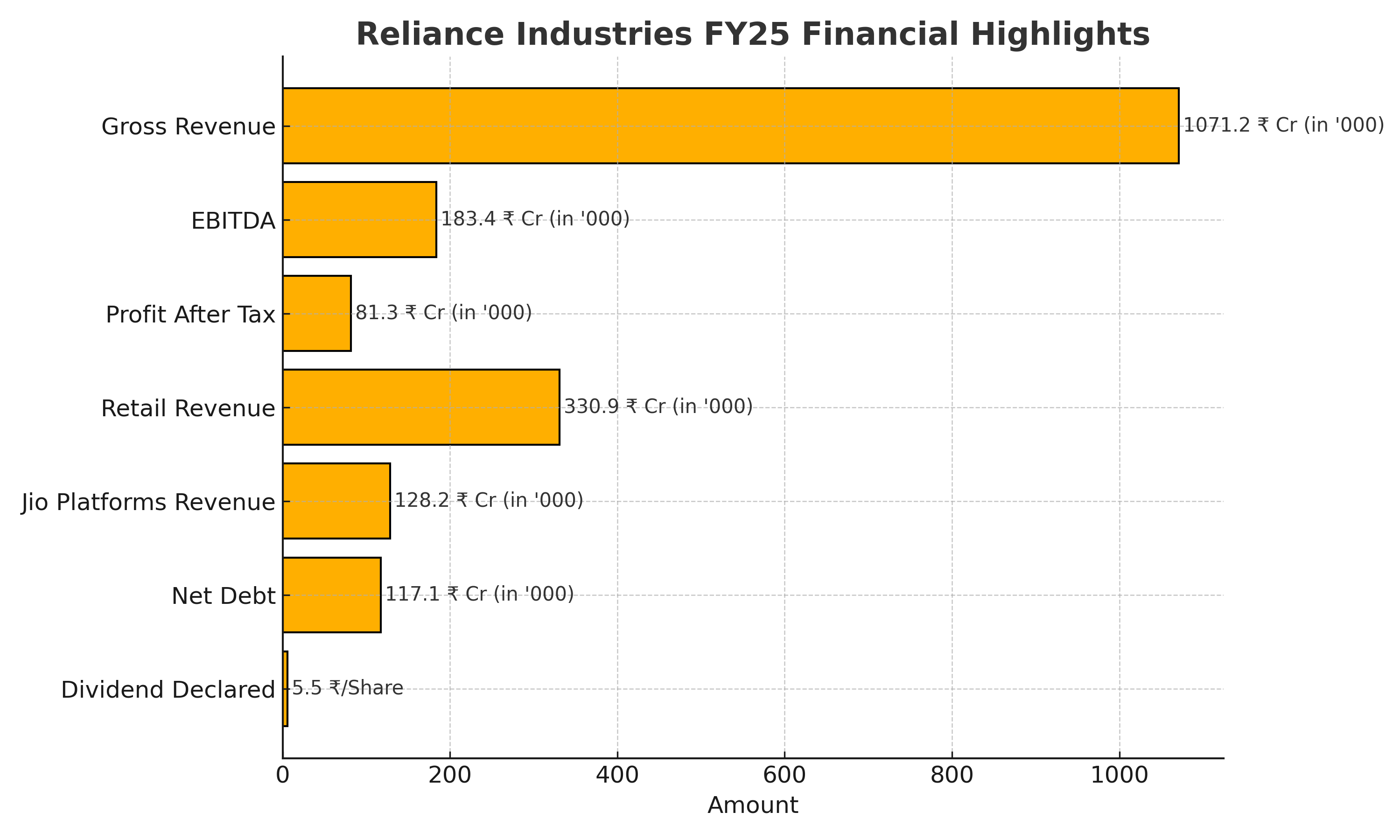

Reliance Industries Limited (RIL) has once again underscored its resilient operational execution and strategic foresight amidst global macro volatility. With consolidated revenue crossing the ₹10 lakh crore mark and robust performance from its Consumer and Digital businesses, RIL is uniquely positioned to spearhead India's next growth cycle. The diversified earnings architecture and progressive investments across New Energy, Retail, and Digital platforms fortify RIL’s long-term value proposition.

Key Financial Highlights (Consolidated)

Dividend: ₹5.50 per share declared for FY25.

Capital Expenditure: ₹131,107 Cr primarily towards New Energy, Digital, and Retail expansion.

Segment-Wise Performance Analysis

1. Jio Platforms (Digital Services)

Revenue Growth: +17% YoY; FY25 Revenue ₹1,28,218 Cr

EBITDA: ₹64,170 Cr (+16.8% YoY), EBITDA Margin maintained at ~50%

Strategic Updates:

Subscriber Base: 488.2 Million; ARPU ₹206.2 (+13.5% YoY)

True 5G rollouts: Industry-leading with 191 Million 5G users

Expansion into homes and enterprises via JioFiber and JioAirFiber

2. Reliance Retail (Consumer Businesses)

Revenue Growth: +7.9% YoY; FY25 Revenue ₹3,30,870 Cr

EBITDA: ₹25,053 Cr (+8.6% YoY); EBITDA Margin at 8.3% (+20 bps)

Operational Metrics:

2,659 New Stores; Total 19,340 Stores

Registered Customer Base: 349 Million (+15% YoY)

Strong scale-up in Grocery, Apparels, Electronics, and Quick Commerce via JioMart.

3. Oil-to-Chemicals (O2C)

Revenue Growth: +11% YoY driven by volume growth and higher gasoline/gasoil placement.

EBITDA Decline: -11.9% YoY due to weak global fuel and chemical spreads.

Strategic Focus: Feedstock optimization, retail expansion through Jio-bp, and enhanced domestic placement.

4. Oil & Gas Exploration and Production

Revenue: Marginal growth (+3.2% YoY) despite a challenging production environment.

EBITDA: Record high, driven by incremental production from KG-D6 and CBM blocks.

Solvency, Liquidity, Profitability & Valuation Metrics (at CMP ₹2,575)

Near-Term and Long-Term Outlook

Near-Term Catalysts (FY26):

Stabilization of O2C margins amid anticipated commodity rebalancing.

Monetization opportunities in Jio Platforms and Retail segments.

Initial operationalization of New Energy (solar, battery, hydrogen) projects.

Long-Term Growth Engines (FY26–FY30):

New Energy business (targeting Green Hydrogen and Battery Gigafactories).

Market leadership expansion in Digital (5G, Enterprise IoT) and Retail.

Resilient Cashflow Management to fuel inorganic and organic growth.

Enhanced shareholder value through consistent dividend payouts and strategic deleveraging.

Strategic Corporate Actions

Acquisition of Kandla GHA Transmission Ltd for ₹20 Cr to boost Renewable Energy supply chain infrastructure.

Issuance of NCDs (₹25,000 Cr) to strategically refinance debt and optimize capital structure.

Management Commentary

"Despite global economic volatility, Reliance Industries Limited demonstrated operational excellence, consumer-focused innovation, and strategic foresight across sectors. As India’s largest and most diversified conglomerate, Reliance is uniquely positioned to unlock massive shareholder value through its visionary pivot towards New Energy, Digital Leadership, and Consumer Ecosystem dominance."

— Mukesh Ambani, Chairman & Managing Director.

Disclosure

This analysis is intended for educational and informational purposes only. It does not constitute investment advice. Investors are advised to conduct their own research before making any investment decisions.

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025