📊 Market Coverage & Exposure

📌 Total Market Capitalization Considered: ₹42.4 trillion

📌 Market Cap Covered in Analysis: ₹23.85 trillion (56% of total market)

📌 Total Companies Covered: 227

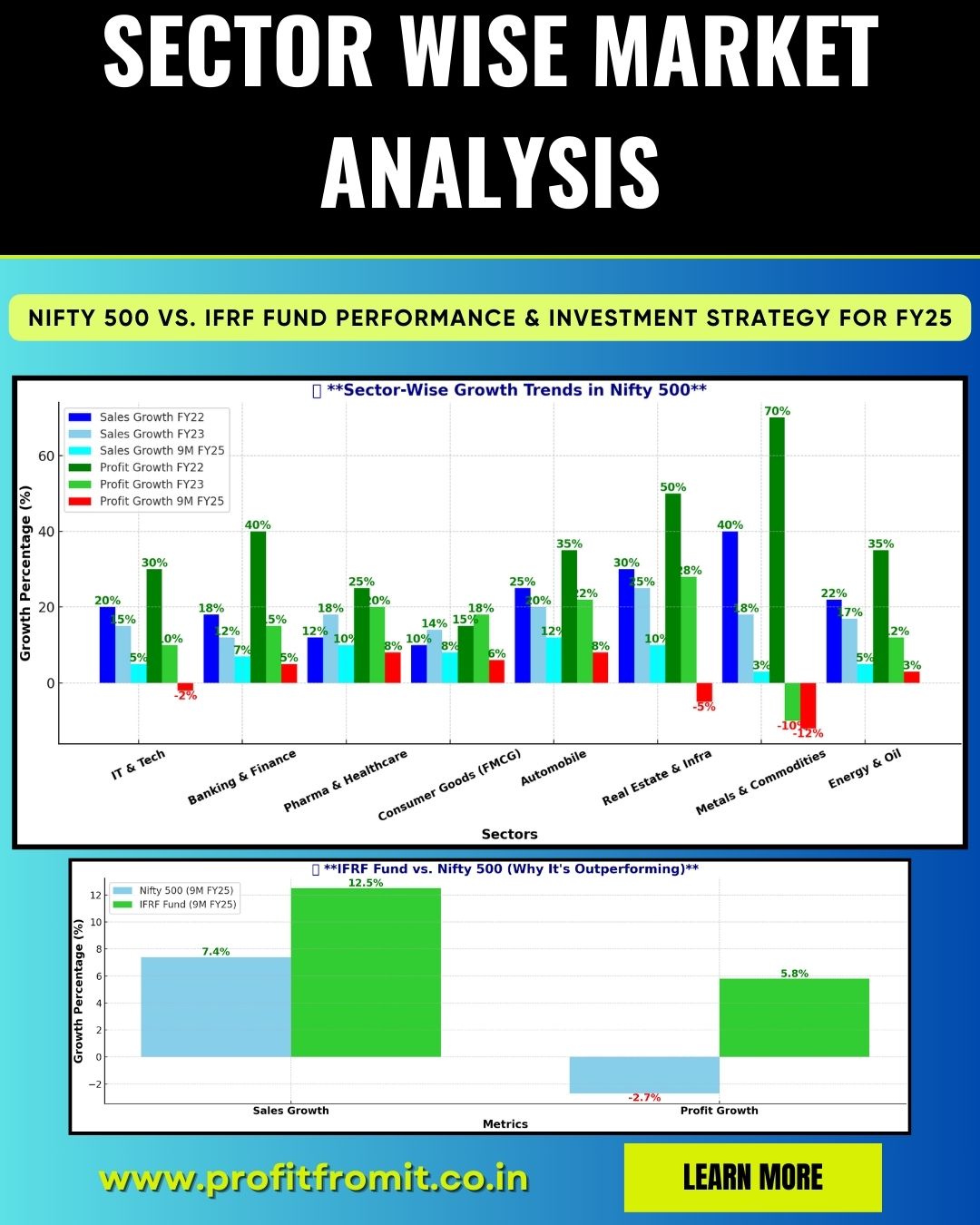

📢 This analysis provides sector-wise trends in sales growth and profit growth across different time periods, comparing the performance of Nifty 500 Index and IFRF Fund.

📈 Sector-Wise Performance Analysis

🔍 Key Observations from Nifty 500 & IFRF Fund

✅ Sales growth is declining across both Nifty 500 and IFRF Fund, but IFRF Fund continues to outperform.

✅ Profit growth in Nifty 500 has turned negative (-2.7%) in the first nine months of FY25, while IFRF Fund has maintained a positive profit growth of 5.8%.

📊 Sector-Wise Trends:

📉 IT & Tech: Slowing down with negative profit growth.

⚖ Banking & Finance: Stable, moderate growth.

📈 Pharma & Healthcare & FMCG: Strong and resilient growth.

🚗 Automobile: Consistent performance with improving profitability.

🏗 Real Estate & Infrastructure: Sharp decline in profits.

🛢 Metals & Commodities: Weakening, steep profit decline.

⚡ Energy & Oil: Stable but limited upside potential.

📝 Key Takeaways for Investors

📉 Sectors Facing Decline 🚨

❌ Metals & Commodities (-12% profit growth)

❌ Real Estate & Infrastructure (-5% profit growth)

❌ IT & Tech (-2% profit growth)

🔹 Action: Investors should remain cautious due to margin pressures and cyclical downturns.

⚖ Sectors Showing Stability 🏦

🟢 Banking & Finance (7% sales growth, 5% profit growth)

🟢 Energy & Oil (5% sales growth, 3% profit growth)

🔹 Action: Investors may hold positions in these sectors but should not expect high growth.

🚀 Best Performing Sectors 🔥

✅ Pharma & Healthcare (10% sales growth, 8% profit growth)

✅ Automobile (12% sales growth, 8% profit growth)

✅ Consumer Goods (FMCG) (8% sales growth, 6% profit growth)

🔹 Action: Investors should increase allocation to these high-growth and defensive sectors to optimize returns.

🏆 Why IFRF Fund is Outperforming Nifty 500

🚀 IFRF Fund has delivered superior returns by strategic sector allocation:

✅ Higher exposure to strong sectors like Pharma, FMCG, and Automobiles.

✅ Lower exposure to underperforming sectors like Metals, Real Estate, and IT.

✅ Better profit margins and financial management, leading to 5.8% profit growth vs. -2.7% in Nifty 500.

💡 Conclusion: IFRF Fund’s sector-focused strategy is the reason for its outperformance in the current market cycle.

📌 Investment Strategy for FY25

✅ For Conservative Investors (Low Risk) 🛡

🔹 Focus on Defensive Sectors → Pharma, FMCG, Banking

🔹 Consider Funds Like IFRF → Proven stability and growth

🔹 Avoid Volatile Sectors → Metals, Real Estate

⚖ For Growth-Oriented Investors (Moderate Risk) 📊

🔹 Invest in Auto & Banking → Balanced risk-reward

🔹 Monitor IT & Energy Stocks → Buying opportunities in short-term dips

🚀 For High-Risk Investors (Aggressive Growth) 💎

🔹 Consider Cyclical Stocks → Real Estate, Energy (if interest rates stabilize)

🔹 Avoid Metals & Commodities → Weakest profit growth trends

✅ Final Conclusion

✅ IFRF Fund is outperforming the Nifty 500 due to its focus on high-growth and resilient sectors.

✅ Pharma, FMCG, and Auto remain the best investment sectors due to their strong fundamentals.

✅ Metals & Real Estate should be avoided due to declining profit margins.

✅ Banking & Energy are stable and suitable for long-term holding.

📢 Disclaimer & Disclosure Statement

Important Investor Advisory Notice

This research analysis is for informational purposes only and should not be considered as financial, investment, or legal advice. The information provided herein is based on publicly available financial reports, market data, and our analysis. Investors are advised to exercise caution and discretion before making any investment decisions.

🔹 Stay informed. Invest wisely. 🚀

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)