Introduction:

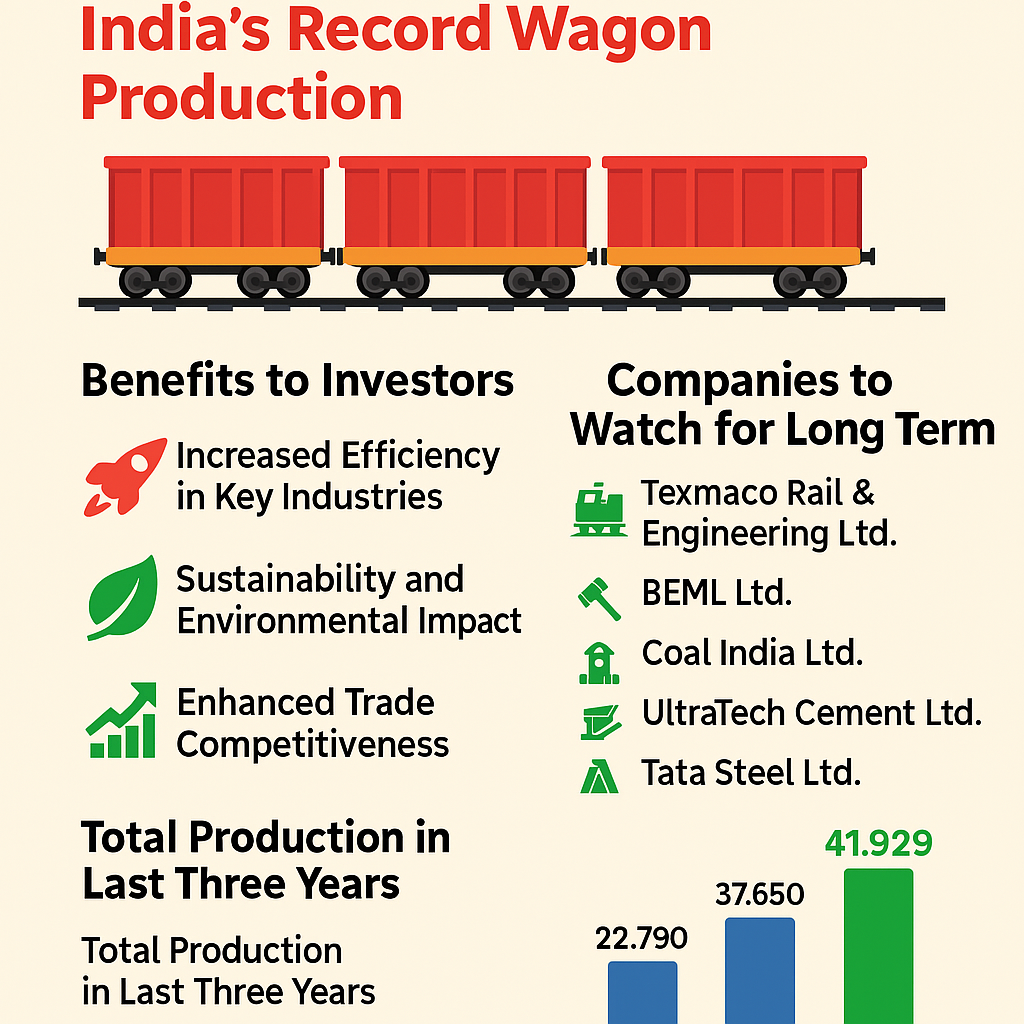

The record-breaking production of 41,929 wagons by Indian Railways in FY 2024-25 marks a transformative phase in India's logistical and industrial capabilities. This surge is not just a number—it symbolizes a leap towards enhancing the efficiency of key economic sectors. Let's explore the multifaceted investment opportunities that this development opens up.

Investor Benefits and Sector Analysis:

🚀 Enhanced Industrial and Economic Efficiency:

The increase in wagon production directly translates to heightened efficiency in industries reliant on heavy logistics such as coal, steel, and cement. This efficiency boost reduces costs and accelerates production cycles, benefiting stakeholders across the value chain.

🌱 Environmental and Sustainability Gains:

By shifting a significant volume of freight transport from road to rail, the initiative supports sustainability. This reduction in carbon footprint aligns with global environmental targets, making companies involved in this transition attractive for ESG-focused investors.

📊 Trade Competitiveness Enhancement:

Improved freight capacity is instrumental in bolstering India's trade capabilities, reducing internal and export-related logistical bottlenecks. This enhancement supports India's position in global markets, potentially leading to increased foreign investment and economic growth.

Key Companies Positioned for Growth:

🚂 Texmaco Rail & Engineering Ltd.:

Directly benefits from the demand for new wagons, positioning it as a primary beneficiary of the rail expansion.

🛤️ BEML Ltd.:

With a stake in manufacturing rail coaches and parts, BEML is set to grow alongside the expanding rail infrastructure.

⛏️ Coal India Ltd.:

Stands to gain from more efficient coal transport, which can lead to operational cost savings and increased production output.

🏗️ UltraTech Cement Ltd.:

Likely to see reduced logistical costs and enhanced distribution capabilities, which could improve profit margins.

🔩 Tata Steel Ltd.:

Enhanced rail freight capabilities mean better raw material supply and finished product distribution, bolstering overall business efficiency.

Most Important Note: Do not invest in companies that are benefited due to policy changes, as Quality analysis is most important. Low quality companies can make pain despite of tailwinds on the long run.Conclusion:

The unprecedented increase in wagon production by Indian Railways is more than just an industrial achievement; it's a catalyst for broader economic growth and sustainability. For investors, focusing on companies that are integral to this expansion offers a pathway to potentially lucrative returns. Keeping an eye on the evolving landscape and associated risks will be crucial for capitalizing on these opportunities effectively.

investment opportunities in Indian rail expansion

sustainable industrial growth in IndiaDisclaimer

This blog is for informational purposes only and is not intended as financial advice. Investors should conduct their own research or consult a professional advisor before making investment decisions. Information presented is believed to be accurate but is not guaranteed.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)