Supreme Industries Limited – FY25 Financial Results Update

(CMP: ₹3,475)

📈 Key Performance Metrics:

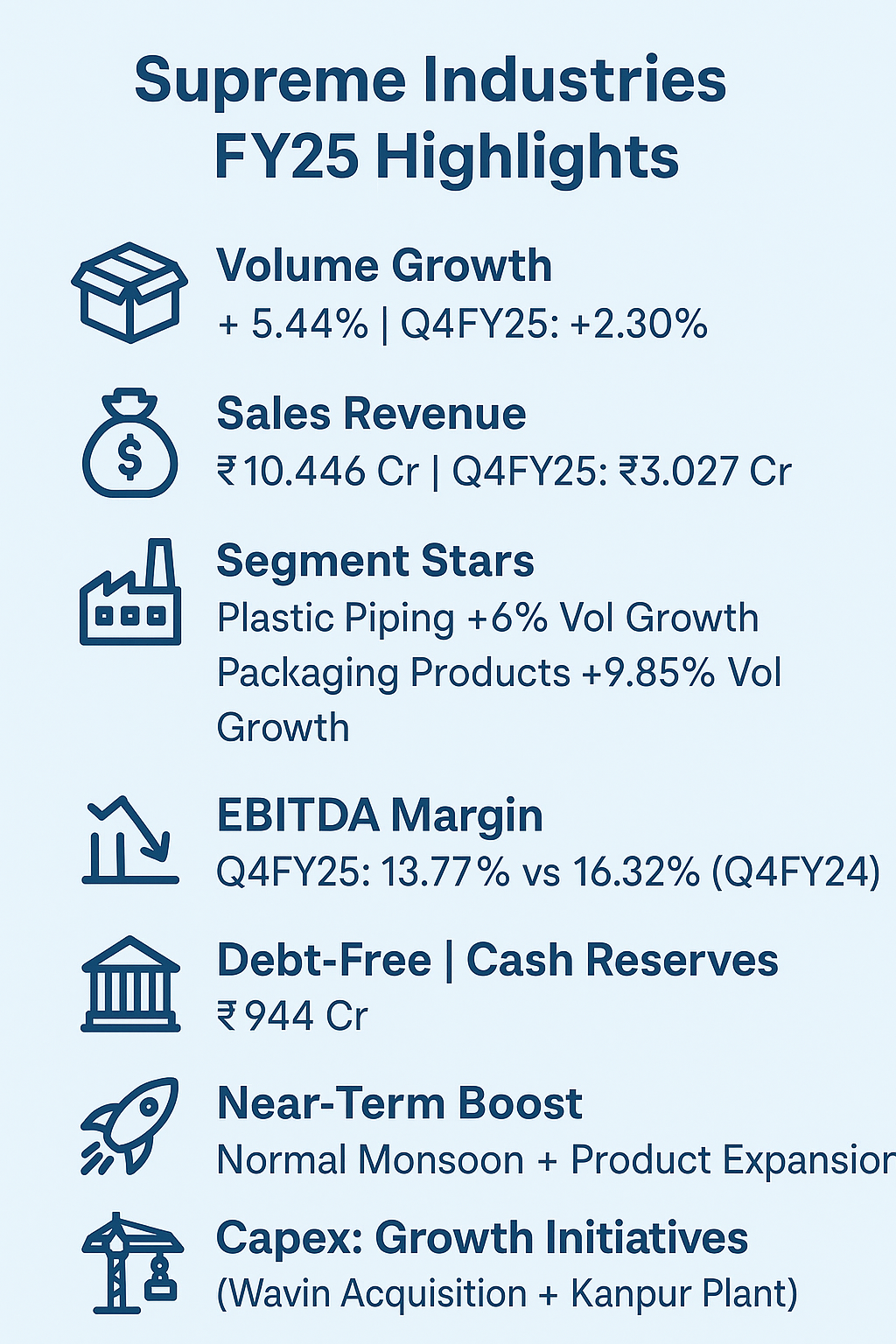

1. Volume Growth:

Q4 FY25:

Plastic goods sold: 199,865 MT, reflecting a YoY growth of 2.30%.

FY25:

Plastic goods sold: 674,510 MT, registering a 5.44% YoY growth.

2. Segment-Wise Performance:

3. Sales Growth:

Q4 FY25 Revenue: ₹3,027 crore (+0.64% YoY growth).

FY25 Revenue: ₹10,446 crore (+3.08% YoY growth).

4. Profit Margins Analysis:

Observation: Margins were under pressure YoY due to volatile PVC resin prices and muted government infrastructure spend impacting profitability.

5. Solvency, Liquidity, Profitability Ratios (Standalone):

Strong Financial Stability: Company remains completely debt-free with ample internal accruals to fund expansions.

🔮 Near-Term and Long-Term Strategic Estimates:

Near-Term Outlook (FY26):

Management expects improved volume growth led by normal monsoon boosting rural demand.

Margins are anticipated to stabilize with raw material prices (PVC resins) expected to remain range-bound.

New product launches (e.g., PP Silent Pipes, enhanced Bath fittings SKUs) will fuel top-line growth.

Long-Term Growth Drivers:

₹1,100 crore Capex Plan focused on:

New manufacturing facilities (e.g., Kanpur for uPVC profiles & windows).

Expansion through strategic acquisition: Wavin India Business (73,000 MT capacity addition).

Installed piping capacity to cross 1 Million MT by FY26.

Focus on exports, new applications, and premium product categories like Protective Packaging and Cross Laminated Films.

📋 Disclosure:

This report is intended solely for informational and educational purposes. It should not be construed as investment advice. Readers are advised to perform their own due diligence before making any investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)