Surjit S. Bhalla's (Former Executive Director, IMF for India, Bangladesh, Bhutan and Sri Lanka) insights on inclusive growth in India highlight several key points that could be useful for investors looking into the Indian market:

Facts on Inclusive Growth in India:

1) Inequality declined over the last decade

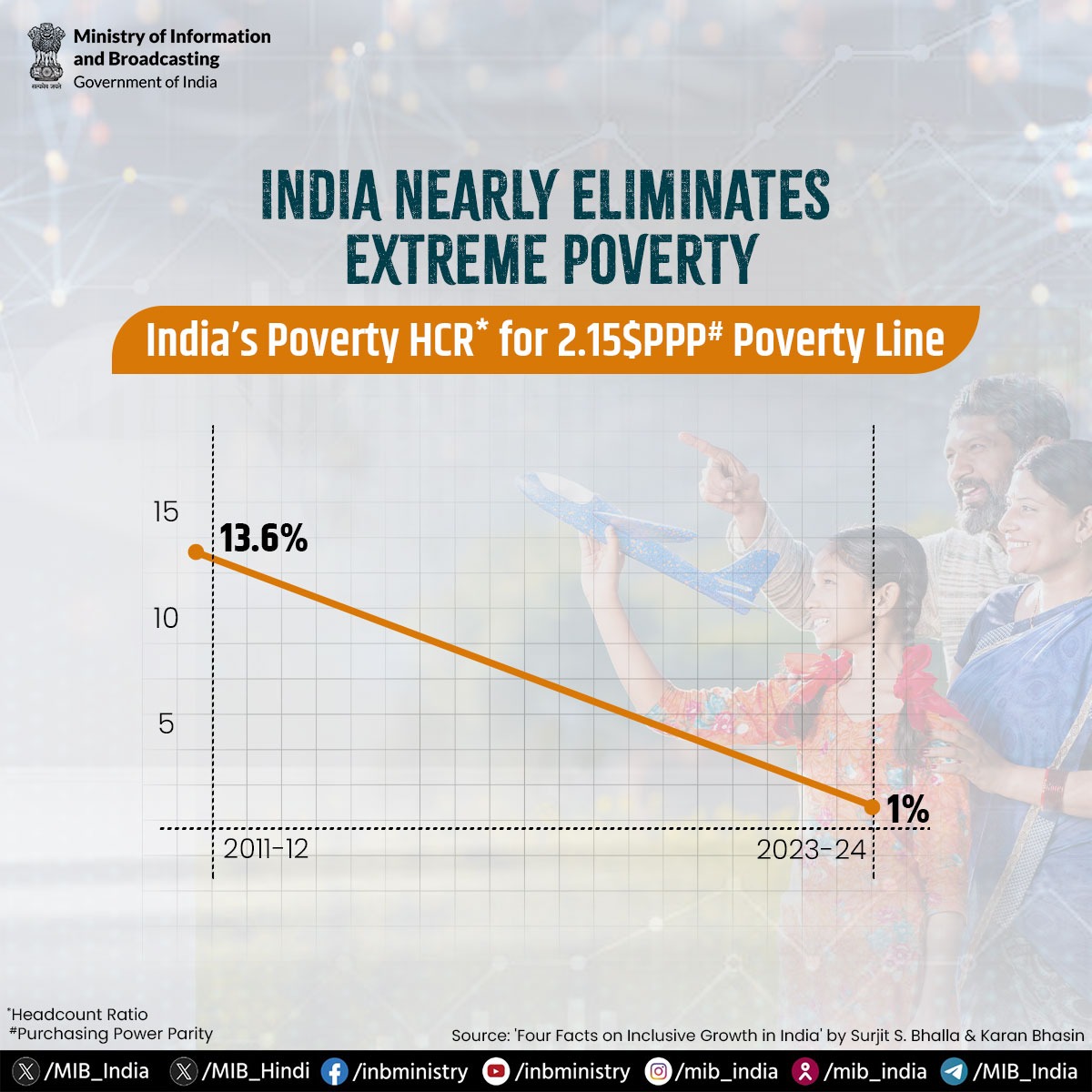

2) Poverty has declined across all possible poverty lines

3) Extreme poverty eliminated

4) Poverty at 15% for World Bank’s higher poverty line of 3.2$ PPP down from 52% in 2011-12!

Poverty Reduction 📉: Bhalla highlights that poverty reduction is a key indicator of inclusive growth. He notes a significant decline in poverty rates during periods of high economic growth, suggesting that growth has helped reduce poverty. This trend is attractive to investors as it indicates a growing consumer base and potential increases in domestic demand.

Education and Gender Equality 📘👩🎓: There has been notable progress in educational attainment, especially among women, nearing gender parity in education. This could impact sectors like ed-tech, professional training, and consumer goods aimed at an educated and equitable workforce.

Agricultural Growth 🌾: Emphasizing the importance of agricultural development, Bhalla points out that growth in this sector can significantly improve living standards for India's rural poor. Opportunities may arise in agricultural technologies, infrastructure, and rural development projects.

Inequality and Economic Policy 📊: Despite some increases in inequality, the overall levels have remained relatively stable compared to other rapidly growing economies. This stability suggests that growth has not been overly concentrated among the wealthiest, supporting policies that promote broad economic participation.

Investors might find promising opportunities in sectors like consumer goods, financial services for lower-income groups, agricultural tech, and educational services. Companies aligning with government policies promoting inclusive growth could also be attractive investment targets.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)