📡 TRAI Drive Test Report February 2025 – In-Depth Performance Analysis Across 6 Indian Circuits

🏛 Published by: Telecom Regulatory Authority of India (TRAI)

📅 Date Released: 17 April 2025

🧭 Coverage: 6 Licensed Service Areas (LSAs) across India

🔍 Purpose: Independent Drive Test (IDT) to evaluate Quality of Service (QoS) for voice & data

🌐 Why Investors Should Care?

With India's fast-growing data consumption, increasing smartphone penetration, and 5G rollouts, understanding telecom service quality helps investors assess the strength of market leaders like Airtel, Jio, Vodafone Idea, and BSNL.

📊 Key Metrics Evaluated by TRAI:

🔈 Voice Services:

✅ Call Setup Success Rate (CSSR)

📉 Drop Call Rate (DCR)

📞 Mean Opinion Score (MOS – Voice Quality)

🔇 Call Silence/Mute Rate

📶 Signal Strength Coverage

📶 Data Services:

⬇️⬆️ Data Throughput (DL & UL)

🎥 Video Streaming Delay

⏱️ Latency & Jitter

❌ Packet Drop Rates

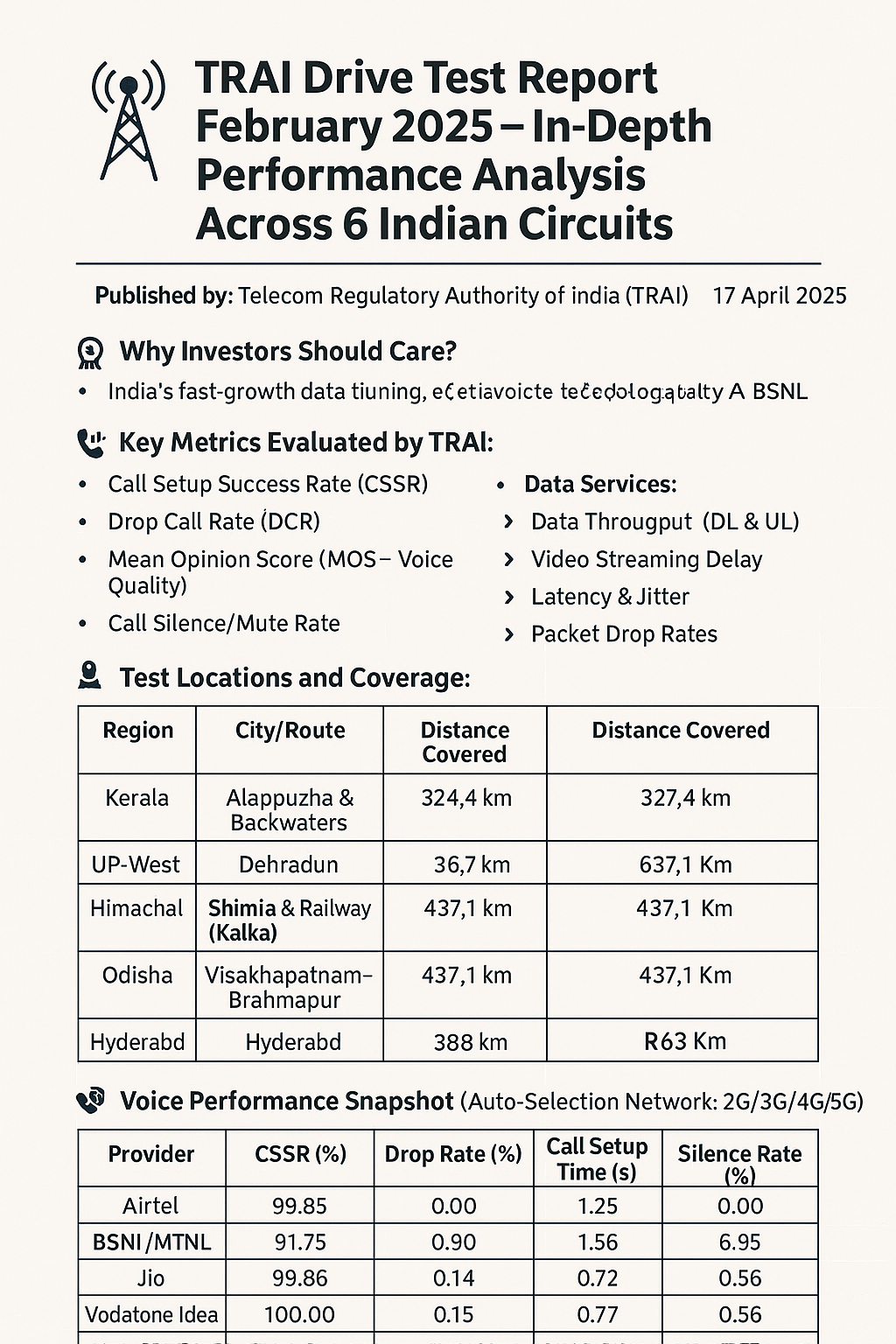

🗺️ Test Locations and Coverage

| Region | City/Route | Distance Covered |

|---|---|---|

| Kerala | Alappuzha & Backwaters | 324.4 Km |

| UP-West | Dehradun | 227.5 Km |

| Himachal | Shimla & Railway (Kalka) | 253.8 Km |

| Odisha | Visakhapatnam–Brahmapur, Paradeep | 437.1 Km |

| Andhra Pradesh | Hyderabad | 396 Km |

| Gujarat | Rajkot | 368.8 Km |

📞 Voice Performance Snapshot (Auto-Selection Network: 2G/3G/4G/5G)

| Provider | CSSR (%) | Drop Rate (%) | Call Setup Time (s) | Silence Rate (%) | MOS (Score out of 5) |

|---|---|---|---|---|---|

| Airtel | 99.85 | 0.00 | 1.25 | 0.00 | 4.02 |

| BSNL/MTNL | 91.75 | 0.90 | 1.56 | 6.95 | 2.91 |

| Jio | 99.86 | 0.14 | 0.72 | 0.56 | 3.91 |

| Vodafone Idea | 100.00 | 0.15 | 0.77 | 0.56 | 4.53 |

🔍 Investor Takeaway:

📈 Vodafone Idea delivered best voice quality (MOS: 4.53), while Jio showcased lowest call setup time (0.72s).

⚠️ BSNL continued to lag behind significantly on almost every metric—highlighting operational inefficiencies that may impact user base and investor trust.

📡 Data Service Assessment

Although detailed throughput and latency figures per provider are not in this summary, the report reinforces rising user expectations from 5G-level performance in both urban and semi-urban corridors.

🔮 Investment Outlook – Telecom Sector

🚀 Growth Drivers:

Rising 5G adoption

Rural network expansion

Mobile-first economy

Higher ARPU (Average Revenue Per User) with premium data plans

⚠️ Risks to Monitor:

High spectrum debt

Intense price wars

BSNL’s underperformance dragging sectoral averages

📌 Key Players to Watch:

Jio – Tech-efficient, lowest setup time

Airtel – Balanced leader with consistent performance

Vodafone Idea – Improving on voice, but stressed financially

BSNL – Public enterprise in urgent need of revamp

📎 Strategic Insights for Investors

📊 Prefer private sector telecoms with strong customer service metrics, especially Airtel & Jio, based on TRAI's direct measurement data.

🔄 Expect 5G-related CAPEX to remain high but yield returns via network-led customer stickiness.

📉 Consider exposure to telco-support sectors (tower infra, cloud data services, fiber optics).

📜 Disclosure:

This content is created for informational and educational purposes only. It should not be considered investment advice. Please consult your financial advisor before making investment decisions.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)