📊 Tata Elxsi Q4FY25 & FY25 Review: Growth Foundations Amidst Headwinds

CMP: ₹4,900 | Sector: IT Services & Product Engineering | Date: April 20, 2025

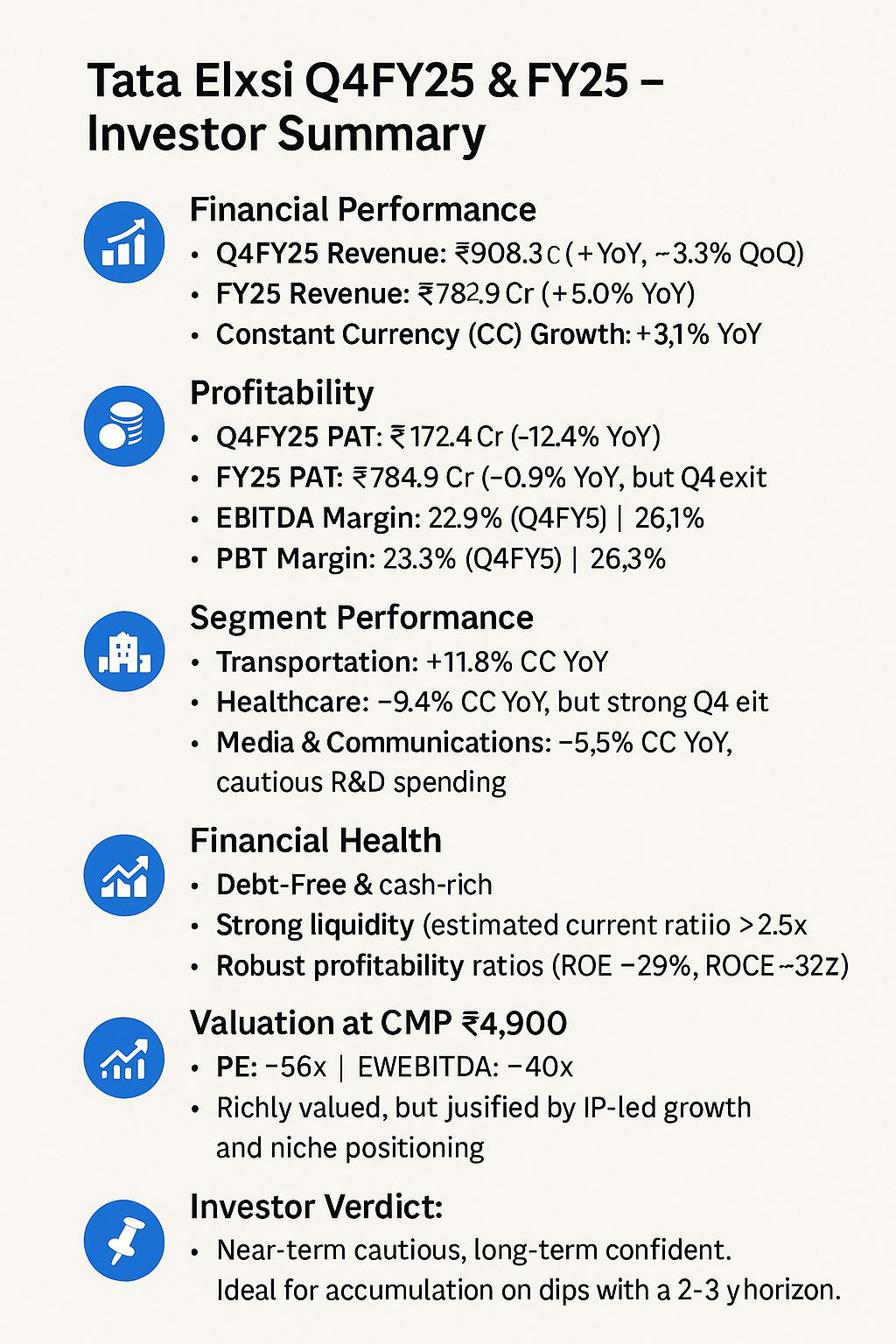

Tata Elxsi, the engineering R&D arm of the Tata Group, has announced its results for Q4FY25 and FY25. The numbers reflect a mixed year with strategic wins setting the stage for long-term growth, while near-term performance shows some softness due to industry dynamics.

💹 Revenue & Constant Currency (CC) Growth

🔸 Q4FY25

Reported Revenue: ₹908.3 Cr (+0.3% YoY, -3.3% QoQ)

CC Growth: -2.9% YoY | -5.3% QoQ

🔸 FY25

Reported Revenue: ₹3,729 Cr (+5.0% YoY)

CC Growth: +3.1% YoY

Commentary: FY25 witnessed subdued growth, largely due to macro uncertainty. Transportation was a bright spot, growing 11.8% YoY in CC terms, driven by SDV projects. Media and Healthcare faced temporary declines but closed Q4 with deal momentum.

📈 Profit Margins & Profit Growth

YoY PAT Growth:

Q4FY25: -12.4%

FY25: -0.9%

📌 Margin contraction was largely attributed to ramp delays and cautious customer spending in media and automotive.

🏭 Segmental & Industry KPIs

Key Wins:

€50M SDV deal with European OEM

$100M product engineering deal in Media & Comms

Expanded in Aerospace & Defence (HAL, UAVs, AI platforms)

💼 Solvency, Liquidity, Profitability & Cash Flow

Profitability Ratios:

ROE: ~29% (est.)

ROCE: ~32% (est.)

Net Profit Margin (FY25): 21.1%

Solvency:

Debt-Free Company

Interest Coverage Ratio: High due to cash surplus and low/no debt

Liquidity:

Current Ratio: >2.5x (strong working capital position)

Cash & Equivalents: Estimated ₹800–1,000 Cr range

Cash Flows:

Strong Operating Cash Flow

Capex focused on SDV infrastructure, digital labs, and CoEs

📊 Valuation at CMP ₹4,900

📌 Stock remains richly valued vs peers, justified by differentiated services in SDV, AI, and healthcare platforms.

🔮 Outlook

🔹 Near-Term (6–9 months)

Modest growth expected due to project delays and macro caution

Q1FY26 to benefit from large deal ramp-ups in auto and media

Focus on improving margins through cost optimization

🔹 Long-Term (1–3 years)

SDV, Healthcare, AI-driven transformation to drive multi-year growth

Expansion into aerospace/defence and EMEA to open new verticals

Margin expansion potential from IP-led service delivery

🏁 Conclusion: Steady Amidst Storm

Despite short-term margin compression and muted profit growth in Q4, Tata Elxsi remains fundamentally strong. Backed by marquee deals, entry into new verticals, and IP-led platforms, the long-term trajectory remains upward.

📌 Investor Verdict: Accumulation on dips with a long-term horizon makes sense given deal momentum and strategic positioning.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)