🚗 Tata Motors' March Moves: NCD Issuance & Digital Pivot – What Investors Should Know

Author: Piyush Patel

Date: March 28, 2025

Category: Market Insights | Automotive | Investment Analysis

📌 Executive Summary

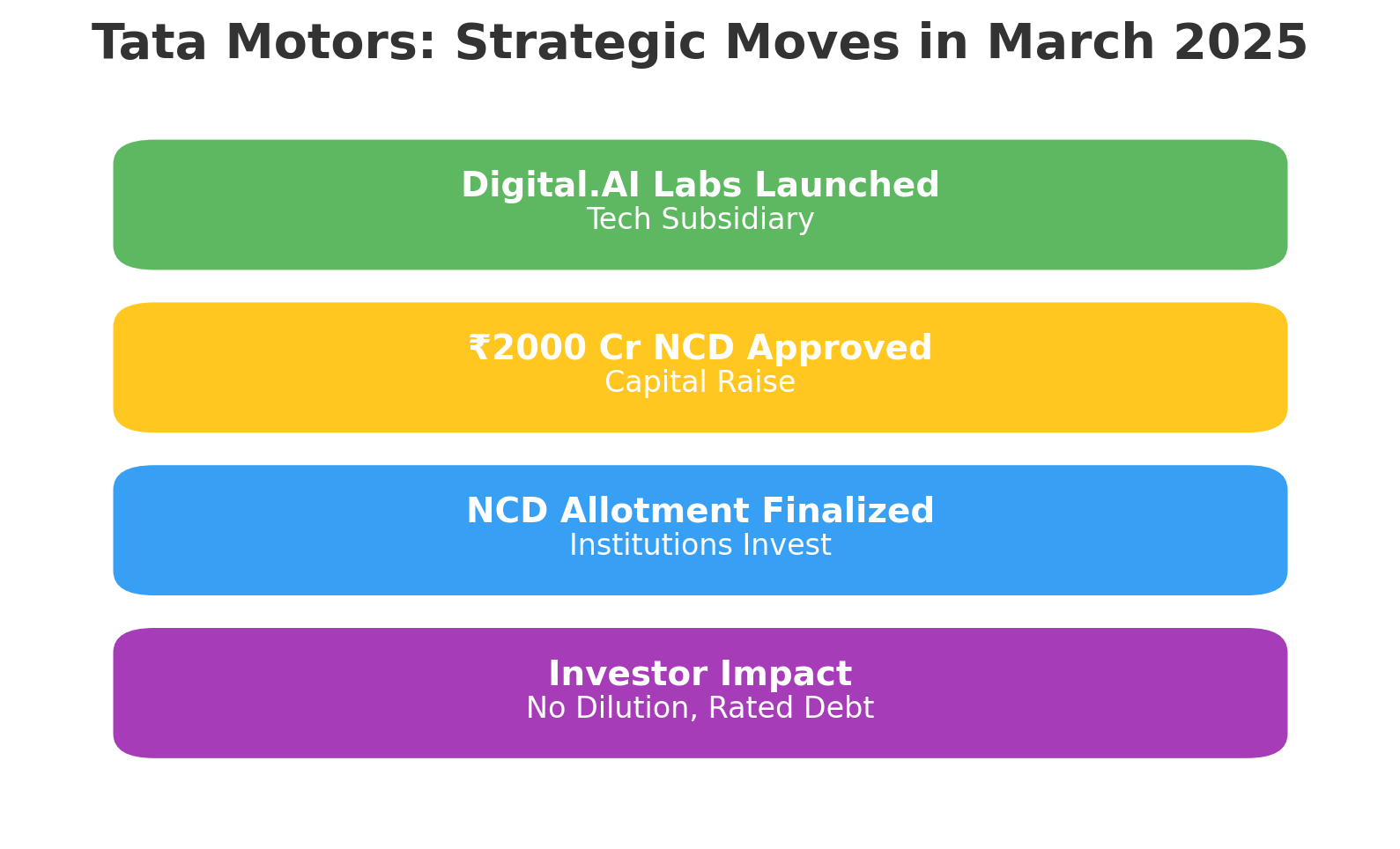

Tata Motors has had a busy March 2025 – from raising ₹2,000 crore via debt to launching a tech-focused subsidiary. These moves might seem like routine corporate events, but for investors, they provide powerful clues about the company’s direction and financial strategy.

In this post, I break down what happened, what it means, and how it may impact your investment in Tata Motors.

📅 Timeline of Key Events

🔧 Event 1: Tata Motors Goes Digital with AI Subsidiary (Mar 17)

What’s New?

Tata Motors incorporated a new wholly owned subsidiary:

👉 Tata Motors Digital.AI Labs Ltd. (TMDALL)

Focus Area:

Technology, Data Science, AI for Automotive Innovation

Why It Matters:

This isn't just a side project – it’s a signal that Tata Motors is actively pivoting towards becoming a future-ready, software-defined mobility company. With global competitors like Tesla and BYD investing in tech-first vehicles, this move aligns Tata Motors with global trends.

Investor Take:

✅ Positive signal for long-term equity investors

✅ Reinforces the company’s strategic transformation in EVs and digital vehicles

💸 Event 2: ₹2,000 Cr NCD Issuance Approved (Mar 19)

Tata Motors’ board greenlit a non-dilutive capital raise of ₹2,000 crore via:

📌 Non-Convertible Debentures (NCDs)

🔒 Unsecured

📈 Rated AA+/Stable by CRISIL

📆 Annual coupon of 7.65%

Breakdown by Tranche:

Why It Matters:

No equity dilution = Shareholder value protection

Raised at a competitive rate = Financial credibility

Signals liquidity strength = Confidence from lenders

Negative = Interest Cost will increase due to New issuance of NCD’s

Investor Take:

📊 Neutral to Positive for equity investors

📉 No dilution = Share value preservation

💰 Stable debt returns = Attractive for debt portfolio investors

💰 Increased Finance Cost = Due to New issuance of NCD’s

📝 Event 3: Allotment to Blue-Chip Investors (Mar 27)

Tata Motors successfully placed NCDs with reputed institutions, including:

🏦 HDFC Bank

🏥 Care Health Insurance

📊 SBI Short Term Debt Fund

🌍 BNP Paribas

🛡️ Reliance General Insurance

What It Means:

Institutions backing Tata Motors’ debt = Market Trust + Strong Governance

NCDs will be listed on NSE’s Wholesale Debt Market, offering tradability and liquidity.

🔍 Final Analysis: What Should Investors Do?

📈 Equity Investors

These moves show strategic discipline – tech expansion + capital raise without dilution.

Keep an eye on how the ₹2,000 Cr is used – capex, EV push, or digital transformation.

💰 Debt Investors

If you're looking for safe, fixed income, these NCDs are attractive:

High credit rating

Solid parent company

Predictable returns

🧠 Analyst's Take

Tata Motors is not just making cars anymore – it’s building an ecosystem. From electric vehicles to AI labs, the company is prepping for the next generation of mobility.

Its March actions show a well-balanced approach:

📉 No equity dilution

🔬 Tech-forward subsidiary

📊 Clean, rated fundraising

🧾 Strategic investor base

We have not invested in TataMotors, but should always keep an eye on what is happening around the industry.

🔗 Want More?

💬 Let me know in the comments if you’d like a breakdown of Tata Motors’ EV strategy, earnings, or stock forecast.

📩 Subscribe for more actionable investment insights every week!

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025