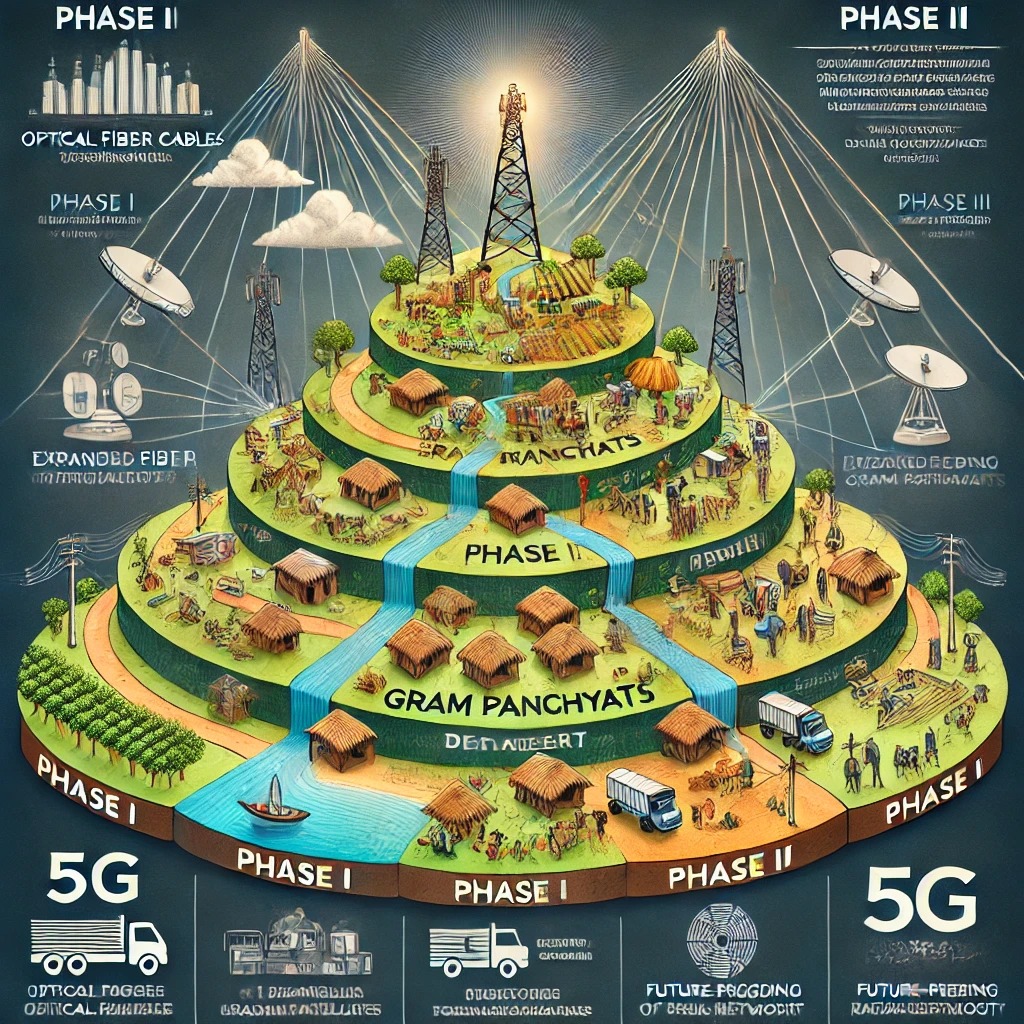

The BharatNet project: Represents a significant development in India's telecommunications landscape, particularly for rural areas.

🌐 Telecommunications and Infrastructure

The BharatNet initiative is set to massively enhance the digital infrastructure across India by extending high-speed internet connectivity to all Gram Panchayats and even non-GP villages on demand. This massive rollout involves an investment of Rs. 1,39,579 crores and promises a robust return on investment potential for companies engaged in optical fiber, routers, and other related telecommunications equipment.

💻 Information Technology and Services

With the deployment of BharatNet, there will be increased demand for IT services such as system integration, network management, and maintenance services. Companies in the IT sector could see an uptick in projects related to the development, deployment, and maintenance of network infrastructure, which can be a positive driver for their stock prices.

🛒 E-commerce and Digital Services

Enhanced connectivity in rural areas can open new markets for e-commerce giants and digital service providers. This can lead to increased user base and potentially higher revenues for companies operating in these domains. The growth in digital payment systems and online retail can lead to increased valuations for firms in these sectors.

🏫 Education and Healthcare

Companies in the edtech and healthtech sectors may also benefit significantly as the document mentions the role of BharatNet in supporting online education and telemedicine services. This connectivity is likely to enhance the reach of companies providing online courses and digital healthcare solutions to rural demographics, thus potentially boosting their growth and market presence.

🏢 Public Sector Undertakings (PSUs) and Partnerships

Public sector enterprises involved in the rollout and maintenance of BharatNet, as well as private companies entering into public-private partnerships, could see financial benefits from government contracts. This could positively impact their stock performance as these projects proceed.

📈 Broader Economic Impact

Long-term investors might be interested in the broader ripple effects of such an infrastructure project, which aims to bridge the digital divide and boost socioeconomic activities in rural areas. As the rural economy integrates more with the digital economy, sectors like banking, agriculture tech, and consumer goods might experience new growth avenues.

Strategic Moves:

🔍 Investors should look for companies announcing new contracts or expansions in line with the BharatNet rollout.

📊 Monitoring stocks in the telecommunications equipment, IT services, and e-commerce sectors might reveal overperformers benefiting from this initiative.

🌱 Diversification into sectors indirectly affected by improved connectivity, like consumer goods and fintech, could also be a wise strategy.

In summary, BharatNet is poised to be a catalyst for significant economic and digital transformation in India, potentially benefiting various industries and offering numerous opportunities for investors to capitalize on sector-specific growth stimulated by enhanced digital connectivity

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)