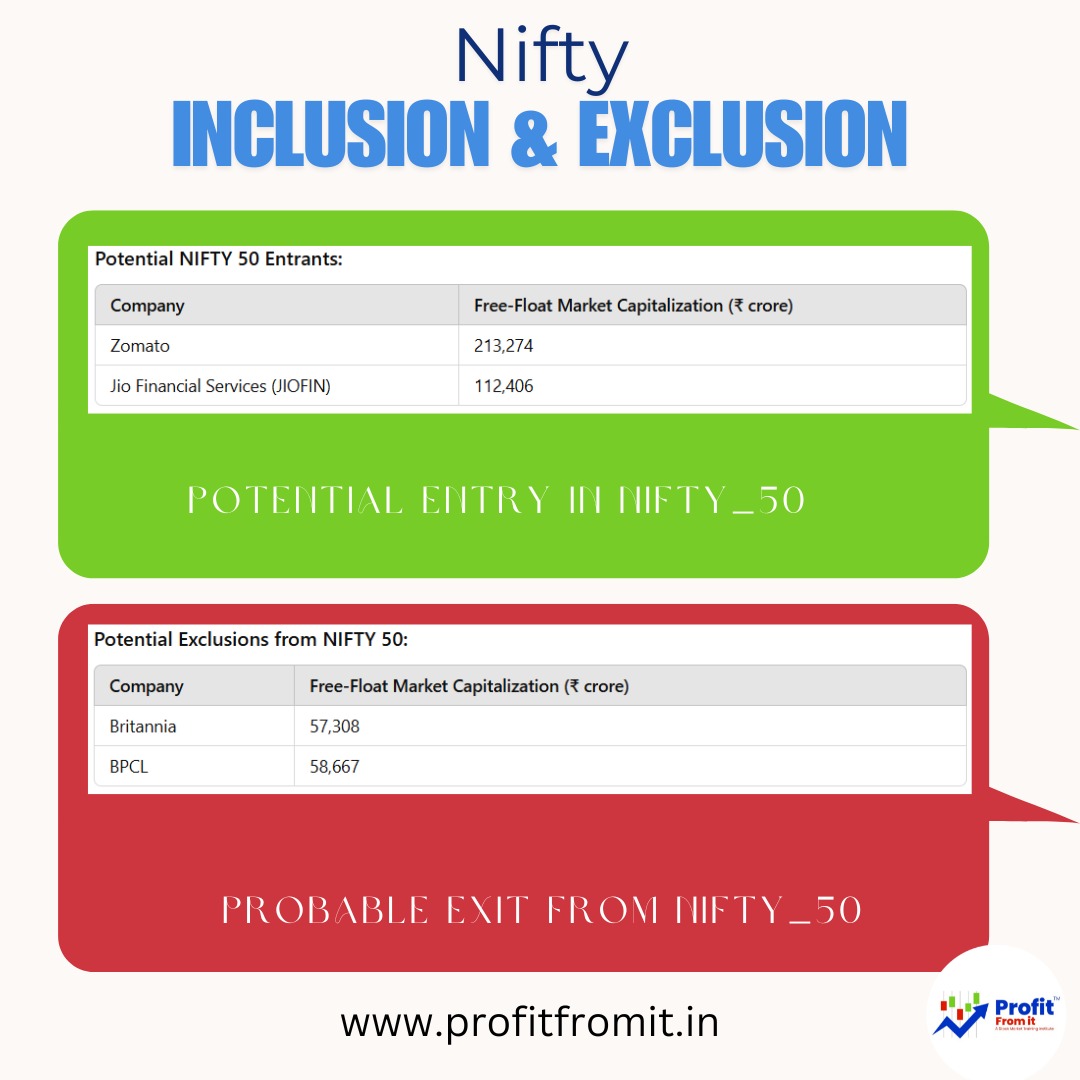

*Potential NIFTY 50 Entrants:*

| Company | Free-Float Market Cap (₹ crore) |

|---------|--------------------------------------------|

| Zomato | 213,274 |

| Jio Financial Services (JIOFIN) | 112,406 |

*Potential Exclusions from NIFTY 50:*

| Company | Free-Float Market Cap (₹ crore) |

|-----------|--------------------------------------------|

| Britannia | 57,308 |

| BPCL | 58,667 |

*Eligibility Criteria for NIFTY 50 Inclusion:*

1. *Liquidity:* The stock should have traded at an average impact cost of 0.50% or less during the last six months for 90% of the observations, for a basket size of ₹100 crore.

2. *Listing History:* A minimum listing history of one calendar month as of the cut-off date.

3. *Derivatives Eligibility:* The company must be allowed to trade in the Futures & Options (F&O) segment.

4. *Free-Float Market Capitalization:* The company's free-float market capitalization should be at least 1.5 times that of the smallest constituent in the NIFTY 50.

Note: The index is rebalanced semi-annually, with changes typically announced four weeks in advance.

*Analysis:*

- *Zomato:* With a free-float market capitalization of ₹213,274 crore, Zomato surpasses the threshold for inclusion. If it meets the liquidity and derivatives eligibility criteria, it stands a strong chance for inclusion.

- *Jio Financial Services (JIOFIN):* Holding a free-float market capitalization of ₹112,406 crore, JIOFIN also exceeds the required threshold. Its inclusion would depend on meeting other criteria, such as liquidity and F&O eligibility.

- *Britannia and BPCL:* Both companies have relatively lower free-float market capitalizations (₹57,308 crore and ₹58,667 crore, respectively). If their market capitalizations fall below the threshold or if there are better candidates for inclusion, they might face exclusion during the rebalancing.

In summary, Zomato and Jio Financial Services are strong candidates for inclusion in the NIFTY 50, provided they meet all eligibility criteria. Conversely, Britannia and BPCL could be at risk of exclusion if they no longer meet the necessary benchmarks.

Www.profitfromit.in

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025