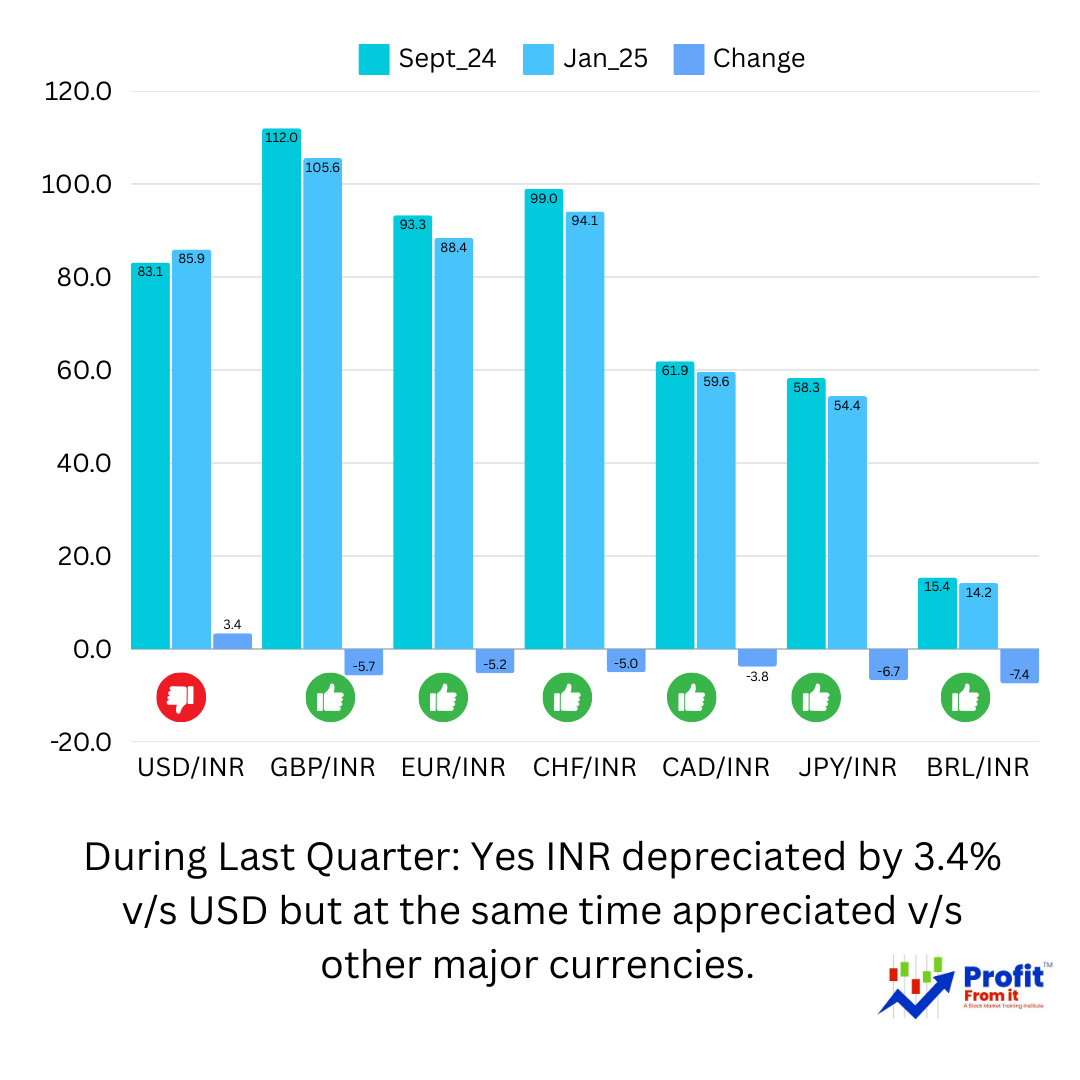

The currency value changes between September 2024 and January 2025 can have several implications on different sectors of the stock market. Here's a breakdown of how these changes could potentially impact various industries:

Import-Export Businesses:

📈 Appreciation of USDINR: Companies in India importing goods or services from the U.S. would face higher costs, potentially squeezing margins unless they can pass these costs onto consumers. Conversely, exporters to the U.S. may benefit from higher revenues when converting dollars back to rupees.

📉 Depreciation of GBP/INR, EUR/INR, CHF/INR: Indian companies exporting to the UK, Eurozone, and Switzerland might see reduced revenue in rupee terms due to the depreciation of these currencies against the INR. Importers from these regions could see cost benefits.

Technology and IT Services:

💻 Companies in the IT sector often bill their overseas clients in foreign currencies like USD, EUR, or GBP. The appreciation of USD against INR would be beneficial for Indian IT firms as it increases their revenue in rupee terms. However, the depreciation of the Euro and Pound may offset some of these gains, depending on the geographic revenue distribution.

Pharmaceuticals and Chemicals:

🏥 These industries also rely heavily on exports. The trends observed in the IT sector regarding currency fluctuations would similarly affect them. Appreciation in USD can boost revenues, while the decline in other major currencies could pose revenue challenges.

Automobile and Heavy Machinery:

🚗 Companies in these sectors that import raw materials or components priced in foreign currencies would be impacted. For example, the depreciation of JPY (Japanese Yen) might reduce the cost of importing Japanese components, benefiting companies in the auto sector.

Consumer Goods:

🛒 The cost of imported consumer goods might decrease due to the depreciation of the EUR, GBP, and CHF, potentially leading to lower prices for consumers and better margins for companies importing from these regions.

Energy Sector:

⛽ Since global oil prices are typically in USD, a stronger USD might lead to increased costs for importing energy, affecting industries like airlines and transportation negatively.

Financial Services:

💰 Currency fluctuations can lead to foreign exchange gains or losses for companies with international operations or those that engage in currency trading. Financial service providers could see an impact on their profitability based on their exposure to these currencies.

In conclusion, the overall impact on the stock market will depend on various factors including company-specific exposure to foreign markets, their hedging strategies, and the overall economic conditions in their primary markets. Investors should look into company-specific annual and quarterly reports to better understand how these currency fluctuations might impact their financials and stock performance.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)