💎 Titan Q4 FY25 Performance: Solid Finish to the Year 🚀

— An Investor’s Guide for Long-Term Vision

Titan Company Limited, a jewel in the TATA Group crown, has once again demonstrated resilience and multi-segment strength, closing FY25 with a commendable ~25% YoY growth in Q4 and ~21% for the full year. As a discerning long-term investor, here's how you can read between the lines and decode the sector trends.

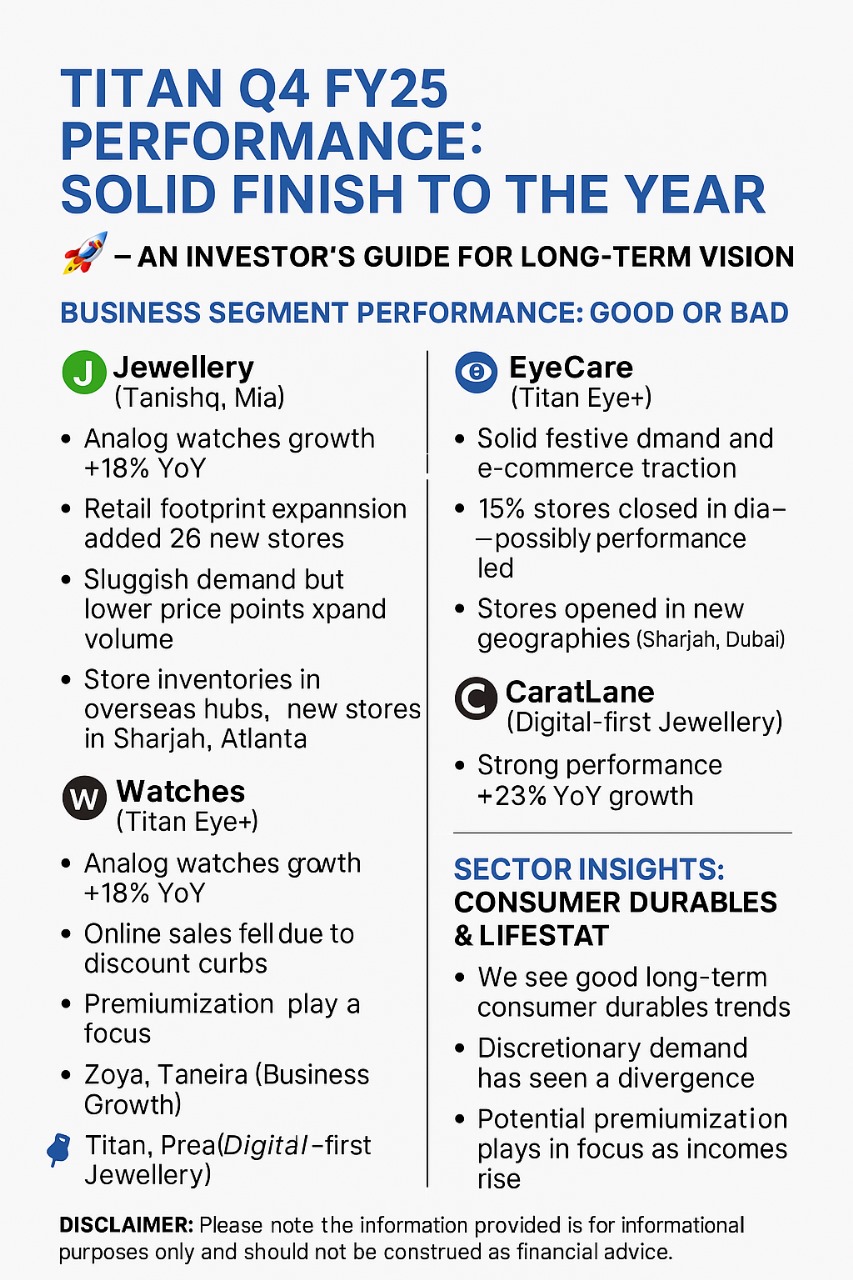

🏬 Business Segment Performance: Good or Bad?

📿 Jewellery (Tanishq, Mia)

✅ +24% YoY | 📈 Gold prices boosted value-based demand

✅ Coins: +65% YoY – Store-of-value mindset is strong

⚠️ Sluggish demand at lower price points due to elevated gold rates

✨ International Expansion – New stores in Sharjah, Atlanta & Seattle

Investor Insight:

Good 🔼 – Strong premium demand, brand strength, and global expansion signal robust long-term potential in the jewellery segment.

⌚ Watches (Titan, Fastrack, Sonata)

✅ +20% YoY Growth

✅ Analog watches growth: +18% YoY

✅ Retail footprint expanded: 41 new stores

📍 Key driver: Helios’ premium push

Investor Insight:

Good 🔼 – Revival in analog watches and premiumization strategy reflects sustainable growth in the lifestyle wearables space.

👓 EyeCare (Titan Eye+)

✅ +18% YoY

✅ Multi-brand strategy & e-commerce traction

📉 11 stores closed in India – possibly performance-led pruning

🌍 International additions in UAE (Sharjah, Dubai)

Investor Insight:

Mixed ⚖️ – New international reach is encouraging, but store closures need close monitoring on profitability metrics.

🌟 Emerging Businesses

🧴 Fragrances: +26% YoY

👝 Fashion Accessories: +12% YoY

🧵 Taneira (Ethnic Wear): -4% YoY

Investor Insight:

Mixed ⚖️ – Innovation and retail trials like SKINN experiential stores are promising; Taneira’s decline needs strategic re-evaluation.

💍 CaratLane (Digital-first Jewellery)

✅ +22% YoY

✅ Strong demand for studded jewellery

✅ +17 stores added

Investor Insight:

Good 🔼 – A promising digital disruptor in Titan’s portfolio; hybrid expansion can boost long-term margins and brand equity.

🧠 Long-Term Investor Strategy: How to Watch Titan

📌 1. Sector Leadership – Jewellery remains Titan’s crown jewel. Monitor gold price sensitivity and premium consumer sentiment.

📌 2. Retail Footprint – Consistent store expansion (net 72 stores added this quarter) supports long-term compounding.

📌 3. Global Diversification – Presence in UAE and USA increases resilience against domestic economic cycles.

📌 4. Omni-channel Strength – CaratLane and Eye+ digital traction proves adaptability to e-commerce shift.

📌 5. Brand Innovation – Experiential stores and new category entries reflect future-ready strategies.

🌐 Sector Insights: Consumer Durables & Lifestyle

🛍️ India's aspirational middle class is expanding – fueling demand for branded jewellery and accessories.

📉 Gold volatility can affect near-term jewellery volumes but Titan's premium positioning offers pricing power.

📱 Online growth & D2C channels becoming a core revenue stream – Titan is adapting smartly.

💼 Organized retail's market share is rising, benefiting players like Titan with brand legacy and retail muscle.

📊 Final Verdict: Titan – A Jewel for Long-Term Portfolios 💼💰

✅ Strong financial growth

✅ Leadership in high-margin segments

✅ Bold innovation and global expansion

⚠️ Watch for margin pressure in lower-ticket segments and eye care restructuring

Long-Term View: POSITIVE 📈 – Titan continues to shine as a compounding story driven by brand trust, expanding footprint, and multi-category dominance.

📢 Disclaimer

This blog report is intended solely for informational and educational purposes. It does not constitute investment advice or a recommendation to buy or sell any securities. Readers are encouraged to conduct their own research and consult with a registered financial advisor before making any investment decisions. Titan Company Limited’s performance data mentioned above is based on provisional Q4 FY25 updates and is subject to final audit confirmation. The author holds no responsibility for any direct or indirect loss arising from the use of this information

Comments (0)

Categories

Recent posts

ITC Hotels and its strategic plans ...

30 Dec 2024

Reliance Leads Energy Revolution: 100% ...

22 Jan 2025 for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)

📊 Analysis of Nifty 500 Companies: ...

14 Feb 2025