Infrastructure Sector Insights: Q3 FY25 Stock Performance Analysis

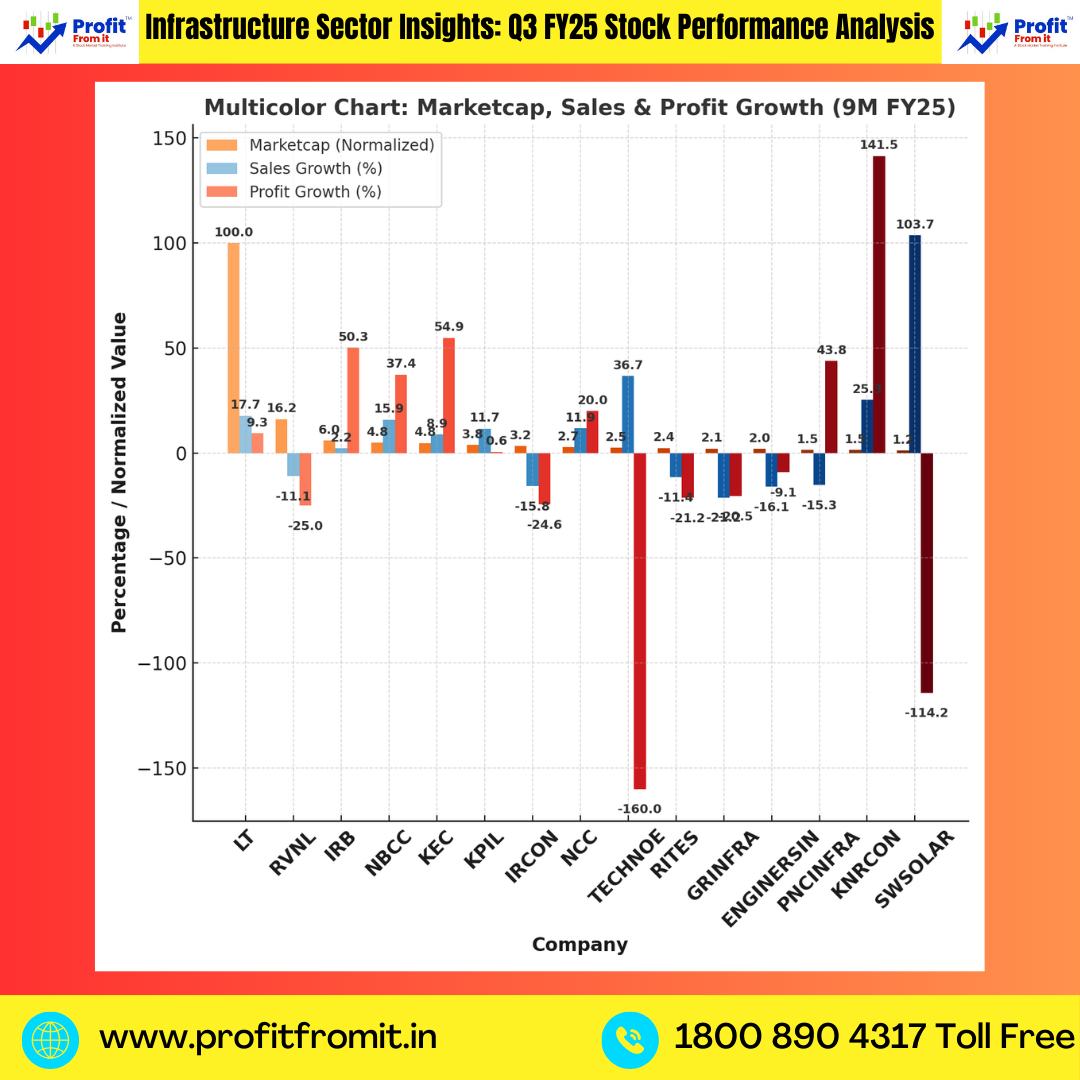

India’s infrastructure sector continues to be a cornerstone of growth, with several companies showing impressive financial performance in Q3 FY25. Based on sales and profit growth, here’s a breakdown of outperformers and underperformers, along with a deep dive into some key players for informed investing.

🚀 Outperformers – Power-Packed Growth Stocks

These companies delivered strong operational results, with notable sales and profit growth:

| Company | Sales Growth | Profit Growth |

|---|---|---|

| KNRCON | +25.31% | +141.50% (Due to Low Profit Base Last year) |

| L&T | +17.73% | +9.35% |

| NBCC | +15.95% | +37.36% |

| NCC | +11.89% | +20.04% |

📌 KNR Constructions shows good sales growth this year while LT is the most consistent growing company with leading OrderBook.

📉 Underperformers – Companies Under Pressure During 9M_fy25

These stocks posted negative sales and profit growth, indicating operational challenges:

| Company | Sales Growth | Profit Growth |

|---|---|---|

| ENGINERSIN | -16.08% | -9.09% |

| GRINFRA | -21.19% | -20.52% |

| IRCON | -15.80% | -24.56% |

| RITES | -11.44% | -21.23% |

| RVNL | -11.06% | -25.00% |

📌 GR Infraprojects is the weakest performer, with double-digit decline in both revenue and profit.

💼 Deep Dive: Larsen & Toubro (L&T)

1. Performance Snapshot:

Market Cap: ₹4,60,916 Cr (Largest in infra space)

Sales Growth: +17.73%

Profit Growth: +9.35%

✅ Strong and steady growth from India’s infra giant.

2. Financial Ratios:

P/E Ratio: 31.48 (Below industry avg. 41.76 – Reasonable valuation)

Debt-to-Equity: 1.41 (Higher than median – Due to Finance division in LTFH company)

Net Profit Margin: 5.52% (Below industry avg. 8.65%)

ROA: 4.57% (Above industry avg. – efficient)

3. Growth Drivers:

Huge order book in construction, defense & infra

Government infra push (rail, roads, urban development)

Global presence expanding in Middle East & Africa

📌 Verdict: ✅ Safe, stable, and ideal for long-term investors.

📊 Other Notable Infra Stocks

NBCC India

Market Cap: ₹22,351 Cr

Sales Growth: +15.95%

Profit Growth: +37.36%

🔍 Verdict: ✅ High-growth mid-cap stock

IRB Infrastructure

Market Cap: ₹27,707 Cr

Sales Growth: +2.19%

Profit Growth: +50.3%

🔍 Verdict: ✅ Due to last year low profit base, sales growth & In consistent Profits a concern

KEC International

Market Cap: ₹22,099 Cr

Sales Growth: +8.91%

Profit Growth: +54.87%

🔍 Verdict: ✅ Balanced performance with strong earnings

KNR Constructions 🏆

Market Cap: ₹6,696 Cr (Small-cap)

Sales Growth: +25.31% (Highest revenue growth!)

Profit Growth: +141.5% (Massive earnings explosion due to low profits last year)

📌 Note: The exceptionally high profit growth is also due to a low profit base in the same quarter last year.

💡 Investor Takeaways

✅ Stable Bets: L&T – Consistent leader with reliable returns.

✅ Mid-Cap Growth: NBCC, KEC – Great mix of growth and stability.

🔥 High-Risk, High-Reward: KNR Constructions – For aggressive investors.

⚠️ Avoid for Now: GRINFRA, IRB – Currently facing financial pressure.

📌 Stay tuned for more Q3 insights and sector-specific performance reviews to help you stay ahead in your investment journey.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)