Long-Term Impact Investing: Shaping the Future Through Strategic Company Selection

📊 Empowering sectors. Elevating companies. Enriching portfolios.

🧭 Introduction: Investing Beyond Returns

In today’s dynamic economy, long-term investing enables you to align wealth-building with sectoral progress and sustainability. By identifying companies that benefit from demographic, technological, and economic megatrends, investors can achieve both financial returns and social impact.

🔍 The Power of Long-Term Vision in Investing

Investing with a 5–10 year horizon empowers you to:

💸 Fund innovation and sector growth

🗳 Influence governance for sustainable practices

📈 Attract more capital into impactful companies

🏗 Key Pillars of Long-Term Impact Investing

(Refer to the detailed analysis in previous section covering company financials, industry trends, macroeconomics, and stock strategies.)

📡 Key Sector Spotlight: Telecom & Digital Infrastructure

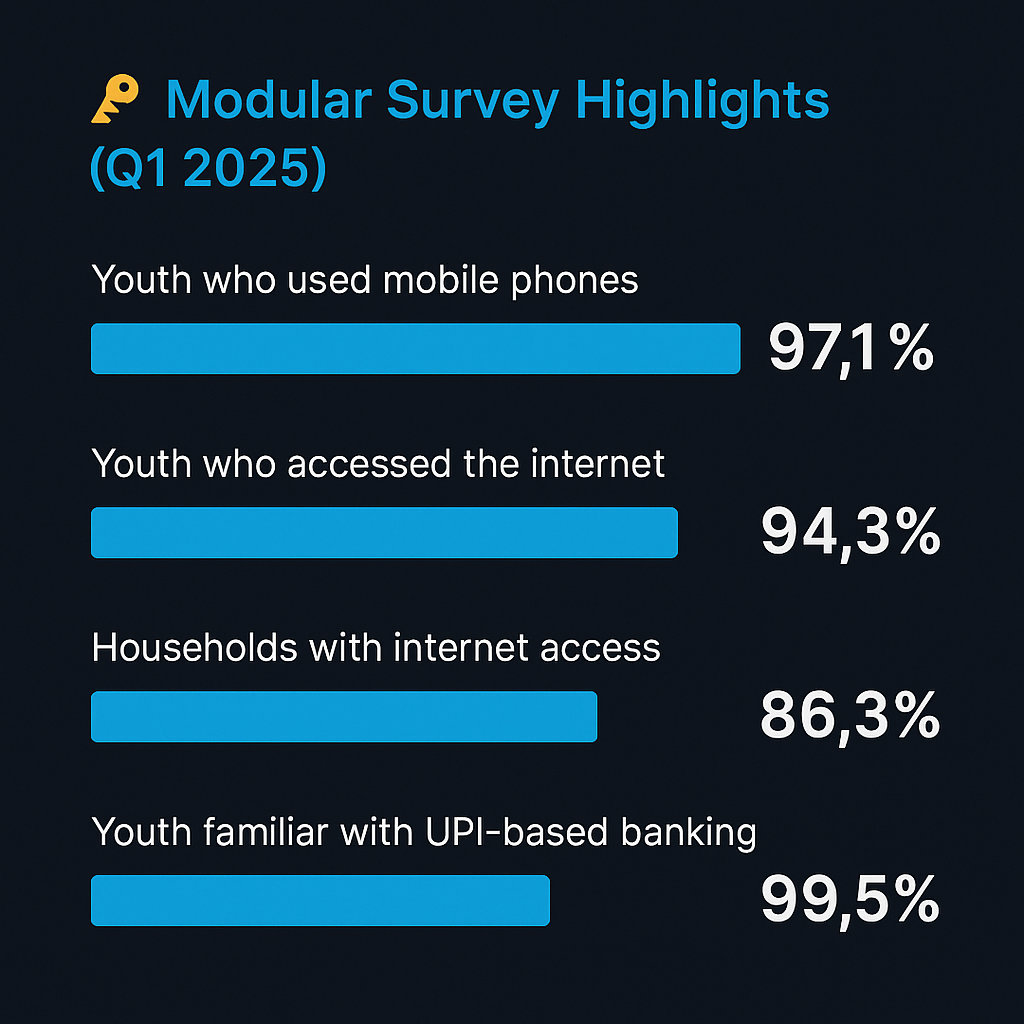

🔑 Modular Survey Highlights (Q1 2025):

📱 97.1% of youth (15–29 yrs) used mobile phones

🌐 94.3% of youth accessed the internet

📶 86.3% of households have internet access

💳 99.5% of youth familiar with UPI-based banking

🎯 Interpretation for Investors:

This confirms the explosive demand for data, connectivity, mobile services, and digital platforms—making telecom, broadband, and digital financial infrastructure long-term investment themes.

📈 Long-Term Beneficiary Companies (India-Focused)

1. Telecom & Infrastructure

| Company | Segment | Rationale |

|---|---|---|

| Bharti Airtel | Telecom Services | Leader in 4G/5G rollout, rural expansion, and mobile payments via Airtel Money |

| Reliance Jio (RIL) | Digital Ecosystem (Jio + JioFiber) | Aggressive expansion in broadband, OTT, cloud, and digital commerce |

| Indus Towers | Telecom Tower Infrastructure | Backbone for growing mobile and 5G network infrastructure |

| Tejas Networks | Optical Equipment & 5G Hardware | Building India’s indigenous 5G and broadband gear (Tata Group-backed) |

2. Digital Payments & Fintech

| Company | Segment | Rationale |

|---|---|---|

| Paytm (One97 Comm.) | Payments & UPI Ecosystem | Dominant UPI presence, expanding into lending and insurance |

| PhonePe (Walmart-backed, unlisted) | UPI, Wallets | Large transaction volumes, rural reach, and cross-platform ecosystem |

| Zomato (Blinkit) | Digital Commerce & QR UPI | QR-enabled hyperlocal commerce integration and UPI scale |

3. IT & Cloud Infrastructure Enablers

| Company | Segment | Rationale |

|---|---|---|

| Tata Communications | Cloud, Data Centers, Connectivity | Key digital infra provider to telecoms and global enterprises |

| HCL Technologies | Digital Transformation | Building global 5G, IoT, and AI platforms |

| L&T Technology Services | Embedded Tech & Smart Devices | Beneficiary of IoT and smart device growth from rising smartphone penetration |

4. Smartphone & Consumer Tech

| Company | Segment | Rationale |

|---|---|---|

| Dixon Technologies | Electronics Manufacturing | Leading contract manufacturer for phones, TVs, wearables (Make in India) |

| Amber Enterprises | Mobile & AC Components | Supplies to major OEMs, linked to electronics penetration in Tier 2/3 |

5. Digital Inclusion & Cybersecurity

| Company | Segment | Rationale |

|---|---|---|

| Route Mobile | Enterprise Communication APIs | Growth in A2P SMS, OTPs, enterprise messaging across BFSI & e-commerce |

| Quick Heal Technologies | Cybersecurity Software | Rising digital usage increases demand for endpoint and data protection |

🌍 Global Listed Companies Benefiting from India’s Telecom Growth

| Company | Segment | Reason to Watch |

|---|---|---|

| Apple Inc. | Smartphones | Growing market share in India, supported by Make in India push |

| Qualcomm | 5G Chipsets | 5G handset growth = higher chipset demand |

| Alphabet (Google) | Cloud & Android OS | Dominant OS + Jio partnership for rural smartphones |

| Meta (Facebook) | Digital Ads & WhatsApp | Beneficiary of increased internet access and WhatsApp Pay rollout |

📘 Conclusion: Building an Impactful Portfolio

By aligning your investments with transformative sectors—like telecom, digital payments, and cloud infrastructure—you can participate in the future of India’s digital revolution.

🔎 Key Actions for Investors:

Prioritize companies enabling digital access, payments, and infrastructure

Use fundamental analysis for value assessment and technical tools for timing

Continuously monitor government policies, tech innovations, and macro shifts

✅ Disclaimer

The information provided in this blog is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any securities. Investors are advised to conduct their own research and consult financial professionals before making any investment decisions. The mentioned companies are referenced for illustrative purposes based on available data and trends.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)