📊 Unified Data-Tech Solutions Limited – IPO Analysis (May 2025)

🔍 IPO Snapshot:

IPO Window: 22nd May 2025 to 26th May 2025

Price Band: ₹260 - ₹273 per share

Face Value: ₹10

Issue Type: 100% Offer for Sale (No fresh issue)

Total Offer Size: 52,92,000 equity shares

Market Maker Reservation: 2,67,600 shares

Net Offer: 50,24,400 shares (26.34% of post-offer equity)

🧾 1. Purpose of the IPO

Offer for Sale: Entirely by Promoter Hiren Rajendra Mehta.

No fresh proceeds to the company – the objective is to achieve listing benefits and provide exit/liquidity to the promoter.

💡 2. Business Overview

Unified Data-Tech Solutions Ltd is a technology-driven company offering:

Data Center Infrastructure

Network & Cybersecurity

Cloud & SaaS Products

IT Services & AMC

The company provides tailored IT solutions with strong implementation and post-sales service capabilities across India.

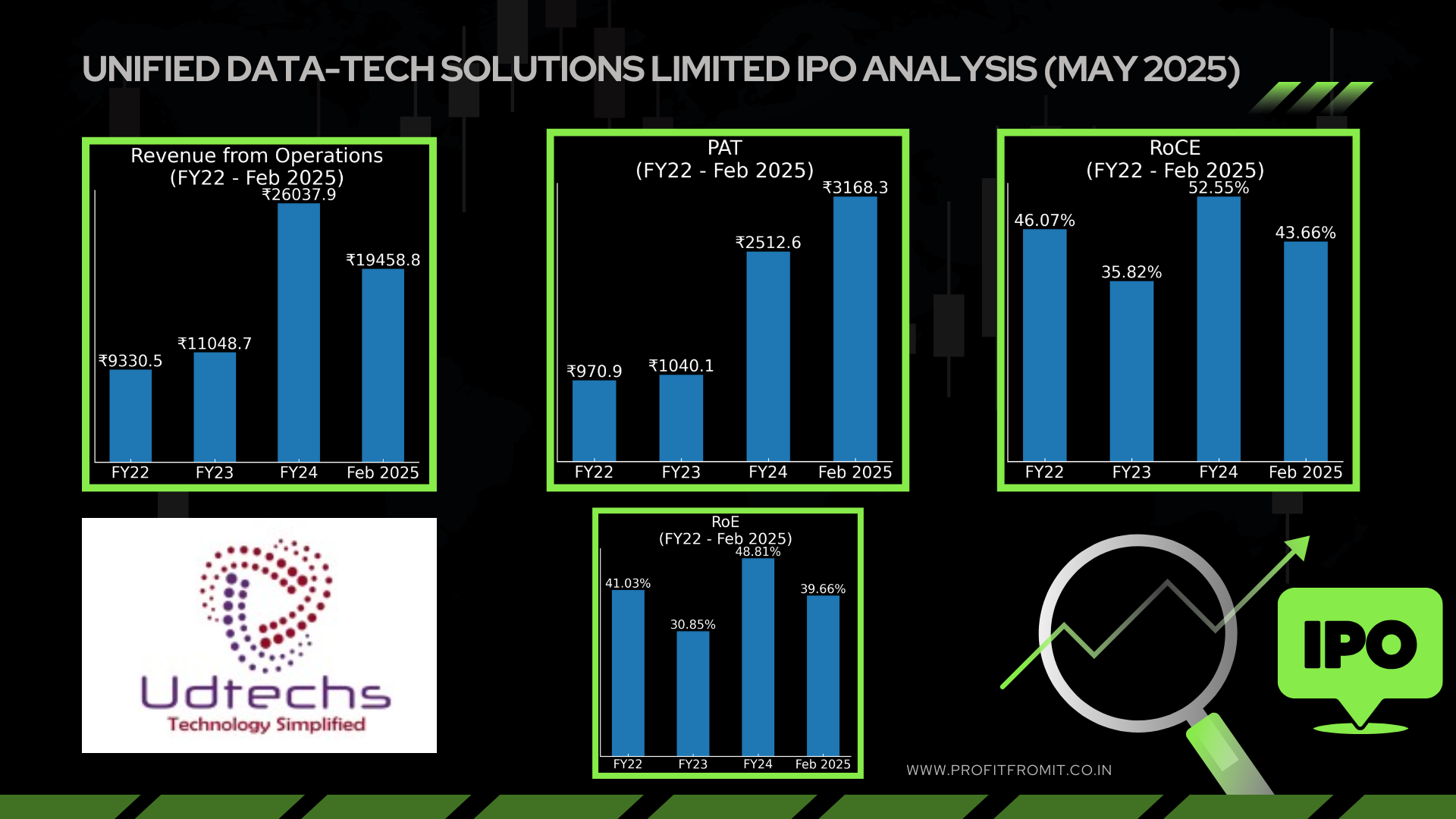

📈 3. Financial Performance (₹ in Lakhs)

| Metric | FY22 | FY23 | FY24 | Feb 2025* |

|---|---|---|---|---|

| Revenue from Operations | 9,330.45 | 11,048.66 | 26,037.87 | 19,458.77 |

| EBITDA | 1,114.96 | 1,246.90 | 2,786.61 | 3,316.92 |

| EBITDA Margin | 11.95% | 11.29% | 10.70% | 17.05% |

| PAT | 970.88 | 1,040.09 | 2,512.59 | 3,168.31 |

| PAT Margin | 10.41% | 9.41% | 9.65% | 16.28% |

| RoE | 41.03% | 30.85% | 48.81% | 39.66% |

| RoCE | 46.07% | 35.82% | 52.55% | 43.66% |

| Net Worth | 2,851.76 | 3,891.86 | 6,404.45 | 9,572.75 |

📌 *February 2025 figures are unaudited & not annualized.

📊 4. KPI & Valuation Metrics

EPS (FY24): ₹12.51

RoNW: 39.23%

Book Value: ₹31.88

PE (Post IPO at ₹273): ~21.83x

Price to Book (P/BV): ~8.57x

🔬 5. Industry Outlook

Unified operates in the IT Infrastructure and System Integration sector – benefiting from:

Digital transformation in SMEs and corporates

Rising demand for data security, cloud solutions, and virtualization

Strong push for Make in India and local IT procurement policies

The company competes with players like Dynacons, Orient Technologies, and Silver Touch, showing better margins but operates at a smaller scale.

🔄 6. Peer Comparison

| Company | CMP (₹) | EPS | PE | RoNW | Revenue (₹ Cr) |

|---|---|---|---|---|---|

| Unified Data-Tech | NA | ₹12.51 | ~21.8x* | 39.23% | ₹260.38 |

| Dynacons | ₹1018.5 | ₹42.41 | 24.02x | 34.25% | ₹1028.85 |

| Orient Tech | ₹328.65 | ₹11.80 | 27.85x | 23.64% | ₹606.86 |

| Silver Touch | ₹693.45 | ₹12.67 | 54.73x | 14.52% | ₹209.25 |

*Implied at upper band ₹273

🏦 7. Shareholding Pattern

| Shareholder | Pre-IPO | Post-IPO |

|---|---|---|

| Promoters (Hiren Mehta & Family) | 86.73% | 60.39% |

| Public | 13.27% | 39.61% |

Promoter selling 52.92 lakh shares (~26.34% stake) in Offer for Sale.

✅ 8. Strengths

🔹 Strong EBITDA & PAT Margin expansion

🔹 High RoE & RoCE with zero debt

🔹 Award-winning presence and top-tier OEM partnerships

🔹 Strong repeat business model and customer retention

⚠️ 9. Risks & Concerns

❗ 100% Offer for Sale – no fund inflow to company

❗ Limited scale compared to large peers

❗ Operates in a highly competitive and rapidly evolving IT industry

📌 10. Market Sentiment & Underwriter

Listing Exchange: BSE SME

Lead Manager: Hem Securities – reputed in SME IPOs

Registrar: KFin Technologies

📢 Final Thoughts: Should You Invest?

✅ Unified Data-Tech presents a compelling growth story with strong profitability, consistent revenue expansion, and industry relevance in a tech-driven world.

❌ However, being a 100% OFS, investors must evaluate long-term sustainability and post-listing performance.

🎯 Ideal for investors looking for high-growth SME exposure with reasonable valuation and strong return ratios.

⚠️ Disclaimer:

This blog is for educational purposes only. It is not a recommendation to buy/sell any security. Please consult your financial advisor before investing.

for Investors The provided chart outlines key metrics for Nifty 500 companies across different periods (FY22 t.png)