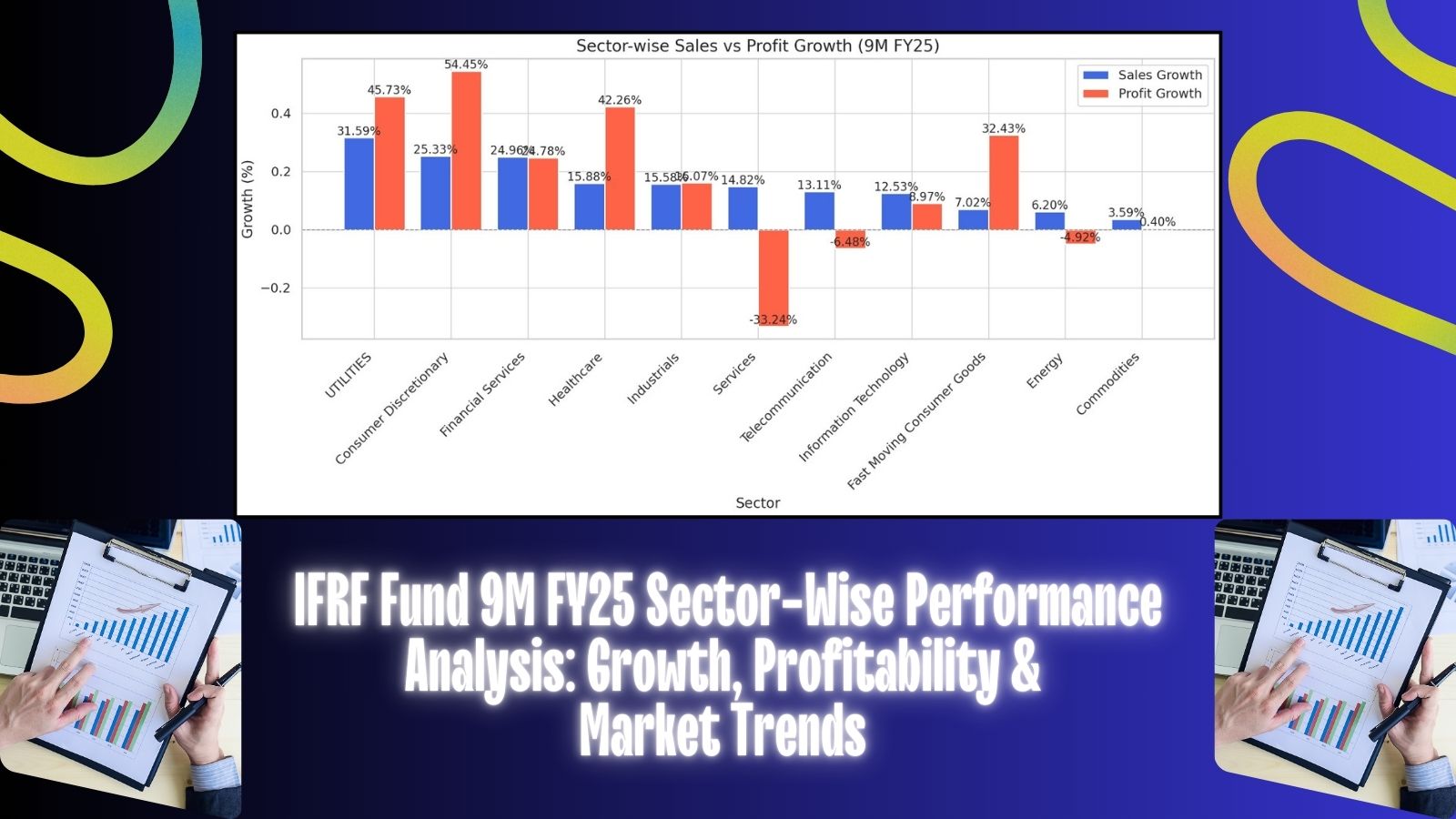

🔹 Top Performing Sectors:

✅ Financial Services

📊 Market Cap: ₹3.16T (30.25% weightage)

💰 Sales Growth: +24.96%

📈 Profit Growth: +24.78%

📉 Margin Change: -0.60% (slight decline due to rising operational costs)

Insight: Continues to be the dominant sector with strong earnings growth and stable credit demand.

✅ Consumer Discretionary

📊 Market Cap: ₹2.22T (36% weightage)

💰 Sales Growth: +25.33%

📈 Profit Growth: +54.45% (highest profit surge)

📊 Margin Change: +0.63% (indicating improved profitability)

Insight: Increased consumer spending and luxury demand drive impressive earnings.

✅ Healthcare

📊 Market Cap: ₹1.15T

💰 Sales Growth: +15.87%

📈 Profit Growth: +42.26%

📊 Margin Change: +2.33% (highest margin expansion)

Insight: Pharma and healthcare services witness strong tailwinds due to increased R&D investments and exports.

✅ Utilities

📊 Market Cap: ₹1.05T

💰 Sales Growth: +31.59% (highest sales growth)

📈 Profit Growth: +45.74%

📊 Margin Change: +0.74%

Insight: Robust energy demand and infrastructure expansion fuel sector performance.

🔹 Stable Performers:

📌 Industrials

📊 Market Cap: ₹0.95T

💰 Sales Growth: +15.58%

📈 Profit Growth: +16.07%

📊 Margin Change: +0.53%

Insight: Strong manufacturing output and capex spending sustain steady growth.

📌 Information Technology (IT)

📊 Market Cap: ₹1.42T

💰 Sales Growth: +12.53%

📈 Profit Growth: +8.97%

📊 Margin Change: -0.99% (slight margin compression)

Insight: Global IT spending remains stable, but cost pressures weigh on margins.

📌 FMCG (Fast Moving Consumer Goods)

📊 Market Cap: ₹1.18T

💰 Sales Growth: +7.02%

📈 Profit Growth: +32.43%

📊 Margin Change: +0.78%

Insight: Resilient demand, premiumization, and better cost efficiencies drive earnings.

🔹 Struggling Sectors:

⚠ Energy

📊 Market Cap: ₹1.64T

💰 Sales Growth: +6.2%

📈 Profit Growth: -4.92% (declined)

📊 Margin Change: -0.91%

Insight: Volatile crude prices and regulatory hurdles impact profitability.

⚠ Telecommunication

📊 Market Cap: ₹1.02T

💰 Sales Growth: +13.11%

📈 Profit Growth: -6.48% (declined)

📊 Margin Change: -1.69%

Insight: Increased competition and high 5G capex put pressure on profitability.

⚠ Commodities

📊 Market Cap: ₹0.88T

💰 Sales Growth: +3.59%

📈 Profit Growth: +0.40% (barely positive)

📊 Margin Change: -0.25%

Insight: Weak commodity pricing affects revenue growth.

⚠ Services

📊 Market Cap: ₹0.78T

💰 Sales Growth: +14.82%

📈 Profit Growth: -33.24% (biggest decline)

📊 Margin Change: -5.15% (major crash)

Insight: Rising operational costs and weak demand trends affect the sector.

💡 Investor Takeaways & Market Outlook:

📈 Where to Invest?

High-growth sectors like Financial Services, Consumer Discretionary, Healthcare, and Utilities show strong sales and profitability trends.

Stable sectors like Industrials, IT, and FMCG provide consistent returns with moderate risk.

⚠ Sectors to Watch Closely:

Underperforming sectors like Energy, Telecom, and Services face structural headwinds but may offer value opportunities for long-term investors.

🔎 Which sector are you most bullish on for the coming quarters? Share your views! 👇

#StockMarket #SectorAnalysis #InvestmentStrategy #Finance #MarketTrends #WealthBuilding #Investing #IFRF #FundAnalysis #FinancialServices #ConsumerDiscretionary #Healthcare #Utilities #StockGrowth