🏪 DMart Q1 FY26 Financial Results: Stable Growth Amid Margin Pressures

📅 CMP: ₹4063

📆 Period: Quarter Ended June 30, 2025

🏢 Company: Avenue Supermarts Ltd (DMart)

📌 1. Key Insights from Management

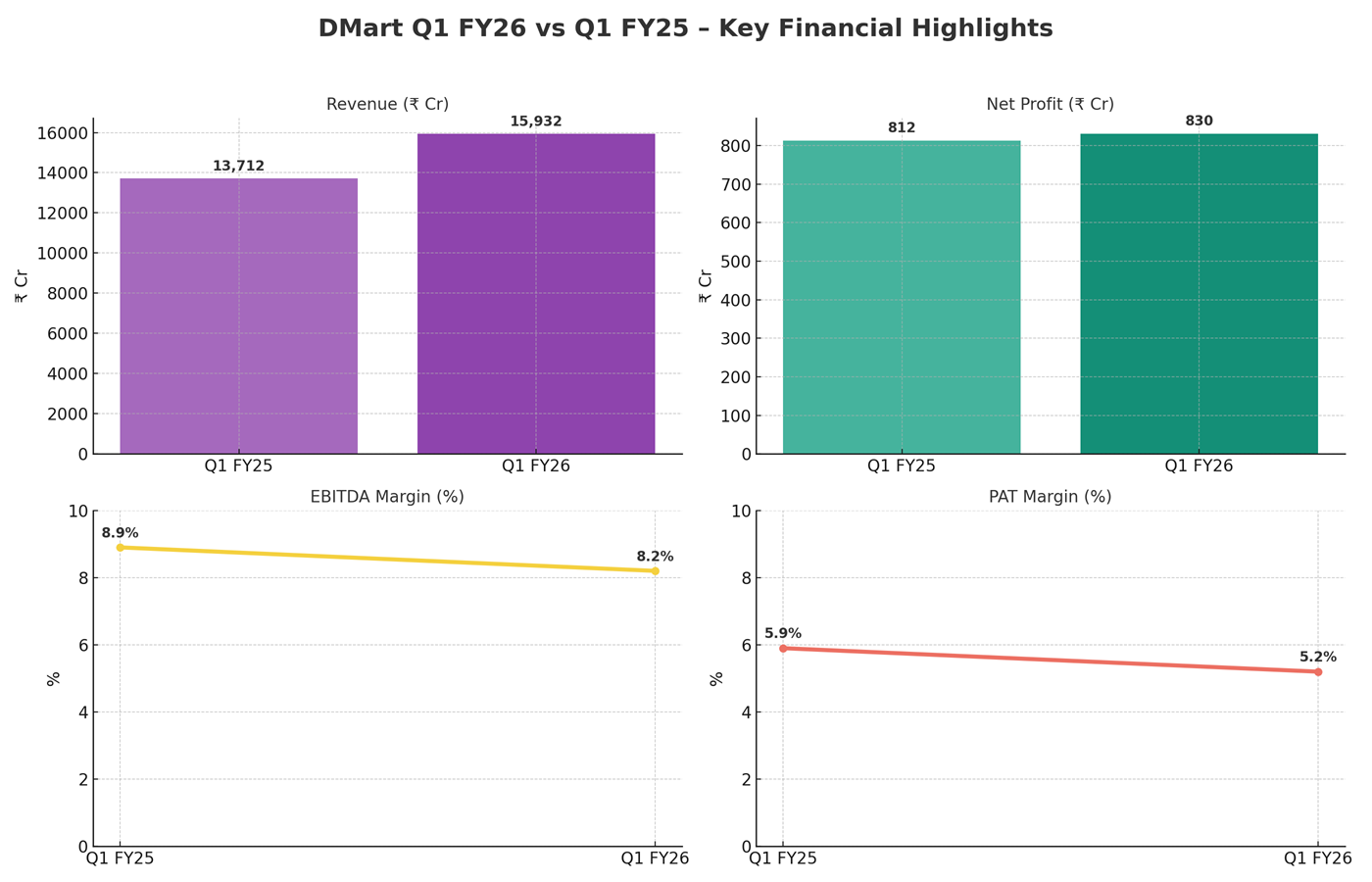

“Revenue in Q1 FY26 grew by 16.2% YoY. Profit after tax grew by 2.1%. Like-for-like growth for 24+ months stores was 7.1%.”

— Neville Noronha, CEO & MD

Highlights:

🔺 Opened 9 new stores, total at 424 stores across 14 states.

🧺 Revenue growth was impacted by deflation in staples & non-food products.

📉 Gross margins under pressure due to higher competition in FMCG.

👥 Higher operating costs from wage inflation and service improvement efforts.

📊 2. Consolidated Financial Performance

🛒 3. Retail Operations & KPIs

📈 4. Profitability & Valuation Metrics (at CMP ₹4063)

🛍️ 5. Industry-Specific Metrics: Retail

📦 Volume trends were affected by pricing deflation in staples.

🛍️ Cluster-based expansion model continues—focused on dense urban consumption hubs.

🌆 DMart Ready is now present in 24 cities, increasing online + offline synergy.

🔮 6. Outlook: Near-Term vs Long-Term

✅ Near-Term (Q2 & Q3 FY26)

Margin recovery will depend on inflation trends and competitive pricing.

Operating leverage to improve with festive season approaching.

🚀 Long-Term (FY26–FY30)

Urban consumption growth and shift from unorganized retail continues to favor DMart.

Store expansion, tech integration (via DMart Ready), and operational efficiencies remain growth drivers.

🧭 7. Conclusion: Long-Term Investment View

✅ Positives:

Robust revenue and store expansion

Consistent profitability even in margin-pressure environment

Scalable and cost-efficient business model

⚠️ Risks:

Margin pressure due to deflation and competitive FMCG pricing

Valuation concerns at ~90x P/E

🎯 Verdict: Hold with long-term positive bias. Investors looking for consistent compounders in the retail space may consider accumulating on corrections.

📢 Disclaimer

This analysis is provided solely for informational purposes and does not constitute investment advice. Investors should perform their own due diligence before making investment decisions.