📊 Nestlé India Q1 FY26 Results Analysis

CMP: ₹2,232 | Sector: FMCG | Quarter Ended: 30th June 2025

🏢 Company Overview

Nestlé India, a part of the global Nestlé group, operates in the Food & Beverage segment with iconic brands like MAGGI, NESCAFÉ, KITKAT, MILKYBAR, and Milkmaid. It has strong presence across urban and RUrban India, growing segments in Ready-to-Eat, Beverages, and Nutrition.

🔍 Recent Insights & Highlights (Management Commentary)

✅ 7 out of 12 power brands showed double-digit growth

✅ Volume-led recovery in key segments:

MAGGI, NESCAFÉ, KITKAT, and MUNCH delivered strong double-digit growth

Pet Food, Breakfast Cereals, and Quick Commerce segments accelerated

💡 New Milestone: 1,000+ NESCAFÉ Corners and KITKAT Break Zones operational

🌐 E-commerce contributed 12.5% to domestic sales

🛒 Export sales saw high double-digit growth with new launches like Masala-Ae-Magic in the UK

💰 Consolidated Financial Analysis

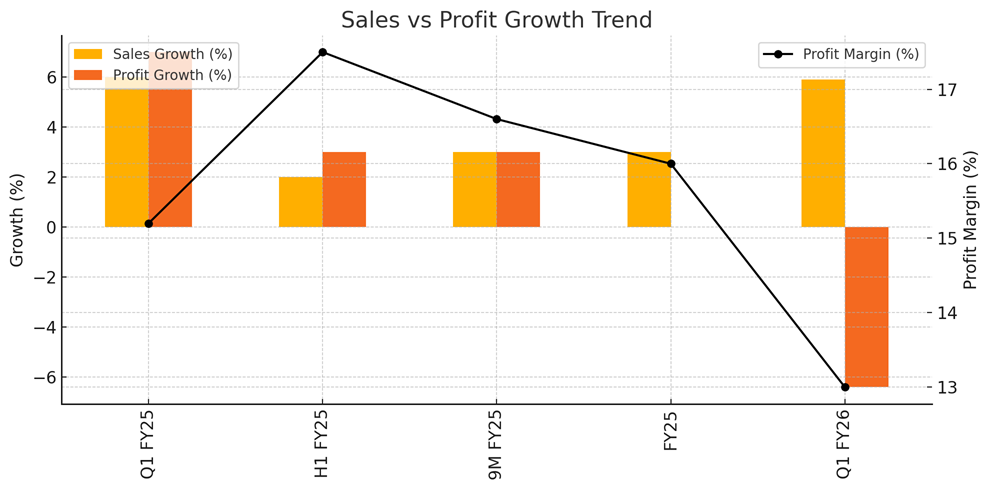

📈 Trend Chart: Sales, Profit, and Margin

📉 Despite strong sales growth, margin pressure and higher costs reduced profit growth in Q1 FY26.

📌 Key Profitability Ratios (Standalone)

🧪 Consumer Goods KPIs

Volume Growth: Positive across Confectionery, Noodles, Beverages

Market Share: NESCAFÉ and KITKAT gained share

Pricing Trends: Commodity inflation impacted margins, but easing seen in coffee, edible oil

🔮 Outlook

Near-Term (Next 1-2 Quarters)

📉 Margin pressure may persist due to operational cost expansion

💡 Cost rationalization and softening raw material prices (milk, cocoa, coffee) can help

Long-Term (FY26–FY30)

🚀 Strategic strength in RUrban, D2C, premium portfolio

📦 Continued product innovation (e.g., KITKAT Duo, MUNCH CHOCO Fills)

🌱 Growth supported by high-quality distribution, e-commerce and pet food segment expansion

📝 Conclusion for Long-Term Investors

✅ Positives

✔ Strong brands and rural reach

✔ Consistent sales growth

✔ Robust premium product pipeline

⚠️ Risks

❗ Margin pressures from inflation

❗ High valuation limits near-term upside

📊 Investment View: Hold with Cautious Optimism

Ideal for long-term investors with a focus on FMCG stability and defensive plays in portfolios.

📢 Disclosure

"This analysis is provided solely for informational purposes and does not constitute investment advice. Investors should perform their own due diligence before making investment decisions."