🏭 Supreme Industries Q1 FY26 Results: Volume Up, Profit Down — What’s Next? 📊

📌 CMP: ₹4326 | Industry: Plastics & Polymers | Market Cap: ₹55,500+ Cr | Net Cash: ₹856 Cr

🌟 1. Key Highlights – Management Commentary 🎯

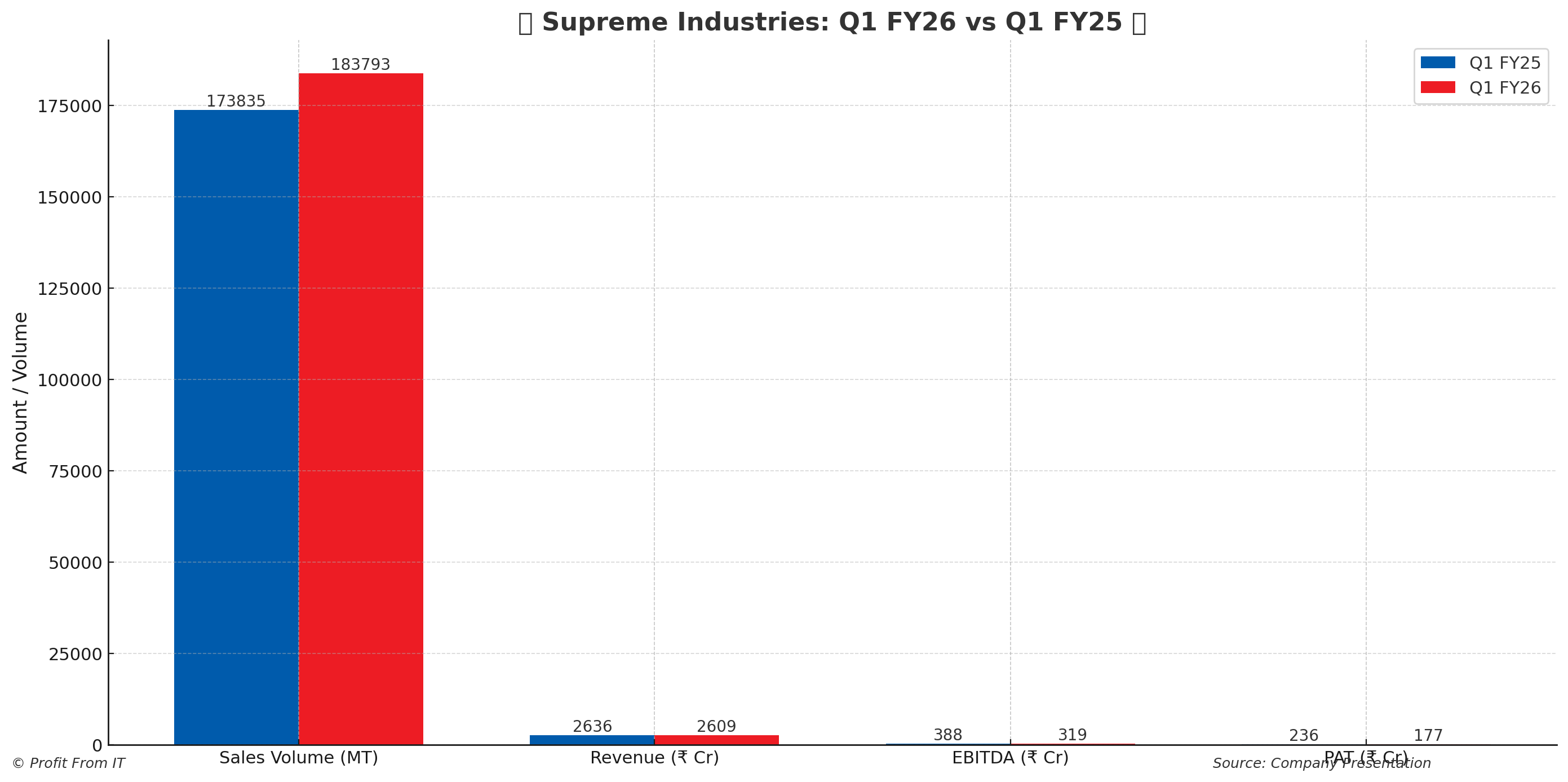

✅ Volume growth of 5.73% YoY despite 20 days early monsoon impact on agri-piping

✅ Decline in Revenue (-1.03%) and PAT (-24.9%) due to PVC price drop and inventory losses

✅ Robust Net Cash Position of ₹856 Cr

✅ New Business Acquisition: Entered into agreement to acquire Wavin India (₹310 Cr deal)

✅ Strategic tech tie-up with Wavin B.V. Netherlands for piping systems

✅ Capex of ₹1350 Cr planned, fully from internal accruals

🧾 2. Consolidated Financial Performance – Q1 FY26 vs Q1 FY25 📈

📌 Segment-wise Volumes (in MT)

🚰 Plastic Piping: 1,48,768

⚙️ Industrial Products: 14,649

📦 Packaging Products: 16,178

🪑 Consumer Products: 4,198

🏷️ 3. Profitability & Valuation Ratios 📊

🧩 4. Industry-specific Metrics (Plastics & Piping Sector) 🏗️

📉 PVC Price Drop led to temporary inventory losses

🚰 Agri-piping demand hit due to early monsoon

🏠 Housing & Infra outlook improving with rising rural demand

🔧 Expansion in composite LPG cylinders & protective packaging

🔮 5. Near-Term & Long-Term Outlook 📅

📌 Near-Term (Next 1–2 Quarters)

Recovery expected in plastic piping as monsoon stabilizes 🌧️

Benefit from new tech collaboration and upcoming launches (PP Silent Pipe, Profile Windows)

📌 Long-Term (FY26–FY30)

Wavin acquisition + tech license to boost scale & innovation

Expansion into central India (Malanpur) to drive logistics & reach

🌱 Focus on sustainability & value-added products continues to build margin strength

🧠 6. Sales & Profit Forecast 📉➡📈

Based on historical trend & strategic initiatives:

✅ 7. Conclusion – Investor Takeaways 💡

👍 Positives:

Strong balance sheet with net cash 💰

Forward-looking acquisitions and exclusive tech license

Pan-India manufacturing & distribution network

Sustainability and innovation-led growth

⚠️ Risks:

Raw material (PVC) price volatility

Agri-dependence in piping segment

Margin pressures in the short term

🔎 Investment View: Hold to Buy (Cautiously Optimistic)

Ideal for long-term investors focused on value-added manufacturing + infra growth.

📜 8. Disclosure

This analysis is provided solely for informational purposes and does not constitute investment advice. Investors should perform their own due diligence before making investment decisions.