Financial Performance

Vishal Mega Mart has shown consistent improvement across its financial metrics:

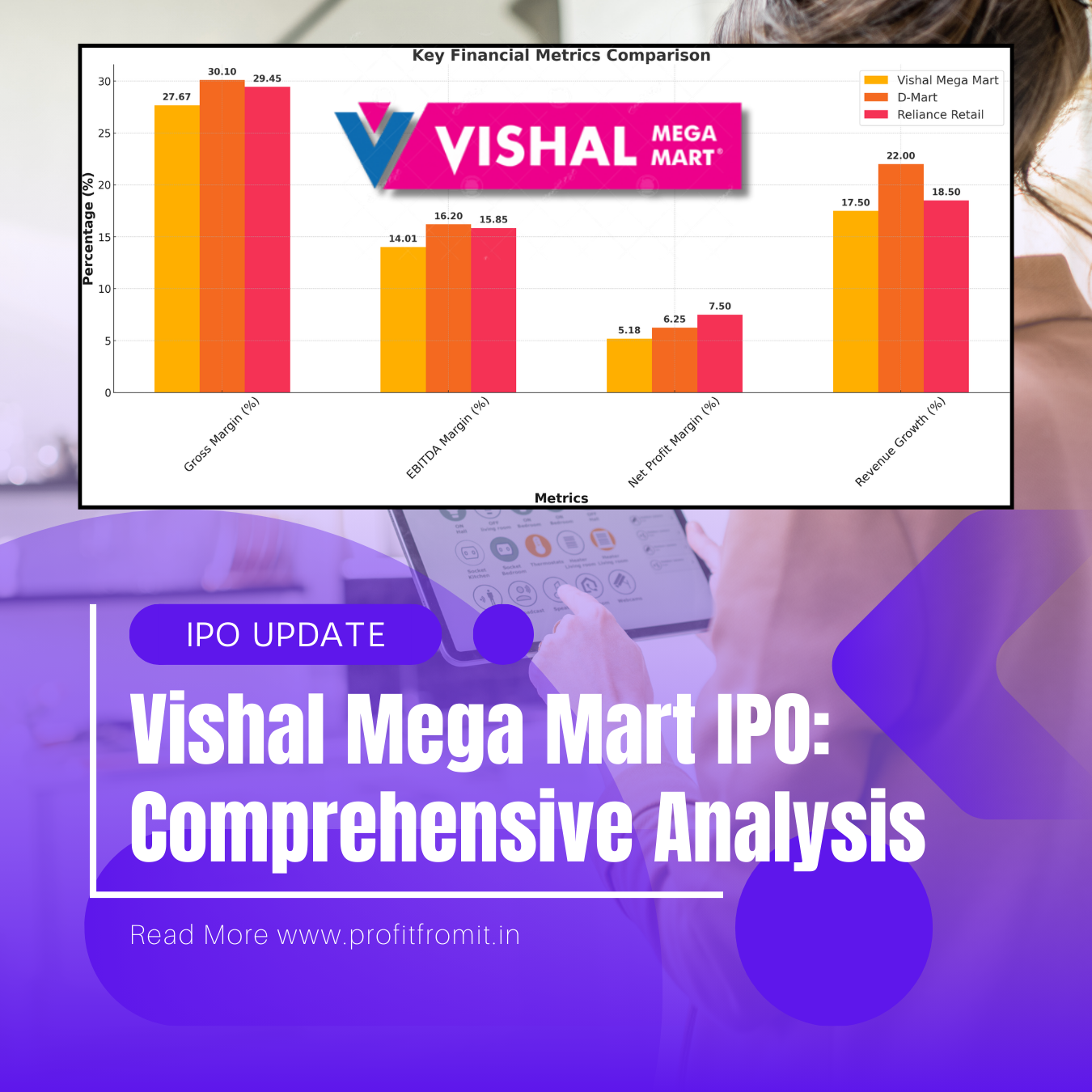

Gross Margin:

FY 2024: 27.67%

(Industry average: ~30%)

Indicates efficient cost management and competitive pricing strategies.

EBITDA Margin:

FY 2024: 14.01%

(D-Mart: 16.20%, Reliance Retail: 15.85%).

Reflects improved operational efficiencies despite sector competition.

Net Profit Margin:

FY 2024: 5.18%

Rising from FY 2023's 4.24%, showing stronger bottom-line performance.

Revenue and Growth Metrics

Total Revenue:

FY 2024: ₹8,911 crores

Demonstrates a 17.5% YoY increase, supported by new store openings and improved same-store sales.

Same-Store Sales Growth (SSSG):

FY 2024: 13.57%

Indicates continued consumer loyalty amidst evolving competition.

Store Count:

Expanded from 576 stores in FY 2023 to 645 stores in FY 2024

.

This aggressive expansion aligns with the company’s strategy to dominate Tier-2 and Tier-3 cities.

Key Financial Ratios

Profitability Ratios:

Gross Margin: 27.67%

EBITDA Margin: 14.01%

Net Profit Margin: 5.18%

Liquidity Ratios:

Current Ratio: 1.2 (Industry Standard: ~1.5).

Adequate short-term liquidity, reflecting strong working capital management.

Leverage Ratios:

Debt-to-Equity Ratio: 1.25.

Vishal Mega Mart's higher leverage compared to D-Mart’s conservative Debt-to-Equity Ratio of ~0.25 makes D-Mart a more stable choice for risk-averse investors.Managed leverage compared to industry peers.

Earnings Ratios:

Earnings Per Share (EPS): ₹1.02 (FY 2024)

.

Price-to-Earnings Ratio (P/E): Estimated at ~6.24, offering an attractive entry point.

Industry Position

Vishal Mega Mart operates within the value retail segment, targeting price-sensitive customers in smaller cities. Compared to competitors:

D-Mart excels in operational efficiency with higher margins.

Reliance Retail, with its massive scale, has unparalleled reach and revenue.

However, Vishal Mega Mart’s focus on underserved regional markets gives it a niche advantage and growth potential.

IPO Details

Price Band: ₹74–₹78 per share

.

Issue Size: 75.67 crore shares (₹80,000 million).

Market Lot: 190 shares

.

Dates: December 11, 2024 – December 13, 2024.

Objectives of the Offer

Working Capital: Fund day-to-day operations and enhance supply chain efficiency.

Infrastructure: Build technological capabilities and improve operational systems.

Promoter Exit: Partial offer-for-sale component provides liquidity to promoters.

Future Outlook

The company is well-positioned to capitalize on India’s growing consumption trends, particularly in smaller cities. Its planned investments in technology and supply chain infrastructure are expected to:

Improve operational efficiency.

Reduce costs across its store network.

Enhance customer experience through better stock availability and digital engagement.

Despite competition, Vishal Mega Mart's growth focus aligns with favorable macroeconomic factors, such as increasing urbanization and disposable incomes.

Disclosure

Investments in equity and equity-related securities involve significant risks. Investors are advised to:

Carefully review the Risk Factors section in the Red Herring Prospectus (RHP).

Perform thorough due diligence before making investment decisions.

The above analysis is based on available data and does not constitute financial advice. Consult your financial advisor for tailored guidance.

📞 Get in Touch for Expert Guidance 📞

📌 Toll-Free: 1800 890 4317

📌 Website: www.profitfromit.in

📌 WhatsApp Channel: https://whatsapp.com/channel/0029Va9KwJOId7nV4uqtE81v