📋 1. Company Overview

Laxmi Dental Limited is a leading end-to-end integrated dental products company in India. Established over two decades ago, the company offers a comprehensive portfolio of dental products, including laboratory offerings, aligners solutions, and pediatric dental products. Their key brand includes 'Illusion Aligners,' which has gained US FDA clearance, making them the first Indian company to achieve this feat.

📌 Key Business Segments:

Custom-made crowns and bridges

Clear aligners and related products

Pediatric dental products

Export-focused products

The company has six manufacturing facilities spread across 147,029 square feet and a presence in both domestic and international markets.

🌐 2. Industry Overview

The global dental products market is expected to grow significantly, with the Indian market growing at a faster rate due to increased healthcare awareness, rising disposable incomes, and improving healthcare infrastructure.

📊 Key Industry Trends:

The Indian dental products market is expected to grow from USD 1.4 billion in 2023 to USD 3.1 billion in 2030.

Increasing demand for clear aligners and pediatric dental products.

A shift from unorganized to organized market players due to regulatory changes.

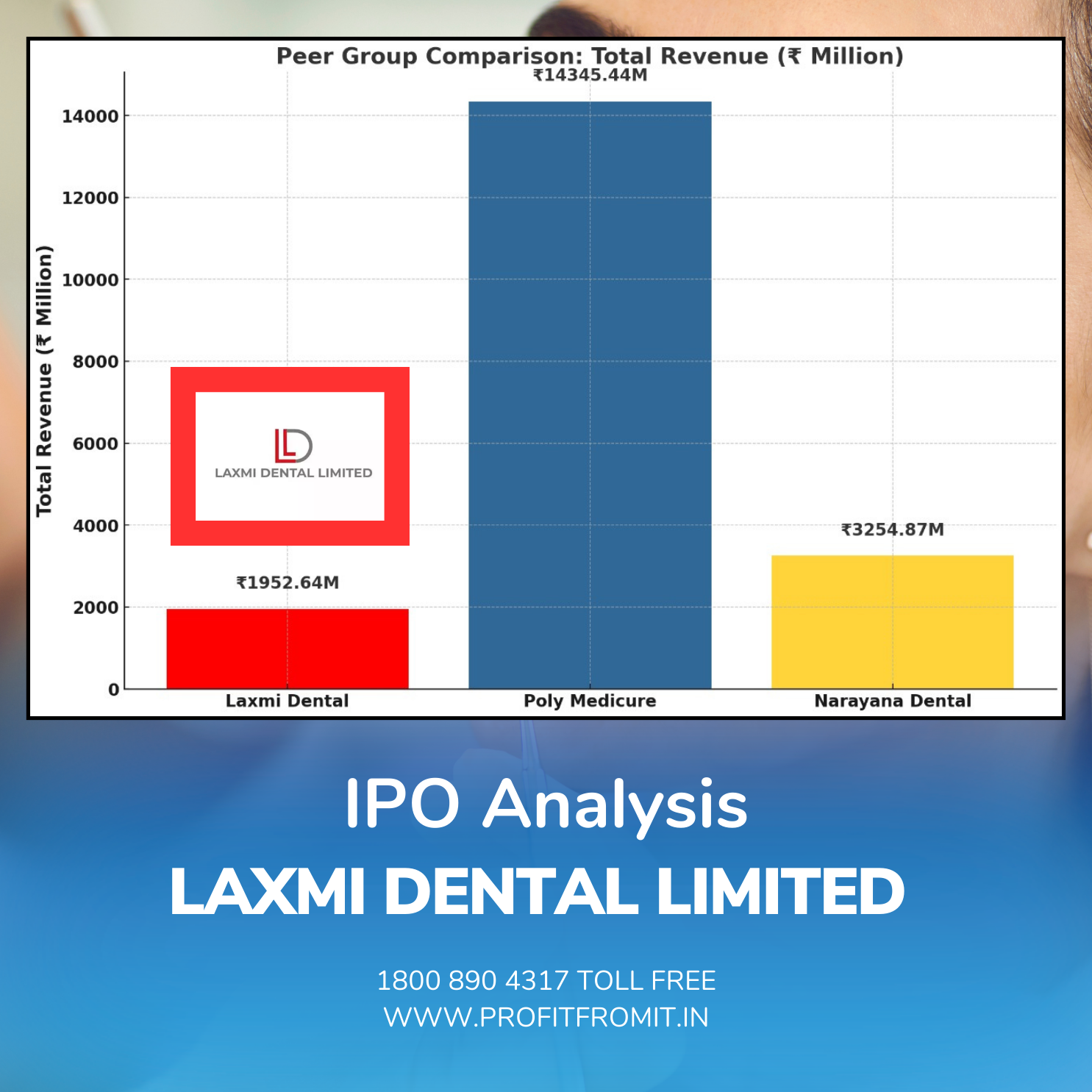

Major players in the industry include Poly Medicure Limited, which serves as a comparable peer in terms of business model and market approach.

🤝 3. Peer Group Comparison

Laxmi Dental Limited does not have a direct peer of comparable size and business model. Poly Medicure is used for industry benchmarking.

📊 Financial Performance:

Total income of ₹1,952.64 million in FY24

Earnings per share (EPS) of ₹4.80

Return on net worth (RoNW) of 78.78%

📈 4. Financial Ratios

💹 Profitability Ratios:

Net Profit Ratio (FY24): 13.03%

Return on Equity (RoE) (FY24): 40.73%

📊 Leverage Ratios:

Debt-Equity Ratio (FY24): 0.94

💧 Liquidity Ratios:

Current Ratio (FY24): 0.96

📉 Earnings Ratios:

Basic and Diluted EPS (FY24): ₹4.80

📅 5. Offer Details

The price band for the IPO is set between ₹407 and ₹428 per share. The issue period is from January 13, 2025, to January 15, 2025.

🧾 Offer Structure:

100% Book Built Offer

Lot Size: 35 shares

Minimum Investment: ₹14,245 at the lower price band

🎯 6. Object of the Offer

The company aims to utilize the proceeds from the IPO for:

Funding capital expenditure for business expansion

Reducing existing debt

General corporate purposes

🔮 7. Future Outlook

Laxmi Dental Limited is well-positioned to capitalize on the growing demand for dental products in India and internationally. The company's strategy focuses on expanding its product portfolio, improving operational efficiency, and increasing brand recognition.

📈 Growth Drivers:

Rising healthcare awareness

Increasing demand for clear aligners

Expanding international presence

The company is also expected to explore strategic partnerships and acquisitions to drive future growth.

💰 8. Grey Market Premium (GMP)

As of the latest available data, the Grey Market Premium (GMP) for Laxmi Dental Limited's IPO is around ₹50-₹55 per share. This indicates a positive sentiment among investors and suggests a potential listing gain. However, investors are advised to consider GMP as an unofficial indicator and not the sole basis for investment decisions.

⚠ 9. Key Risk Factors

Investors should be aware of the following risk factors associated with the IPO:

Dependence on key products such as aligners and dental crowns

Regulatory and compliance risks in international markets

High competition from both organized and unorganized players

Potential fluctuations in raw material costs

📲 Toll-Free Number: 1800 890 4317

📝 10. Disclosure Information

Laxmi Dental Limited is registered under CIN U51507MH2004PLC147394. The registered office is located at Akruti Arcade, J.P. Road, Mumbai.

The lead managers for the IPO are SBI Capital Markets, Motilal Oswal Investment Advisors, and Nuvama Wealth Management Limited.

The company's key promoter group includes Rajesh Vrajlal Khakhar, Sameer Kamlesh Merchant, and Dharmesh Bhupendra Dattani.

⚠ Disclaimer

This document is for informational purposes only and does not constitute investment advice. Investors are advised to perform their own due diligence before investing in the IPO. The Grey Market Premium (GMP) mentioned is unofficial and may vary. Past performance is not indicative of future results.

📈 Investing involves market risks. Please consult with a financial advisor before making any investment decisions.

📌 Final Analysis

This analysis aims to provide investors with essential insights into the IPO, including financials, growth potential, GMP trends, and risk factors. It helps investors make informed decisions by highlighting key aspects of the company's performance, offer details, and future outlook.