Investor Report Fy_25: ICICI Lombard General Insurance Company Ltd

📅 Company Overview

Name: ICICI Lombard General Insurance Company Ltd

Industry: General Insurance

Founded: 2001 | IPO: FY2018

Business Model: Non-life insurance products (motor, health, fire, marine, crop)

Strengths: Strong solvency, robust underwriting, consistent profitability

🌎 General Insurance Industry: Indian Outlook

Insurance Penetration (India): ~1% vs Global Avg ~3%

Growth Drivers:

Rising health insurance awareness

Digital adoption in underwriting/claims

Regulatory support (IRDAI push for financial inclusion)

Estimated CAGR till FY30: ~15%+

Key Challenges: Low awareness, competitive pricing, fraud management

🏢 Peer Comparison (India)

🌐 Global Peers

📊 Historical Performance (ICICI GI)

Premium CAGR (20Y): 22.4%

Profit CAGR (20Y): 33.6%

EPS CAGR (10Y): 15.6%

Reserve CAGR (10Y): 19.2%

💸 Valuation Range (PE Based)

Fair PE: 37x but as the history is small, and growth would be 15% Fair PE could be 30x maximum.

Fair Value FY26 Estimate: ₹1500 – ₹2000

Target FY35 (EPS × PE): 193 × 30 = ₹5779

📊 FY25 Key Financials

Premium: ₹28,258 Cr (+10.4% YoY)

Investment Income: ₹3,156 Cr (+10.3%)

PAT: ₹2,508 Cr (+30.8%)

EPS: ₹50.74

Profit Margin: 8.9%

Combined ratio was at 102.5% in Q4 FY2025 compared to 102.3% in Q4 FY2024.

💳 Cost Structure FY25

🛋️ Segment-wise Premiums (FY25)

✨ Outlook

FY26 Forecast:

Premium: ₹31,084 Cr

Profit: ₹2,487 Cr

EPS: ₹50

Margin: 8.0%

Vision FY35:

Premium: ₹127,240 Cr

Profit: ₹9,487 Cr

EPS: ₹193

Fair Value: ₹5779

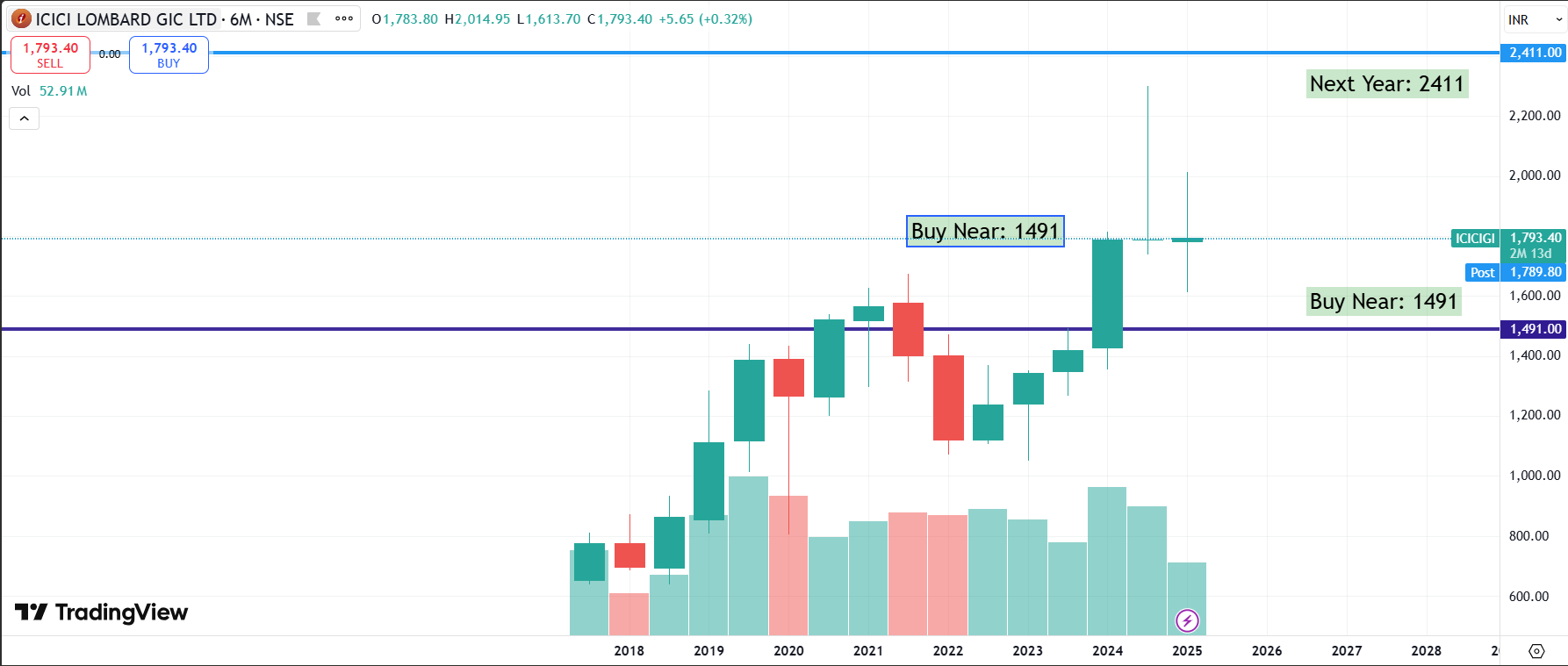

📊 Technical Analysis

CMP: ₹1,793

Buy Zone: ₹1,491 (Long-Term Support)

Target: ₹2,411 (FY26)

PE-based support/resistance provides accumulation opportunity

Fair Value: ICICI GI:

📆 Disclosure

This presentation is for educational purposes only. It should not be construed as investment advice. Investors must conduct their own due diligence before investing.