1. Overview of Core Industries Growth

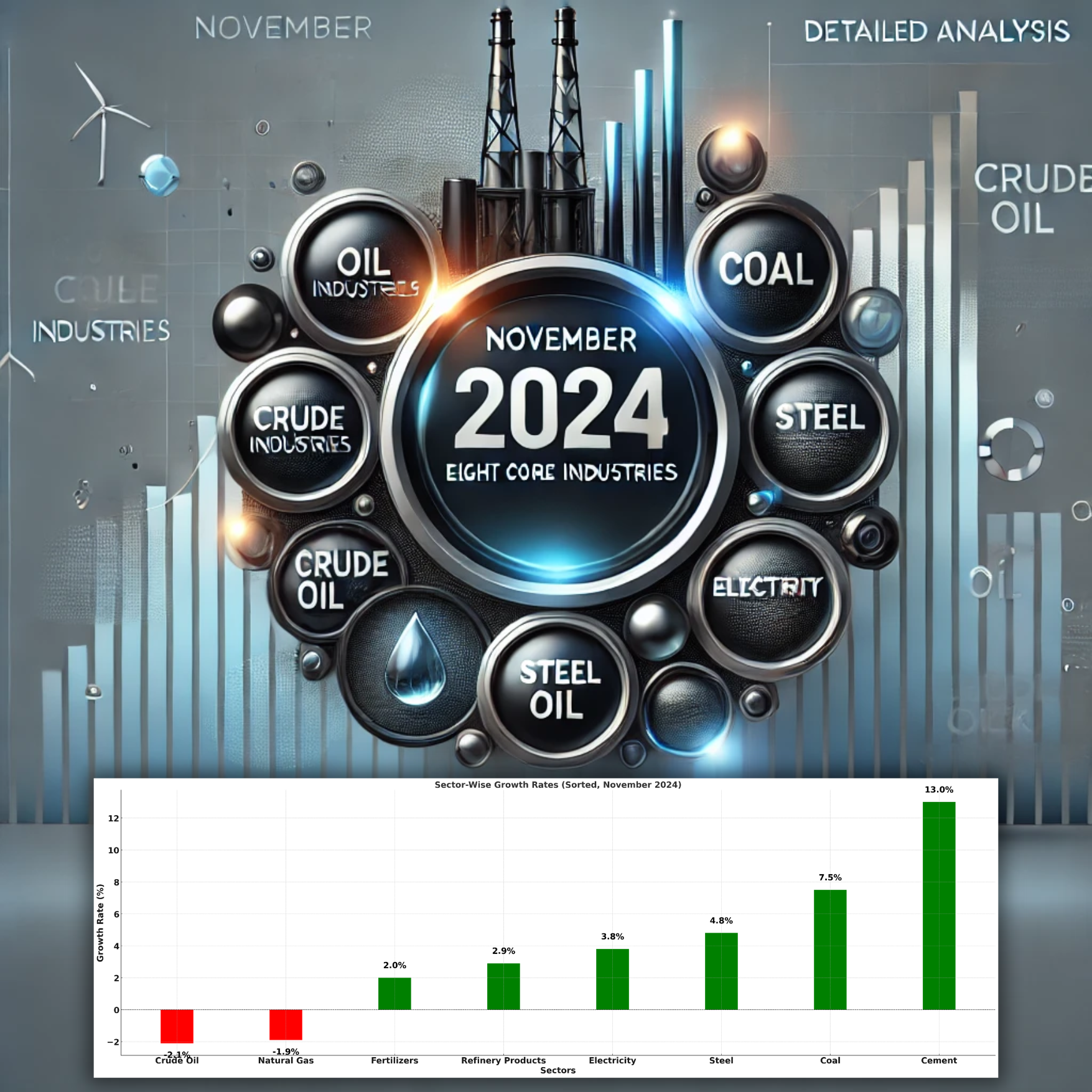

The Index of Eight Core Industries (ICI), representing 40.27% of the weight in the Index of Industrial Production (IIP), recorded a 4.3% year-on-year (YoY) growth in November 2024.

The cumulative growth for April-November 2024-25 stands at 4.2%, driven by the recovery and expansion in key industries.

2. Sector-Wise Insights with Beneficiary Stocks

Coal Sector:

✅ +7.5% YoY growth, cumulative growth at +6.4%.

Drivers: Higher demand from the energy and industrial sectors.

Beneficiary Stocks: Coal India, NMDC.

Beneficiary Industry: Power generation, steel production.

Crude Oil:

🔴 -2.1% YoY decline, cumulative decline at -2.4%.

Challenges: Declining production due to global headwinds and extraction issues.

Beneficiary Stocks: ONGC (subject to recovery plans), Oil India.

Beneficiary Industry: Refinery and petrochemical downstream.

Natural Gas:

🔴 -1.9% YoY decline, cumulative growth at +1.1%.

Opportunities: Government push for domestic exploration.

Beneficiary Stocks: GAIL, Indraprastha Gas Limited (IGL).

Beneficiary Industry: City gas distribution, power generation.

Refinery Products:

✅ +2.9% YoY growth, cumulative growth at +2.7%.

Drivers: Steady domestic fuel demand and refinery output.

Beneficiary Stocks: Reliance Industries, Indian Oil Corporation, BPCL.

Beneficiary Industry: Oil refining, petrochemicals.

Fertilizers:

✅ +2.0% YoY growth, cumulative growth at +1.6%.

Drivers: Strong agricultural demand.

Beneficiary Stocks: Chambal Fertilizers, Coromandel International.

Beneficiary Industry: Agriculture.

Steel:

✅ +4.8% YoY growth, cumulative growth at +5.9%.

Drivers: Rising demand from infrastructure and export.

Beneficiary Stocks: Tata Steel, JSW Steel, SAIL.

Beneficiary Industry: Infrastructure, automotive, and construction.

Cement:

✅ +13.0% YoY growth, cumulative growth at +3.1%.

Drivers: Strong demand from real estate and infrastructure projects.

Beneficiary Stocks: UltraTech Cement, Ambuja Cement, ACC.

Beneficiary Industry: Construction, real estate, rural housing.

Electricity:

✅ +3.8% YoY growth, cumulative growth at +5.3%.

Drivers: Rising energy demand and renewable energy inclusion.

Beneficiary Stocks: NTPC, Power Grid Corporation, Adani Green Energy.

Beneficiary Industry: Renewable energy, industrial power supply.

3. Key Investment Insights for Industries

Infrastructure Boom: Cement and Steel sectors benefit significantly from the government's infrastructure spending spree.

Power Shift: Electricity growth aligns with renewable energy expansion, making it a long-term play for investors.

Agricultural Resilience: Fertilizer stocks offer steady returns, driven by consistent demand from the agriculture sector.

Energy Challenges: Natural Gas and Crude Oil face short-term risks but hold potential with policy and production changes.

4. Opportunities for Investors

Short-Term Plays: Cement and Steel sectors provide opportunities for robust returns based on immediate infrastructure demand.

Long-Term Bets: Renewable energy and Electricity stocks present opportunities for sustained wealth creation in line with global energy transitions.

Defensive Investments: Fertilizer companies offer stability during market volatility due to their strong demand base.

5. Disclosure

Important Notice: This analysis is based on provisional data for November 2024. Investors should note that past performance does not guarantee future results.

Risks: Sectoral performance is subject to market conditions, policy changes, and global economic trends.

📞 Contact for More Insights:

Website:www.profitfromit.co.in

Toll-Free Number: 1800 890 4317

WhatsApp Channel: https://whatsapp.com/channel/0029Va9KwJOId7nV4uqtE81v

#StockMarketUpdates #CoreIndustries #InvestmentOpportunities #WealthCreation #InfrastructureGrowth #ProfitFromIT #EconomicGrowth #LongTermInvesting

Class Sessions

1- Various companies in the healthcare services industry, specifically focusing on their market capitalization, sales for the year 2024, and profits for the same period:

2- 📊 November 2024 Eight Core Industries: Detailed Analysis, Beneficiary Stocks & Industries 📊

3- Report on Indian Banking Sector at a Glance:

4- *2025 to be the year of electric vehicles*:

5- The Bharat Mobility Global Expo 2025 has showcased a remarkable array of product launches and industry advancement:

6- Coffee industry

7- Leading companies in the Computer-Software consulting industry: 9M_Fy25 Results Update

8- 🌐 🇮🇳 Indian Private Banking Industry – Long-Term Investment Analysis (2025) 🚀

9- Capital Shift: RBI Revises Risk Weights, Transforming Bank-NBFC Dynamics

10- 🏡 Housing Finance Industry Overview (India & Global) + 2035 Outlook 🚀

11- 🚗 Indian Auto Industry - February 2025 Report: Investor Insights 📊

12- 📊 Indian Retail Sector Analysis: Compare Dmart, Reliance Retail & global giants on revenue, profitability & growth. Best long-term investment for FY2035! 🚀💰

13- Tanks, Tech & Trillion-Dollar Dreams: The Rise of India's Defence Might:

14- 💼 How to Invest in India’s Booming Mutual Fund Industry – February 2025 Analysis + Stock Picks

15- 🚁 HAL’s ₹62,700 Cr LCH Deal: India’s Defence Sector Enters a New Orbit

16- India’s food processing sector is entering a golden era

17- ⚡ Powering India 2035: The Energy Sectors Set to Explode

18- 🌞 Waaree Energies Powers India’s Solar Future: A 5.4 GW Gamechanger for Long-Term Investors

19- 🏢 REITs in India: A Complete Investor Guide – Comparison, Insights & Global Benchmarks

20- Decoding the Nifty 500 Segment Landscape: FY25 Insights & Highlights

21- 🌟 Special Consumer Services in India: FY25 Insights

22- 🚆 Riding the Rails of Opportunity: How RailOne and Railway Modernization Are Driving Multi-Sector Investment Themes

23- 🧠 Investor takeaways from Asian Paints’ 79th AGM (FY25)

24- 📊 Indian Consulting Software Industry Analysis 2025: Top Companies, Growth Outlook & Investment Insights

25- 🚀 India’s Infrastructure Revolution: Path to FY2035 Growth