🏡 Housing Finance Industry Overview (India & Global) + 2035 Outlook 🚀

📊 1. Current State of the Housing Finance Industry (India - 2024)

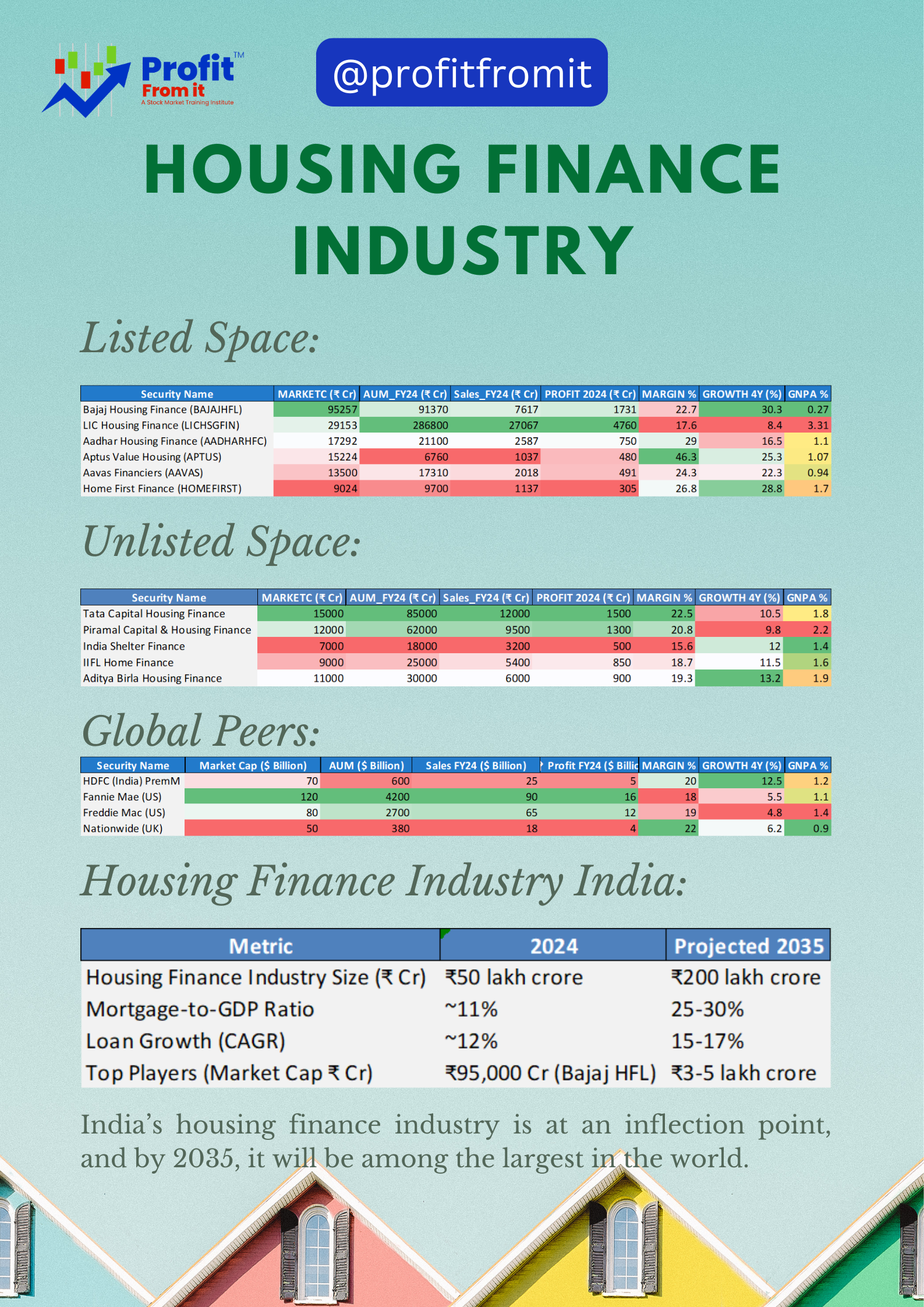

Housing finance companies play a crucial role in India's real estate and home loan sector. To evaluate the best long-term investment opportunities, we analyzed the industry using key performance indicators (KPIs) such as:

✅ Market Size & Stability – Market Capitalization (₹ Cr), Assets Under Management (AUM).

✅ Profitability – Profit Margins, Consistent Profit Growth.

✅ Growth Potential – 4-Year Sales & Revenue Growth.

✅ Asset Quality – Gross Non-Performing Assets (GNPA %).

✅ Financial Strength – Solvency and Liquidity Ratios.

🏆 2. Leading Housing Finance Companies in India (2024)

🏅 Key Takeaways:

Bajaj Housing Finance and LIC Housing Finance are the biggest players in terms of Market Cap & AUM.

Bajaj Housing Finance has the lowest GNPA% suggesting quality Lending.

LIC Housing Finance has higher GNPA (3.31%), indicating higher risk compared to others.

🌍 3. Global Housing Finance Leaders vs Indian Players

🔎 Observations:

Indian companies (Bajaj, LIC, HDFC (preM)) are catching up globally 📈 but still smaller in comparison to US giants like Fannie Mae & Freddie Mac.

HDFC Pre Merger (India) was one of the top global players, competing with the biggest names.

Indian lenders have lower GNPA% than many global firms, indicating better loan quality.

🏗 4. Unlisted Housing Finance Companies in India

Several strong unlisted housing finance companies are expanding rapidly and could go public soon:

🔮 5. Housing Finance Industry Outlook for 2035 (India)

By 2035, the Indian housing finance industry is expected to quadruple in size, driven by:

✅ Mortgage-to-GDP Ratio Growth – From ~11% (2024) → 25-30% (2035).

✅ CAGR of 15-17% 📈 in loan growth.

✅ More financial inclusion & first-time home buyers.

✅ AI & Fintech Innovations 🤖 for faster, low-risk lending.

📌 Projections for 2035

🚀 6. Investment Takeaways for Long-Term Wealth Creation

🔹 Bajaj Housing Finance & HDFC (Pre Merge Identity) – Strongest long-term bets in India's housing finance industry.

🔹 Mortgage market to grow 4x by 2035 – Providing multi-decade investment opportunities.

🔹 Top NBFCs & Unlisted Companies (Tata Capital, IIFL Home Finance) – Could become major market players post-IPO. But we can see Bajaj Housing still leads in Aum as well as better GNPA% even if we compare with unlisted players.

🔹 Focus on companies with low GNPA, high profit margins, and strong AUM growth.

💡 Final Thought: India’s housing finance industry is at an inflection point, and by 2035, it will be among the largest in the world. Smart investors should look for scalable business models, strong balance sheets, and digital transformation capabilities. 📈🔥