Coffee industry in India:

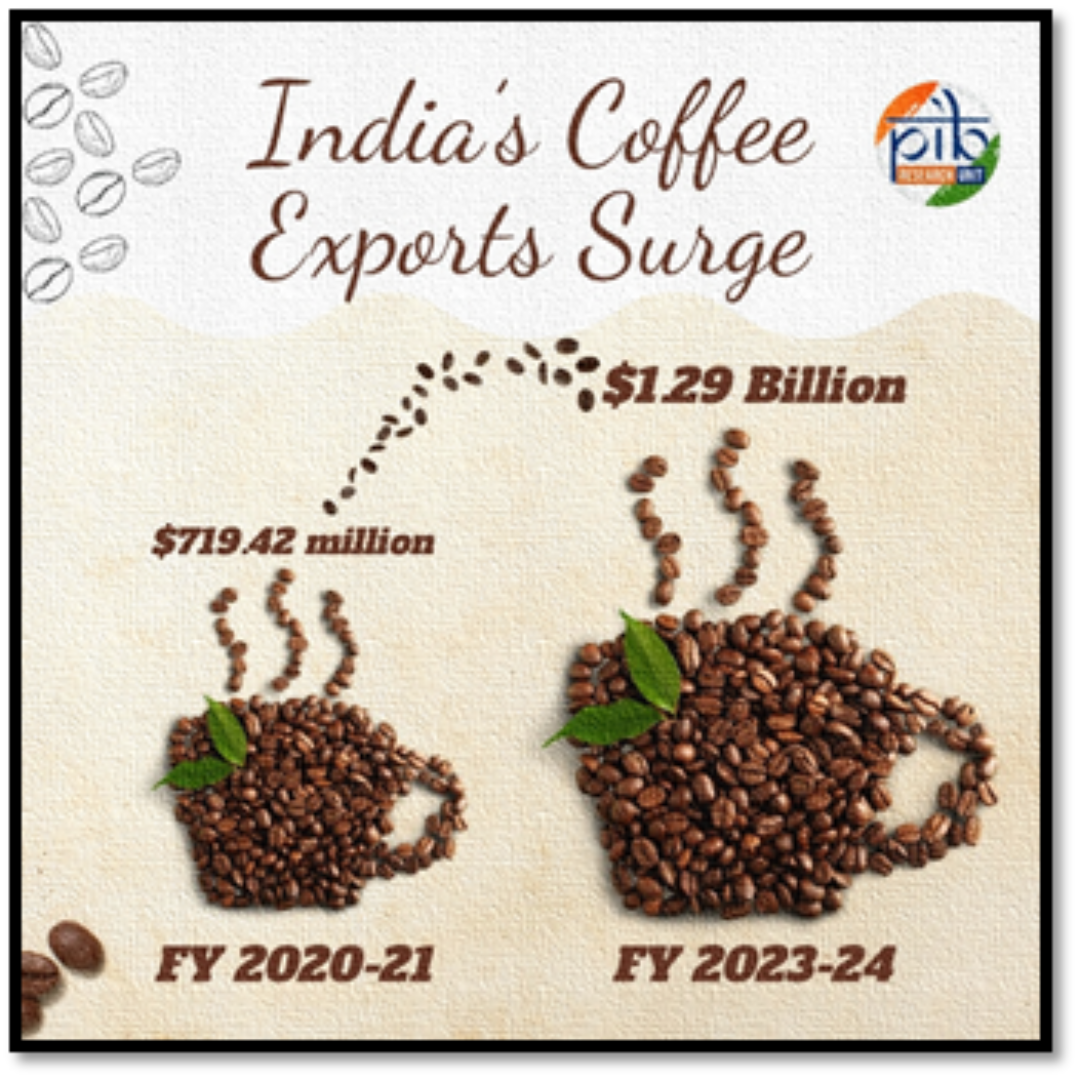

Production and Export Growth 📈: India is the seventh-largest coffee producer globally 🌍, with exports reaching $1.29 billion in FY 2023-24. This marks a substantial increase from $719.42 million in 2020-21, driven by growing global demand for India's unique coffee flavors ☕.

Leading Export Markets 🌐: Italy, Belgium, and Russia are the primary buyers of Indian coffee, mainly purchasing unroasted Arabica and Robusta beans. There is also a rising demand for value-added products like roasted and instant coffee, which contributes further to the export boom 🚀.

Domestic Consumption Increase 📊: Coffee consumption in India has been rising, from 84,000 tonnes in 2012 to 91,000 tonnes in 2023. This increase is seen across both urban and rural areas, fueled by a growing cafe culture ☕, higher disposable incomes 💰, and a shift in preference from tea to coffee 🍵➡️☕.

Primary Coffee Production Regions 🏞️: The main coffee-producing regions in India are the ecologically rich Western and Eastern Ghats, with Karnataka leading the production. These areas also help maintain the ecological balance and biodiversity 🌱.

Government and Development Initiatives 🏗️: The Coffee Board of India has initiated several projects like the Integrated Coffee Development Project (ICDP) to improve yields, expand cultivation, and ensure sustainability. The involvement of tribal communities in Araku Valley, backed by the Girijan Co-Operative Corporation (GCC), has notably increased production by 20% 📈.

Stock Market Investment Interpretation:

Growth Potential 🌟: The substantial growth in coffee exports and domestic consumption highlights a robust demand trajectory, making the coffee industry a promising sector for investors looking at agribusiness-focused stocks 📊.

Leading Companies 🏢: Investors might want to focus on companies directly involved in coffee production, processing, and export. Companies with expanding operations in value-added coffee products could also present good investment opportunities due to higher profit margins associated with these products 💹.

Sustainability and CSR 🌍: Companies engaged in sustainable practices and corporate social responsibility (CSR) activities, especially those supporting ecological conservation and community development (like those in Araku Valley), may attract ESG (Environmental, Social, and Governance) investors 💚.

Leading Companies and Exporters:

Tata Coffee Ltd ☕: One of India's largest coffee producers, involved in the production to the export of both instant and bean coffee. Tata Coffee was merged with Tata Consumer Products on 1 January 2024

Considerations for Investors:

Investors should consider the impact of global coffee prices, exchange rates, and international trade policies on the profitability and stock prices of these companies. The sector's growth, coupled with government initiatives and global market expansion, could make coffee-related stocks a valuable addition to investment portfolios focused on agricultural and food commodities 🌾.