Consistent Dividend Growth:

Over the years, the Nifty 50 index has demonstrated consistent dividend payouts, reflecting the financial health and profitability of its constituent companies.

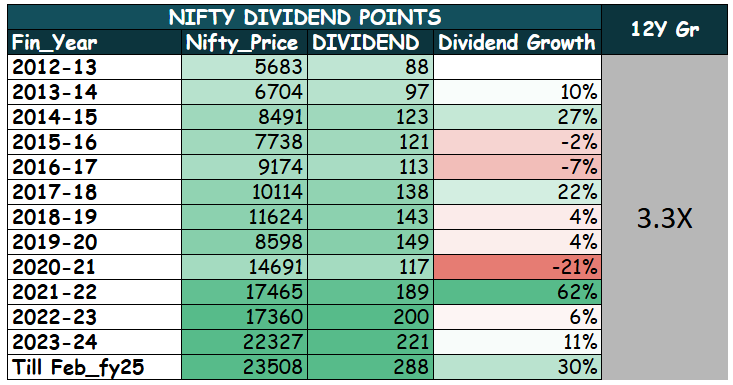

Dividends have grown substantially from 88 points in FY 2012-13 to an estimated 254 points in FY 2024-25, indicating a long-term trend of increasing passive income.

Remarkable Growth Phases:

2014-15 saw a strong 27% growth, indicating an era of increasing corporate profitability.

A record 62% growth in FY 2021-22 highlights recovery and resilience post-pandemic.

Challenges:

There have been minor declines in certain years, such as -21% in FY 2020-21, likely due to global disruptions like the COVID-19 pandemic. However, the subsequent strong recovery shows the robustness of the Nifty 50 companies.

Current Momentum:

Dividend growth for FY 2023-24 stood at 11%, and the current financial year (till November FY25) already shows an impressive 28% increase, indicating potential upside for investors seeking income growth.

Long-term Wealth Potential:

The steady rise in dividends demonstrates the potential of the Nifty 50 for creating a reliable stream of passive income, which grows over time.

This makes it an attractive option for long-term investors focused on compounding wealth and securing passive income.

Investor Takeaway: The Nifty 50 index serves as an excellent choice for investors looking to combine capital appreciation with consistent and growing dividend income. By reinvesting dividends or utilizing them as passive income, investors can leverage this trend for long-term wealth generation.