World Economic Outlook Update: January 2025 Update

🌍 Global Economic Overview 📈

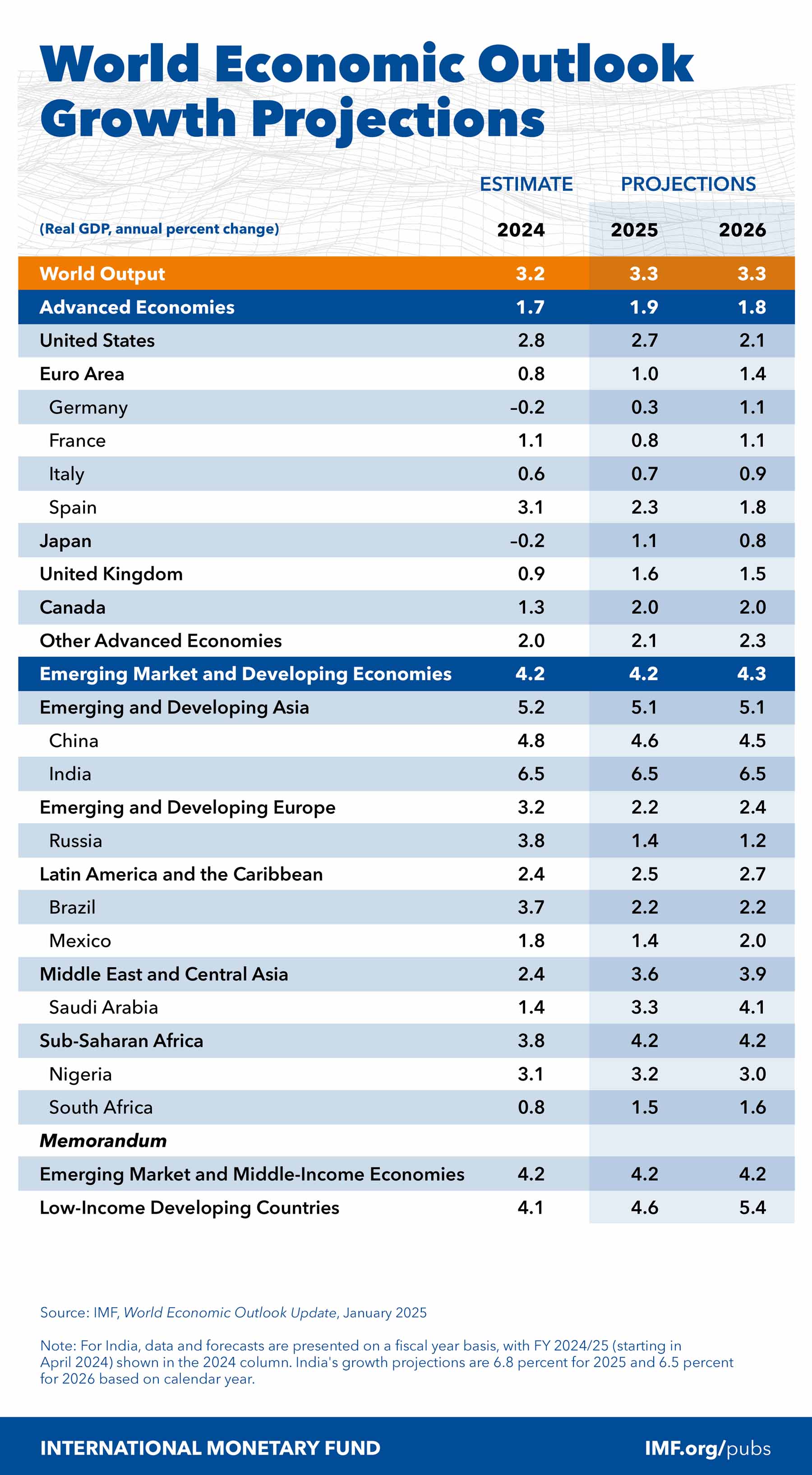

🔹 Global Growth Rates:

📊 2025: Projected at 3.3%

📊 2026: Projected at 3.3%

📉 Below the historical average (2000-2019) of 3.7%

🔹 Annual Inflation Trends:

🎯 2025: Expected to decline to 4.2%

🎯 2026: Further decline to 3.5%, indicating potential easing of monetary policies post-2025.

🌏 Faster convergence to target in advanced economies compared to emerging markets

🔹 2025 Outlook:

🔍 Broadly unchanged from the October 2024 WEO

🇺🇸 Upward revisions in the United States counterbalance downward revisions in other major economies

Detailed Regional Projections 🌐

Advanced Economies:

🇺🇸 United States: From 2.8% in 2024 to 2.1% in 2026

🇪🇺 Euro Area: Gradual increase, with Germany recovering from negative growth

Emerging Markets & Developing Economies:

🇮🇳 India: Steady at 6.5% across 2025 and 2026, India Continue to be the fastest growing Major Economy.

🇨🇳 China: Slight decrease from 4.8% in 2024 to 4.5% in 2026

🌍 Sub-Saharan Africa: Nigeria and South Africa showing varied trends

Equity Market Implications

🔹 Advanced Economies:

United States: Strong growth could support bullish trends in the equity market, but gradual decrease suggests potential volatility.

Euro Area: Modest recovery may lead to cautious optimism in European stocks, with specific opportunities in sectors tied to economic reforms.

🔹 Emerging Markets:

India: Consistent high growth suggests robust domestic demand, likely benefiting sectors like consumer goods, technology, and infrastructure.

China: Slowing growth might dampen market sentiment short-term but could present buy opportunities in dips, particularly in technology and green energy sectors.

Sector-Specific Impacts:

Technology: Strong in advanced economies, potential growth in emerging markets like India.

Consumer Goods: Benefiting from stable economic conditions in emerging markets.

Energy: Volatility in global markets could affect energy stocks; renewable energy may see growth with green policies.

Investment Strategy Recommendations

Diversification: Across geographic and sectoral lines to mitigate risks associated with regional economic uncertainties. Major Investment pie could be in high growth Countries like India and some in the US.

Focus on Fundamentals: Companies with strong balance sheets, good cash flows, and robust business models are likely safer bets in fluctuating economic conditions.

Emerging Markets: Higher growth rates suggest higher potential returns, but with associated risks. Selective investment in high-growth sectors like tech in India or consumer markets in India as well as Africa recommended.