📢 India's GDP Report - Q3 FY 2024-25 & Annual Estimates 📊

🚀 Key Insights & GDP Trends

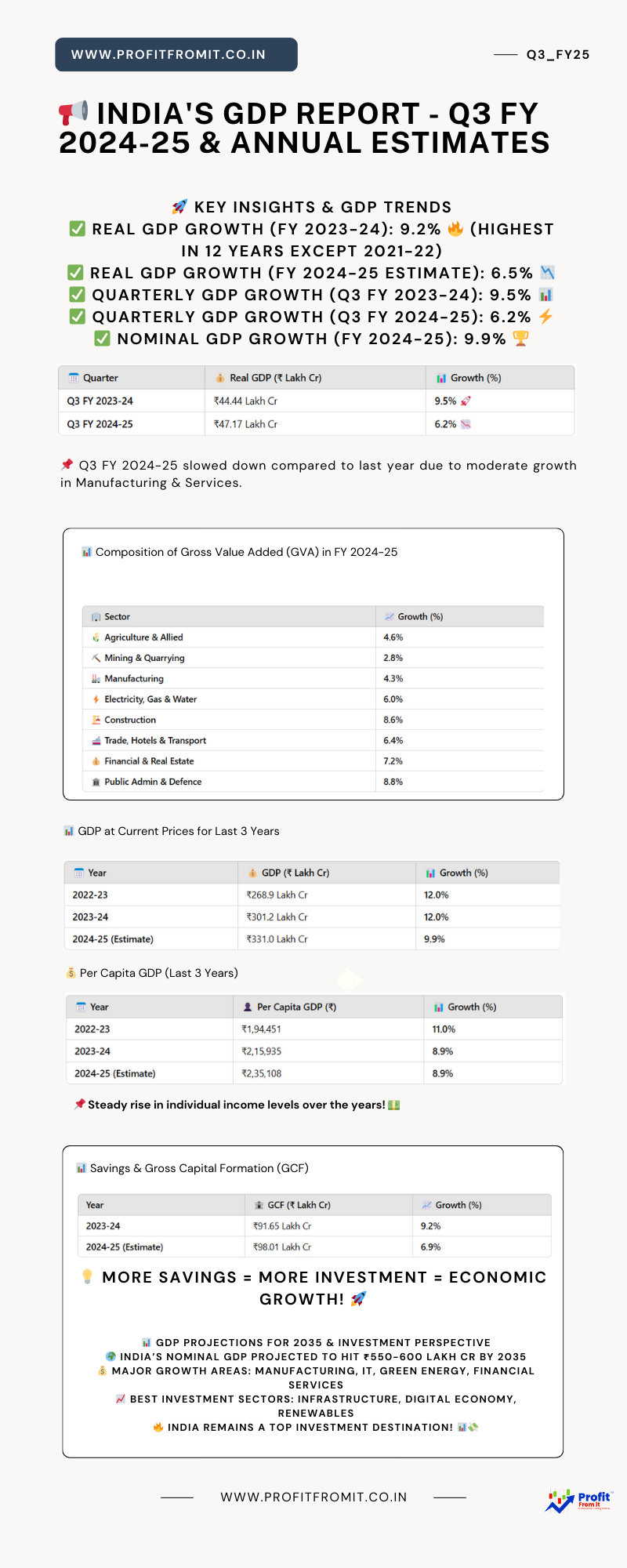

✅ Real GDP Growth (FY 2023-24): 9.2% 🔥 (Highest in 12 years except 2021-22)

✅ Real GDP Growth (FY 2024-25 Estimate): 6.5% 📉

✅ Quarterly GDP Growth (Q3 FY 2023-24): 9.5% 📊

✅ Quarterly GDP Growth (Q3 FY 2024-25): 6.2% ⚡

✅ Nominal GDP Growth (FY 2024-25): 9.9% 🏆

✅ Historical Success of Kumbh Mela would help boost Q4 GDP 🏆

📌 India remains Fastest Growing economy as World estimated to grow at 3.2%

If We compare with Major Economies: US 2.8%, China: 4.8%, Japan: 0.3% and Germany: 0%,

If We compare with Emerging Economies: Brazil 3%, Russia: 3.6%, South Africa: 1.1% and BanglaDesh 4.5% and China we have already taken in Major Economies.

India is incomparable in Growth either with Major or even with growing economies.

📈 Annual GDP Growth Estimate Trends (YoY)

📅 2022-23: 7.6% 📊

📅 2023-24: 9.2% 🚀

📅 2024-25 (Estimate): 6.5% 📉

🛠️ Top Contributors (2023-24):

🏭 Manufacturing: 12.3% 📦

🏗️ Construction: 10.4% 🏢

💰 Financial & Real Estate: 10.3% 🏦

📅 Quarterly GDP Growth Trends

📌 Q3 FY 2024-25 slowed down compared to last year due to moderate growth in Manufacturing & Services.

🏭 Sectoral Composition of GDP (Q3 2024-25)

📌 Primary (Agriculture, Mining, etc.): 19.5% 🌾

📌 Secondary (Manufacturing, Utilities, Construction): 28.5% 🏗️

📌 Tertiary (Services, Finance, Trade, Public Services): 52.0% 💼

🚀 Fastest Growing Sectors (Q3 2024-25)

🏗️ Construction: 8.6% 🏢

🏦 Financial & Professional Services: 7.2% 💰

🚢 Trade, Hotels, Transport & Broadcasting: 6.4% 🚀

📊 Composition of Gross Value Added (GVA) in FY 2024-25

📊 Sector-Wise GDP Growth in Q3 2024-25

🚀 Strong Sectors:

🏗️ Construction (+7.0%)

💼 Financial & Professional Services (+7.2%)

🚢 Trade & Transport (+6.7%)

⚠️ Weakest Sectors:

⛏️ Mining & Quarrying (+2.8%)

🏭 Manufacturing (+4.3%)

📊 Major Data Sources for GDP Compilation

🔹 Industrial Production (IIP) 📦

🔹 Agricultural Production 🌾

🔹 Cement, Steel, and Coal Data ⛏️

🔹 Railways & Aviation Traffic 🚄✈️

🔹 Bank Deposits & Credit 🏦

🔹 GST Collections 💰

💰 Private Final Consumption Expenditure (PFCE)

🔹 PFCE Share in GDP (FY 2024-25): 56.7% 📊

🔹 Growth in PFCE: 7.6% 🚀

💡 Why PFCE is Important?

✅ Drives Economic Growth

✅ Reflects Consumer Demand

✅ Key Indicator of Household Spending

📦 Import & Export Growth (Q3 2024-25 vs Q3 2023-24)

📦 Exports: ₹10.42 Lakh Cr (+10.4%) 🚢

📥 Imports: ₹10.53 Lakh Cr (-1.1%) 📉

🚀 Exports Growing Faster, while Imports Declined, improving trade balance.

📊 GDP at Current Prices for Last 3 Years

💰 Per Capita GDP (Last 3 Years)

📌 Steady rise in individual income levels over the years! 💵

🚀 Fastest Growing Industry in FY 2024-25

🏗️ Construction Sector (+8.6%) 🏢

💼 Financial, Real Estate & Professional Services (+7.2%) 🏦

📊 Fastest & Weakest Growing Indicators

🚀 Fastest Growth:

🏗️ Construction (8.6%)

💰 Financial Services (7.2%)

⚠️ Slowest Growth:

⛏️ Mining (2.8%)

🏭 Manufacturing (4.3%)

📊 Savings & Gross Capital Formation (GCF)

💡 More savings = More investment = Economic growth! 🚀

📊 GDP Projections for 2035 & Investment Perspective

🌍 India’s Nominal GDP projected to hit ₹550-600 Lakh Cr by 2035

💰 Major Growth Areas: Manufacturing, IT, Green Energy, Financial Services

📈 Best Investment Sectors: Infrastructure, Digital Economy, Renewables

🔥 India remains a top investment destination! 📊💸

🔥 India To enter into TOP 10 FDI destinations till 2035 from current ranking of 18th 📊💸

Suno Gaur Se Duniya Walo, Buri nazar na hum pe dalo, Chahe jitna jor laga do, sabse aage honge Hindustani.

🔁 Share this for more economic insights!

📢 Follow for more updates! 🚀📊💰