India's Economic and Demographic Trend Analysis

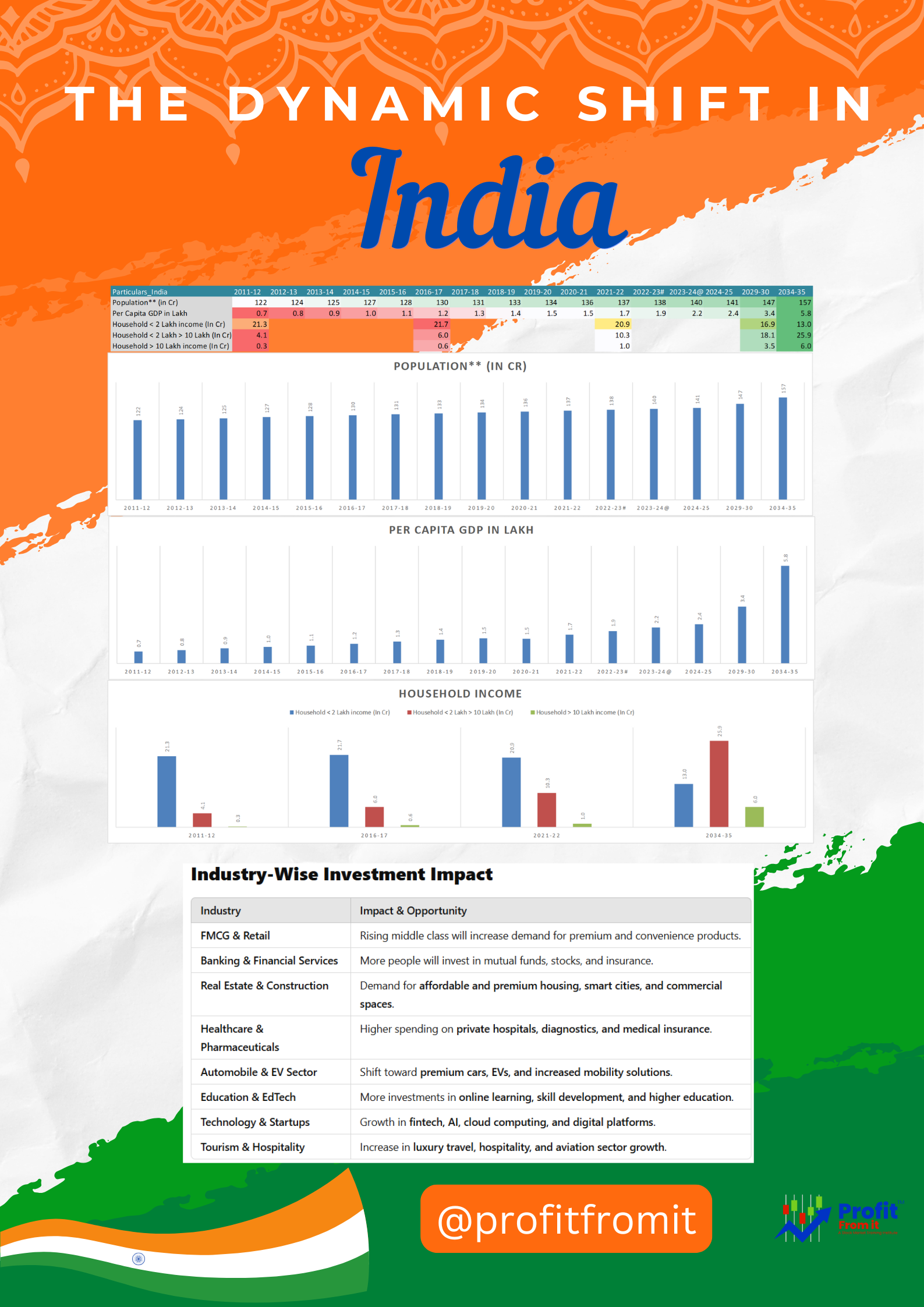

As shown in the image, The dataset presents historical economic trends along with projections for FY2030 & FY2035. Analysis of key trends, their investment implications, and potential opportunities across industries.

Key Trends & Insights

1. Population Growth (Demographic Expansion)

Historical Data (2011-22): India's population grew from 122 Cr (2011-12) to 137 Cr (2022-23).

Future Projections: Expected to reach 147 Cr by FY2030 and 157 Cr by FY2035.

Trend Analysis:

Steady population growth supports a growing labor force and consumer base.

Rising urbanization will fuel demand for housing, transport, and urban infrastructure.

Young population demographics will drive digital adoption, technology, and innovation.

Investment Opportunities:

FMCG & Consumer Goods: Expanding demand for daily essentials, packaged food, and personal care.

Real Estate & Infrastructure: Higher urbanization requires housing, smart cities, and commercial spaces.

Healthcare & Pharmaceuticals: Increased need for hospitals, diagnostics, and medical insurance.

2. Per Capita GDP Growth (Economic Expansion)

Historical Growth: Increased from ₹0.7 Lakh (2011-12) to ₹2.3 Lakh (2024-25).

Future Projection: Expected to reach ₹3.4 Lakh by FY2030 and ₹5.8 Lakh by FY2035.

Trend Analysis:

Rapid rise in per capita GDP signals economic expansion and improved living standards.

Rising disposable income will accelerate premiumization and discretionary spending.

Transition from a low-income to a middle-income economy drives infrastructure, education, and financial growth.

Investment Opportunities:

Luxury & Premium Consumer Goods: Apparel, automobiles, and electronic gadgets will see higher demand.

Banking & Financial Services: Increased savings, investments, and credit expansion.

Travel & Tourism: Higher affordability for both domestic and international travel.

3. Income Distribution Shift (Rising Middle & High-Income Households)

Low-Income Households (< ₹2 Lakh)

Historical: 21.3 Cr in 2011-12 → 20.9 Cr in 2021-22 (gradual decline) despite increasing households in India.

Future: Expected to drop significantly to 10.3 Cr (2034-35).

Implication: Declining low-income households indicate poverty reduction and a transition toward a higher-income economy.

Middle-Class Households (₹2-10 Lakh)

Historical: 4.1 Cr (2011-12) → 10.3 Cr (2021-22).

Future Projection: 25.9 Cr by FY2035.

Implication: The explosive growth of the middle-class segment will be the key driver of consumer demand, retail, and housing.

High-Income Households (> ₹10 Lakh)

Historical: 0.3 Cr (2011-12) → 1.0 Cr (2022-23).

Future Projection: 6.0 Cr by FY2035.

Implication: India is witnessing an emerging affluent class, which will drive demand for luxury products, premium healthcare, and investment services.

Investment Opportunities:

Retail & Ecommerce: Rapid shift toward premium brands, online shopping.

Automobiles & EVs: Growth in premium car demand and electric vehicle adoption.

Education & EdTech: Higher spending on quality education, online learning, and skill development.

Industry-Wise Investment Impact

Investment Recommendations

Instant Impact:

E-commerce, fintech, and digital services (rising internet penetration and digital adoption).

EdTech and skilling platforms (growing demand for online education and upskilling).

Slow but steady Impact:

EV and Automobile Industry (transition from fuel to electric).

Financial Services (investment in mutual funds, insurance penetration).

Long-Term Impact:

Luxury Consumer Goods & Premium Retail (affluent class expansion).

Smart Cities & Real Estate (mass urbanization and infrastructure demand).

Final Takeaway for Investors

India’s economic transition is clear: Higher incomes, expanding middle-class, and urbanization.

Sectors benefiting most: E-commerce, fintech, automobiles, real estate, healthcare, and luxury goods.

Long-term growth story: A shift toward a consumer-driven economy with increasing affluence.

Class Sessions

1- World Economic Outlook Projections

2- SUMMARY OF UNION BUDGET 2022-23

3- Analysis of the IIP data for November 2024:

4- Consumer Price Index (CPI) for December 2024

5- World Economic Outlook Update: January 2025 Update

6- "Investing in India’s Future: What Economic Survey 2024-25 Reveals" 🌏💵

7- Summary of Union Budget 2025-26

8- 📊 RBI Repo Rate Trends & Nifty 50: A 15-Year Market Impact Analysis

9- Inflation, Liquidity, and Market Moves: RBI’s Playbook for 2025:

10- 📊 Inflation Insights & Stock Market Impact – January 2025 CPI Report 📉

11- Income Tax Bill 2025: In The View of Potential long-term impacts for investors in India:

12- India's Labour Market (PLFS: Oct - Dec 2024)

13- India & Qatar: A $10 Billion Investment Game-Changer for 2030!

14- 🔥 Investment Insights from WEF Global Cybersecurity Outlook 2025 🔥

15- Analysis of Foreign Direct Investment (FDI) IN INDIA

16- 📢 India's GDP Report - Q3 FY 2024-25 & Annual Estimates 📊

17- 📊 GST Collection Growth again on uptick in February 2025 after slow down post Octo_24. – 🚀

18- Q3 FY25 GDP data Main Indicator Published

19- India's Economic and Demographic Trend Analysis

20- 🚀 IIP Growth Analysis - January 2025: Insights for Investors 📈

21- India's Inflation Hits an 8-Month Low in February: What It Means for Your Investments

22- 📊 India's Household Savings Trends & 2035 Forecast

23- Unleashing Potential: Education as a Catalyst for Economic Growth and Equity in India

24- 🧭 New Fin Year 2026 Market Brief: Profit Rebounds, Debt Warnings, and a New Gold Rush

25- 🌐 Navigating India’s Global Trade Winds: Opportunities & Risks in 2025

26- 📰 RBI’s April 2025 MPC Policy: A Growth-Friendly Pivot – What Investors Should Know

27- 💡 IIP Insights: What India's Feb 2025 Growth Means for Your Portfolio

28- India–UK Free Trade Agreement: A Transformative Leap for Indian Investors

29- 🧭 Viksit Bharat @2047: Key Insights from the 10th NITI Aayog Governing Council Meeting

30- 📘 India’s IIP April 2025 Report: Capital Goods Lead 20% Growth | Sectors & Stocks to Watch

31- 🇮🇳 India Q4 FY25 GDP Report: Sectoral Trends, Growth Outlook & Stock Market Action Plan

32- 🇮🇳 India’s Poverty Reduction: Key Highlights & Investment Insights (2025)

33- 📊 India’s Inflation Update – May 2025