Summary of Union Budget 2025-26

Key Highlights and Sectoral Impact:

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, focuses on "Sabka Vikas" (Inclusive Growth) with emphasis on four major growth engines: Agriculture, MSMEs, Investment, and Exports. The budget introduces fiscal consolidation measures, tax reforms, industrial development, and incentives for economic expansion.

1. GDP Growth Estimate

Fiscal Deficit: Estimated at 4.8% of GDP in FY-25, with a target reduction to 4.4% in FY-26.

Investment in Infrastructure: ₹1.5 lakh crore in interest-free loans to states for capital expenditure.

Public-Private Partnerships (PPP): A new 3-year project pipeline, increasing private-sector involvement.

Urban Development: ₹1 lakh crore allocated for Urban Challenge Fund, promoting cities as economic hubs.

Tax Benefits to the Middle Class: Increased disposable income through higher tax exemptions, leading to higher consumption.

Fiscal Deficit: Estimated at 4.8% of GDP in FY-25, with a target reduction to 4.4% in FY-26.

Investment in Infrastructure: ₹1.5 lakh crore in interest-free loans to states for capital expenditure.

Public-Private Partnerships (PPP): A new 3-year project pipeline, increasing private-sector involvement.

Urban Development: ₹1 lakh crore allocated for Urban Challenge Fund, promoting cities as economic hubs.

Tax Benefits to the Middle Class: Increased disposable income through higher tax exemptions, leading to higher consumption.

👉 Overall, the budget is pro-growth and positive for GDP expansion, supported by investments in infrastructure, private-sector participation, and increased domestic demand. However, the impact will depend on execution efficiency.

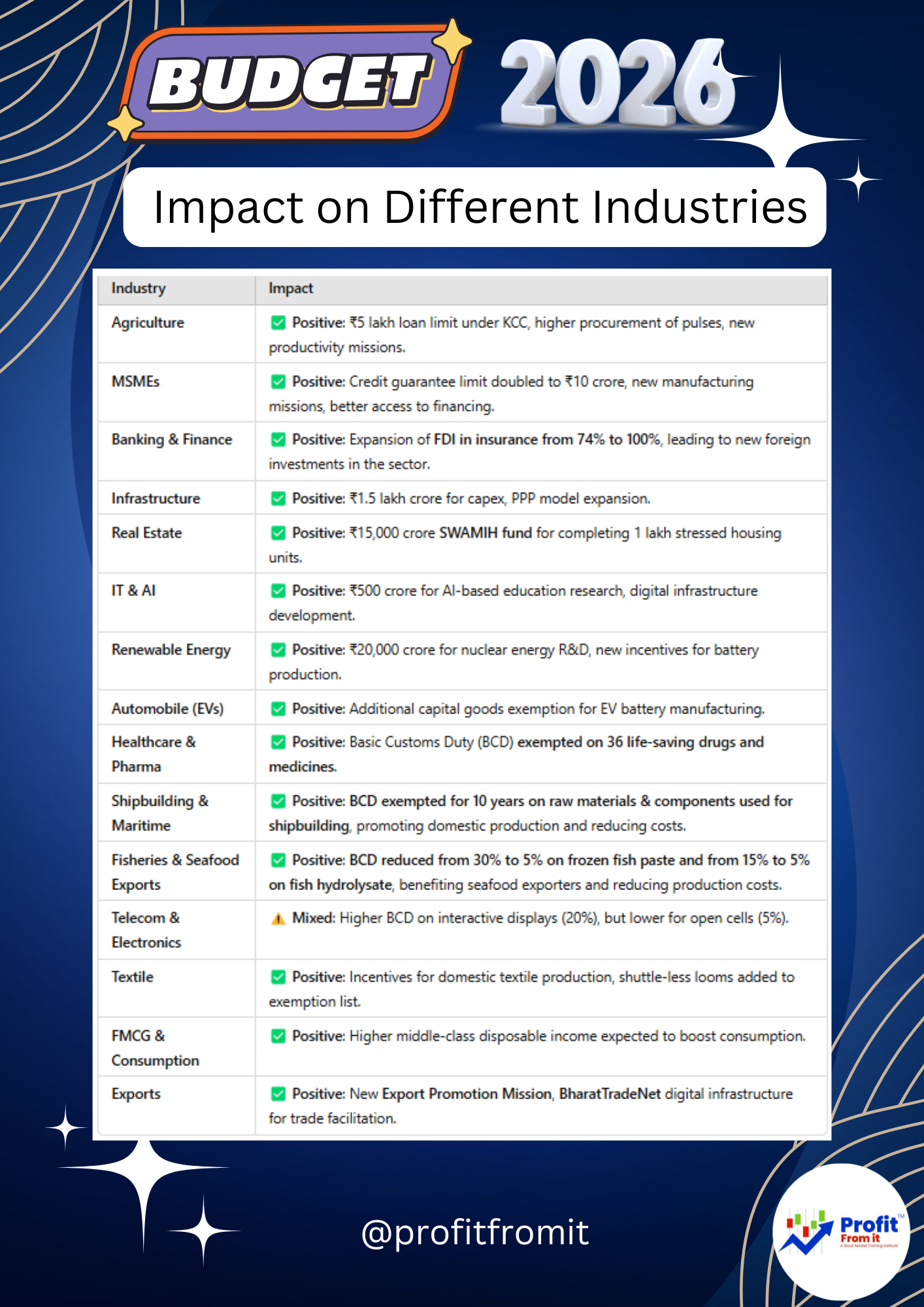

2. Impact on Different Industries

3. Impact on Listed Companies (Including Additional Policies)

Likely Beneficiaries

Potentially Negatively Affected Companies

Final Takeaways

✅ GDP Growth Outlook: Positive, due to fiscal stimulus, increased private-sector participation, and middle-class tax benefits.

✅ Boost to Key Sectors: Agriculture, MSMEs, Infrastructure, Insurance, Shipbuilding, Fisheries, and Renewable Energy.

⚠️ Potential Risks: Execution challenges, impact of higher duties on certain industries.

✅ Boost to Key Sectors: Agriculture, MSMEs, Infrastructure, Insurance, Shipbuilding, Fisheries, and Renewable Energy.

⚠️ Potential Risks: Execution challenges, impact of higher duties on certain industries.