🧭 Viksit Bharat @2047: Key Insights from the 10th NITI Aayog Governing Council Meeting

Date: May 24, 2025

Author: Piyush Patel – Research Analyst | Mentor | Founder, Profit From IT

📝 Summary: Highlights from the NITI Aayog Meeting

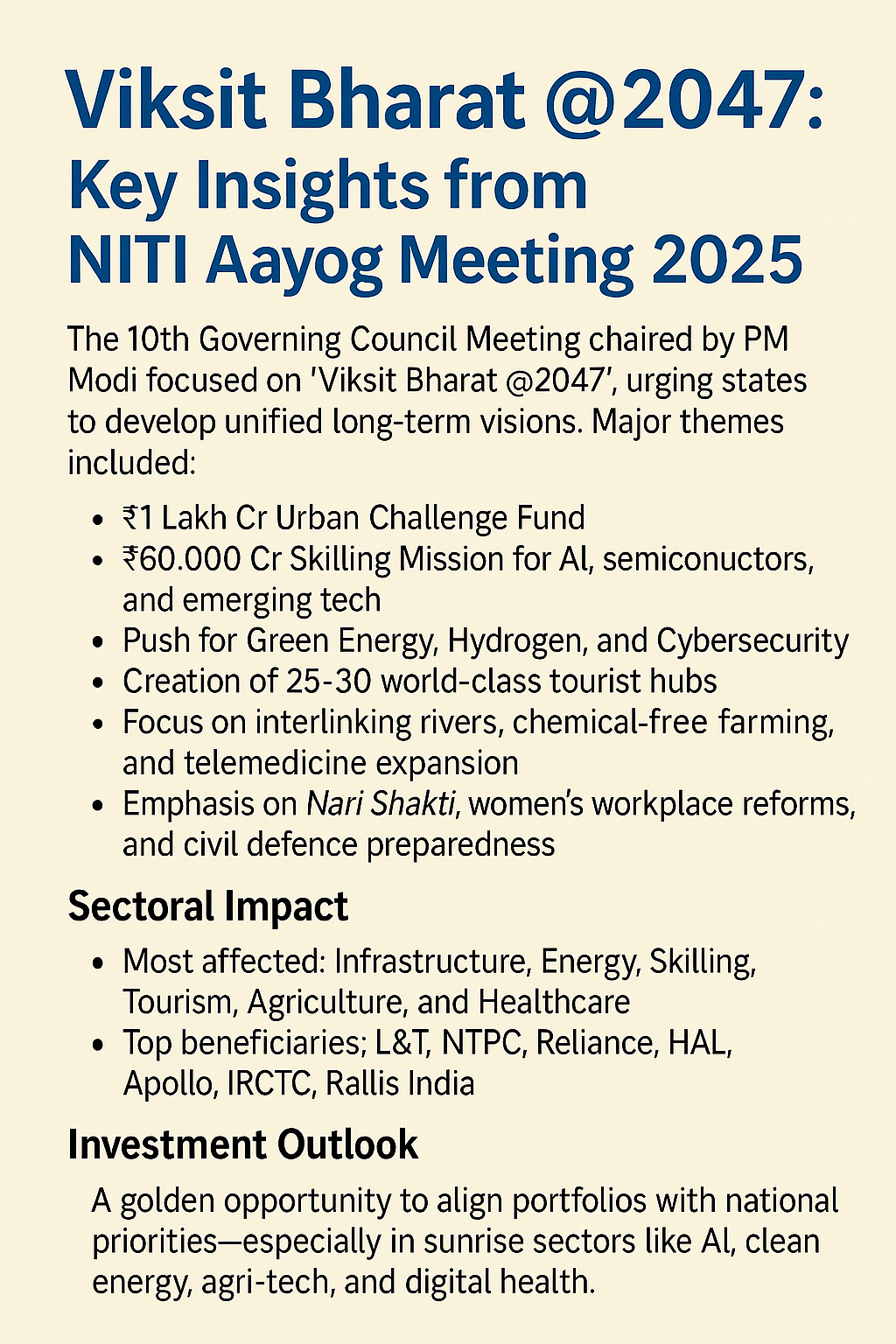

The 10th Governing Council Meeting of NITI Aayog, held at Bharat Mandapam in Delhi, brought together Chief Ministers and Lt. Governors from 24 states and 7 Union Territories. Chaired by Prime Minister Narendra Modi, the meeting was focused on the theme “Viksit Rajya for Viksit Bharat @2047.”

🇮🇳 Major Goals and Vision

Realize the dream of a Developed India by 2047 with joint efforts of Centre and States.

Encourage each state, city, and village to contribute to the national vision.

Reaffirm cooperative federalism as a tool to achieve inclusive growth.

🎯 Key National Priorities Outlined:

Skill Capital of the world with a ₹60,000 Cr skilling mission.

Promotion of AI, Semiconductor, 3D Printing, and modern tech skilling.

Focus on Green Hydrogen, Cybersecurity, and Chemical-Free Farming.

₹1 Lakh Cr Urban Challenge Fund to drive sustainable urbanisation in Tier 2/3 cities.

Interlinking river systems for water security (e.g., Bihar's Kosi-Mochi Grid).

States to create global-standard tourist destinations (25–30 nationwide).

Expansion of e-health services like eSanjeevani & Teleconsultation.

Promote women empowerment with workplace reforms.

Lab-to-Land agriculture strategy with Viksit Krishi Sankalp Abhiyan.

📊 Sectoral Impact Analysis

📈 Charts & Visuals

Chart 1: Government Focus by Sector (Mentions & Budget Emphasis)

🟩 Skilling & Employment: ₹60K Cr

🟨 Urban Development: ₹1L Cr

🟧 Green Energy

🟥 Tourism & Infrastructure

🟦 Agriculture & Water Resources

🟪 Women Empowerment

Chart 2: India @2047 Roadmap: Timeline of Key Milestones

2025–27: State-level action plans, skilling ramp-up, tourist hubs

2027–30: Manufacturing boost, digital economy scaling, green infra push

2030–35: Urban-rural integration, agriculture modernization

2035–40: Advanced health, education, AI integration

2040–47: Viksit Bharat delivery and global leadership ambition

💡 Investment Opportunities: What Should Investors Watch?

✅ Emerging Sectors for Long-Term Gains:

AI & Semiconductor Training: Stake in education tech companies

EV & Green Hydrogen: Accelerated CapEx by Adani, Reliance, NTPC

Healthcare Digitalisation: Surge in demand for telemedicine infra

Tourism & Hospitality: Hotel chains and infra development firms

Urbanization: Housing, infra, smart grid, and logistics players

🧭 Themes to Track:

Women-centric employment platforms

Water-tech & irrigation companies

Defense manufacturing (Make-in-India push)

ESG-friendly agriculture & clean-tech firms

🗣️ Notable Quotes

"Viksit Bharat is not a party’s agenda. It is the aspiration of 140 crore Indians."

— PM Narendra Modi

“States should each build one world-class tourist destination. India can create 25–30 such global attractions.”

— PM Narendra Modi

🔍 Insights & Action Plan for Policy Watchers and Investors

Most Transformative States to Watch:

Bihar – River Grid Pilot (Kosi-Mochi), Agrarian Reforms

Gujarat & Maharashtra – Industrial Development & Global Investment Readiness

Tamil Nadu & Karnataka – Skilling, Semiconductors, and Health Infra

North-East States – Focus on connectivity, sustainability, and grassroots innovation

Strategic Investment Focus: Next 3–5 Years

Participate early in infrastructure & tourism-linked CapEx

Explore ETFs or thematic funds around ESG, Digital Health, Smart Cities

Watch for PLI-linked sectors across manufacturing, electronics, energy

📌 Conclusion

The 10th NITI Aayog Governing Council Meeting has clearly laid the foundation for a multi-decade roadmap for India’s transformation. For investors, this is a unique opportunity to align portfolios with long-term national priorities and emerging sunrise sectors. With every state empowered and incentivized to contribute, the journey to Viksit Bharat @2047 is not just a goal—it's an investable megatrend.

🔒 Disclaimer: The above insights are for educational purposes only. Always conduct your due diligence before making any investment decisions.