🚀 IIP Growth Analysis - January 2025: Insights for Investors 📈

📊 Key Highlights

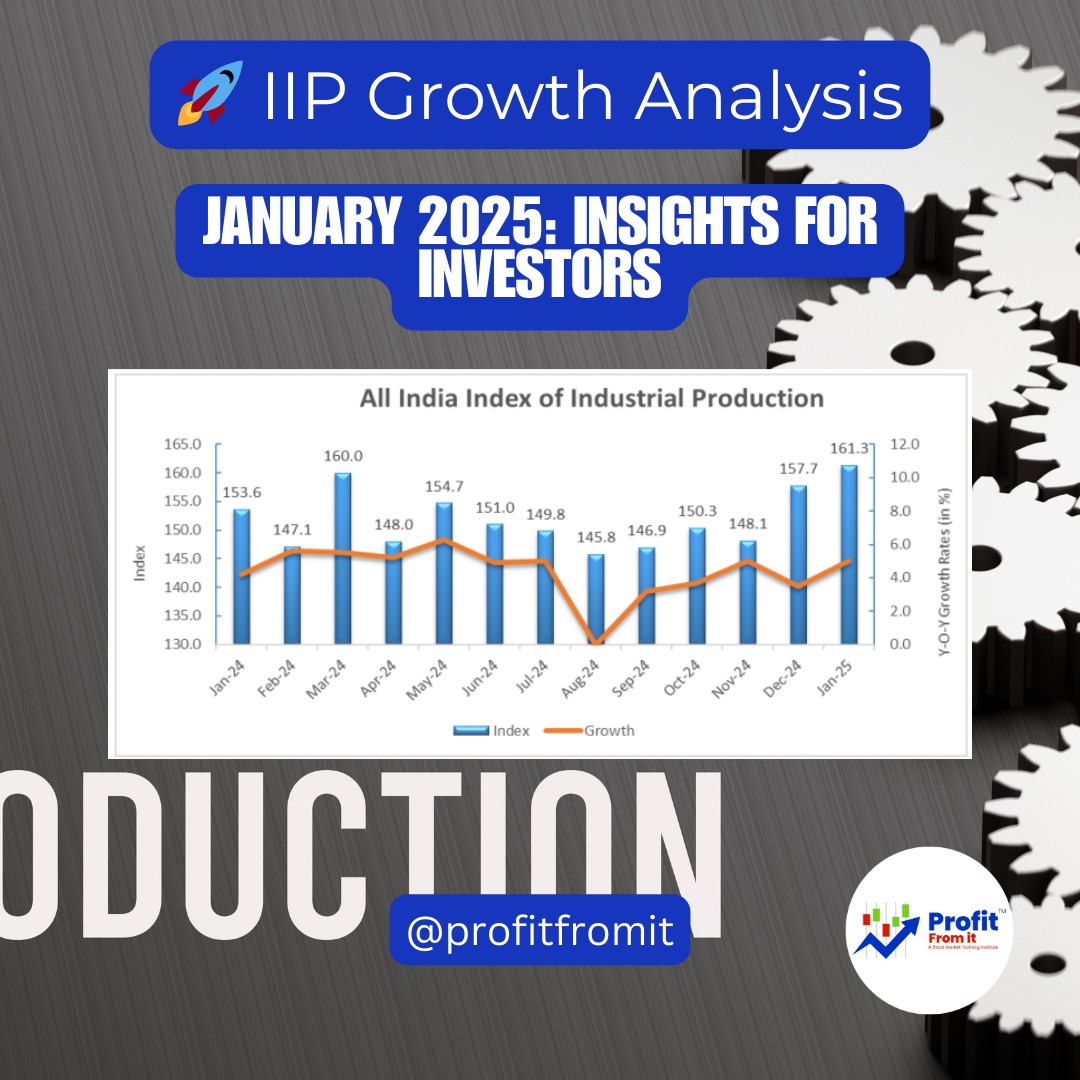

✅ Overall IIP Growth: 📈 5.0% (compared to 3.2% in Dec 2024)

✅ Sectoral Growth:

⛏️ Mining: 4.4%

🏭 Manufacturing: 5.5%

⚡ Electricity: 2.4%

✅ Manufacturing Leads Growth: 19 out of 23 industries saw positive growth.

✅ Top Industry Performer: 🔌 Manufacture of Electrical Equipment (+21.7%)

✅ Biggest Decline: 📉 Printing & Recorded Media (-9.4%)

📈 IIP Growth Trend Over Time

📊 Overall IIP Growth (Apr-Jan 2025): 4.2% (vs 6.0% in Apr-Jan 2024)

📊 December 2024 IIP: 3.5% → 📈 Improved to 5.0% in January 2025

🛠️ Sector-Wise Growth Comparison (Jan 2025)

🔹 Mining: 4.4%

🔹 Manufacturing: 5.5%

🔹 Electricity: 2.4%

📌 Manufacturing is the key driver of growth!

🏆 Top Growth & 📉 Worst Performing Sectors

🚀 Top 5 Growth Segments (Jan 2025)

💡 Investment Insight: These industries are booming and present great opportunities for long-term investors!

📉 Worst Performing Sectors (Jan 2025)

💡 Investment Insight: These industries are struggling. Investors should be cautious before investing.

🔍 Use-Based Growth Analysis (Jan 2025)

💡 Key Takeaways:

✅ Capital Goods (🏗️) & Consumer Durables (🏠) are strong investment areas

❌ Consumer Non-Durables (🛒) are in decline, reflecting weak demand

💰 Investor Strategy: Sector-Wise Opportunities 📊

📈 Sectors to Invest In (Strong Growth)

✅ 🏭 Manufacturing & Electrical Equipment (+21.7%) → Booming industry, high demand for electric components.

✅ 🏗️ Infrastructure & Construction (+7.0%) → Supported by government projects and urbanization.

✅ 🚘 Automobile & Transport Equipment (+20.4%) → Growing demand for vehicles.

✅ 🔩 Fabricated Metal Products (+10.5%) → Driven by infrastructure expansion.

⚠️ Sectors to Watch (Moderate Performance)

🔶 💊 Pharmaceuticals (-0.7%) → Slight decline, but long-term outlook remains positive.

🔶 🛒 Consumer Goods → Durables are strong (7.2%), but Non-Durables are struggling (-0.2%).

❌ Sectors to Avoid (Declining Trend)

❌ 🖨️ Printing & Recorded Media (-9.4%) → Losing relevance due to digitization.

❌ 📄 Paper & Leather Industries (-3.3% & -5.3%) → Struggling with lower demand & high production costs.

🚀 Conclusion & Investment Takeaways

✅ Strong Growth Sectors: Manufacturing, Capital Goods, Infrastructure, and Transport.

✅ Watch Consumer Demand Trends: Mixed signals in consumer goods.

❌ Avoid Printing, Leather, and Paper: Long-term structural challenges.

📢 Investor Tip: Focus on high-growth industrial & infrastructure sectors for maximum returns!

Class Sessions

1- World Economic Outlook Projections

2- SUMMARY OF UNION BUDGET 2022-23

3- Analysis of the IIP data for November 2024:

4- Consumer Price Index (CPI) for December 2024

5- World Economic Outlook Update: January 2025 Update

6- "Investing in India’s Future: What Economic Survey 2024-25 Reveals" 🌏💵

7- Summary of Union Budget 2025-26

8- 📊 RBI Repo Rate Trends & Nifty 50: A 15-Year Market Impact Analysis

9- Inflation, Liquidity, and Market Moves: RBI’s Playbook for 2025:

10- 📊 Inflation Insights & Stock Market Impact – January 2025 CPI Report 📉

11- Income Tax Bill 2025: In The View of Potential long-term impacts for investors in India:

12- India's Labour Market (PLFS: Oct - Dec 2024)

13- India & Qatar: A $10 Billion Investment Game-Changer for 2030!

14- 🔥 Investment Insights from WEF Global Cybersecurity Outlook 2025 🔥

15- Analysis of Foreign Direct Investment (FDI) IN INDIA

16- 📢 India's GDP Report - Q3 FY 2024-25 & Annual Estimates 📊

17- 📊 GST Collection Growth again on uptick in February 2025 after slow down post Octo_24. – 🚀

18- Q3 FY25 GDP data Main Indicator Published

19- India's Economic and Demographic Trend Analysis

20- 🚀 IIP Growth Analysis - January 2025: Insights for Investors 📈

21- India's Inflation Hits an 8-Month Low in February: What It Means for Your Investments

22- 📊 India's Household Savings Trends & 2035 Forecast

23- Unleashing Potential: Education as a Catalyst for Economic Growth and Equity in India

24- 🧭 New Fin Year 2026 Market Brief: Profit Rebounds, Debt Warnings, and a New Gold Rush

25- 🌐 Navigating India’s Global Trade Winds: Opportunities & Risks in 2025

26- 📰 RBI’s April 2025 MPC Policy: A Growth-Friendly Pivot – What Investors Should Know

27- 💡 IIP Insights: What India's Feb 2025 Growth Means for Your Portfolio

28- India–UK Free Trade Agreement: A Transformative Leap for Indian Investors

29- 🧭 Viksit Bharat @2047: Key Insights from the 10th NITI Aayog Governing Council Meeting

30- 📘 India’s IIP April 2025 Report: Capital Goods Lead 20% Growth | Sectors & Stocks to Watch

31- 🇮🇳 India Q4 FY25 GDP Report: Sectoral Trends, Growth Outlook & Stock Market Action Plan

32- 🇮🇳 India’s Poverty Reduction: Key Highlights & Investment Insights (2025)

33- 📊 India’s Inflation Update – May 2025