📘 India’s IIP April 2025 Report: Capital Goods Lead 20% Growth | Sectors & Stocks to Watch

Published on: May 28, 2025

By: Piyush Patel | Investment Mentor @ Profit From IT

📌 Key Insights from April 2025 IIP Data

Overall IIP Growth: 2.7% YoY (vs 3.0% in March 2025) Muted Growth.

Manufacturing Sector: Grew by 3.4% – key contributor to overall growth

Electricity Sector: Up 1.1% | Mining: Contracted by -0.2%

IIP Index Value: 152.0 in April 2025 (vs 148.0 in April 2024)

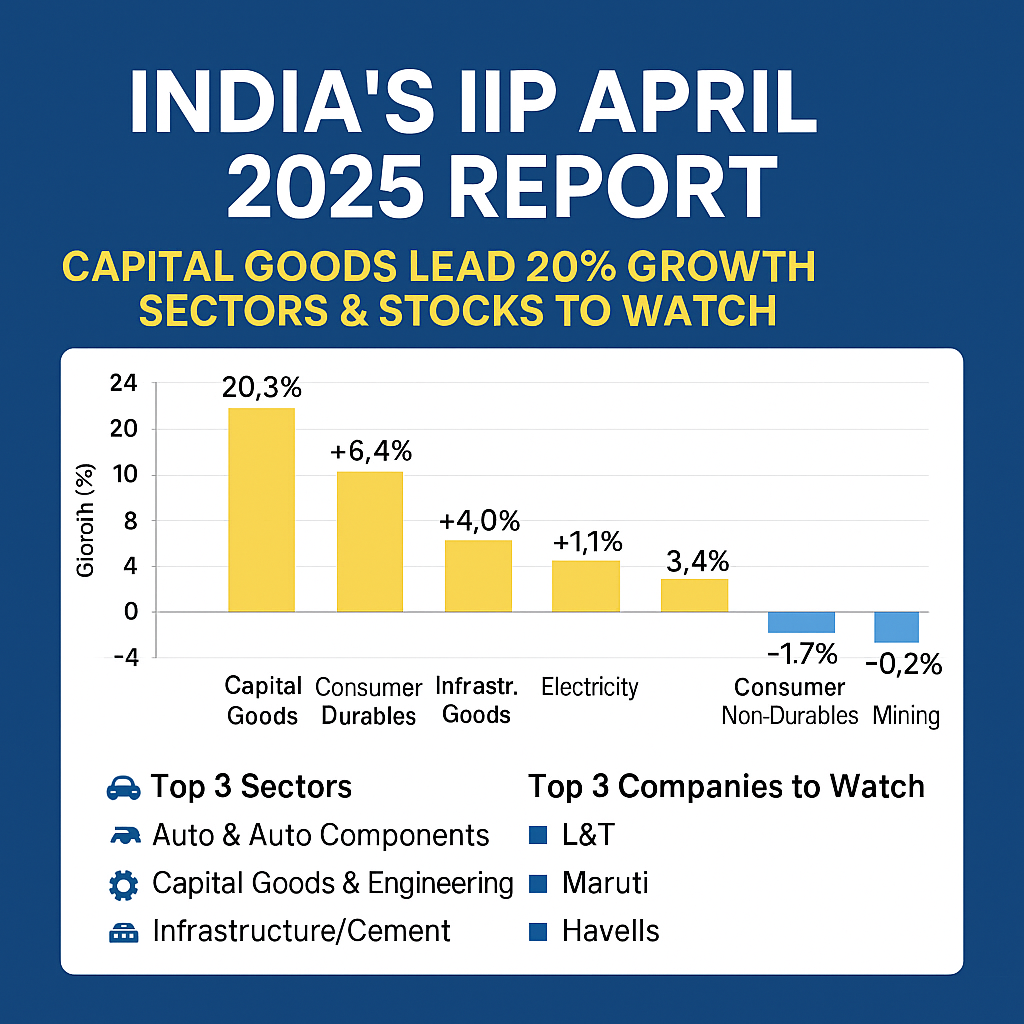

📊 Use-Based Sectoral Growth

🏭 Industry Highlights – Top & Bottom Performers

Top 5 Gainers (YoY):

🏗 Machinery & Equipment: +17.0%

🚗 Motor Vehicles: +15.4%

⚡ Electrical Equipment: +15.2%

🔩 Fabricated Metals: +12.7%

👕 Wearing Apparel: +10.8%

Bottom 3 Decliners:

⚠️ Other Manufacturing: -20.3%

💊 Pharmaceuticals: -3.9%

🧪 Chemicals: -3.6%

🔍 Sectors to Watch – Based on April Trends

Capital Goods: 🚀 Massive 20.3% growth – driven by machinery, tools, engines

Auto & Components: 📈 Revival continues in commercial vehicles & components

Infrastructure & Cement: 🧱 Supported by government capex and construction demand

Electricals: 🔌 Power equipment and appliances gaining momentum

📌 Company Watchlist (Sector-Linked Stocks)

🧠 Analyst’s Interpretation

Industrial output shows mild but broad-based growth.

Capital goods surge points to an investment-led recovery.

Caution in consumer non-durables and mining reflects demand uncertainty.

Manufacturing remains India’s economic backbone.

📅 What to Track Next

May IIP Data (Releases June 30)

Union Budget FY26 – Watch infra spending, PLI schemes

Rural demand trends – FMCG & textile sector impact

🧾 Investor Takeaways

✅ Focus on capital goods and infra-linked sectors

✅ Track auto and electrical space for further gains

✅ Stay cautious on non-durables and commodity-linked sectors

⚠️ Disclaimer

This blog is for educational purposes only and is not a recommendation to buy or sell any securities. Investors must conduct their own research before making any investment decisions.