📰 RBI’s April 2025 MPC Policy: A Growth-Friendly Pivot – What Investors Should Know

📌 Key Takeaway

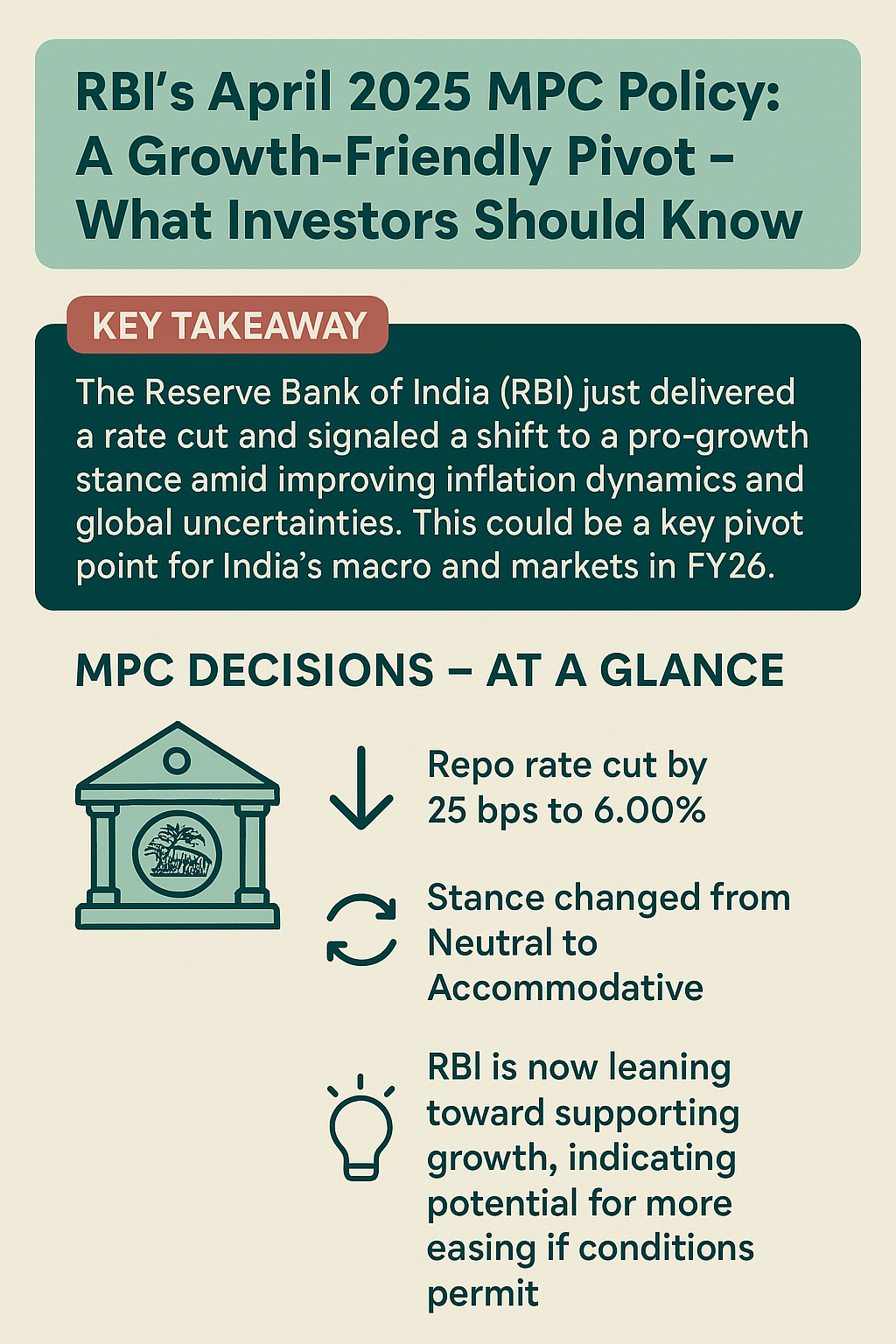

The Reserve Bank of India (RBI) just delivered a rate cut and signaled a shift to a pro-growth stance amid improving inflation dynamics and global uncertainties. This could be a key pivot point for India’s macro and markets in FY26.

🏦 MPC Decisions – At a Glance

Repo rate cut by 25 bps to 6.00%

Stance changed from Neutral to Accommodative

RBI is now leaning toward supporting growth, indicating potential for more easing if conditions permit

💡 What “Neutral to Accommodative” Means for Investors:

A shift from Neutral to Accommodative means the RBI is now more inclined to cut interest rates or maintain low rates to support economic growth. For investors, this signals:

📉 Lower borrowing costs – Positive for businesses and consumers

📈 Potential boost to equity markets – Especially rate-sensitive sectors like banking, real estate, and autos

💰 Better liquidity – Easier access to credit can drive corporate earnings and investment activity

In short: It's a pro-growth signal, and markets often interpret this as bullish in the near to medium term.

🔍 Economic Backdrop

📈 GDP Growth Projections (FY 2025–26)

India’s real GDP is expected to grow at 6.5%, downgraded from previously 6.75% due to global tariff war. Here’s how the quarters stack up:

Growth Drivers:

Urban consumption recovery

Robust rural demand (thanks to strong rabi output)

Infrastructure spending and private capex revival

Healthy banking and corporate balance sheets

💹 Inflation Outlook – Comfortably Within Target

Headline inflation is seen averaging 4.0% in FY26:

What’s helping?

A sharp decline in food inflation (vegetables and pulses)

Softening crude oil prices

Controlled core inflation despite rising gold prices

🌍 Global Influence – A Double-Edged Sword

Global GDP growth is moderating

Dollar weakening; oil falling

Services exports stay strong, but goods exports face headwinds

🔄 Policy Changes Beyond Rates

RBI also announced structural reforms:

Co-lending expansion: Now allowed beyond NBFCs, across all loans

New framework for gold loans: To standardize and de-risk

Securitisation of stressed assets: New mechanism apart from ARCs

Flexibility for UPI limits: P2M transaction limits to be adjusted by NPCI

Regulatory Sandbox: Now “theme-neutral” and always open

📊 Sectoral Impact – Where the Action Is

✅ Potential Winners:

⚠️ On Watchlist:

📈 Investment Strategy Angle

With an accommodative stance and room for future rate cuts, the RBI has laid a foundation for non-inflationary growth. Sectors leveraged to domestic demand, infrastructure, credit, and fintech could see investor interest building up.

🔮 Outlook

The RBI seems ready to stay agile, keeping a close watch on both inflation and global risks. For now, India’s macro story looks stable and growth-positive, setting the stage for broader participation in equity markets.