📊 Industrial Production in India – February 2025 Snapshot

🔍 Key Highlights

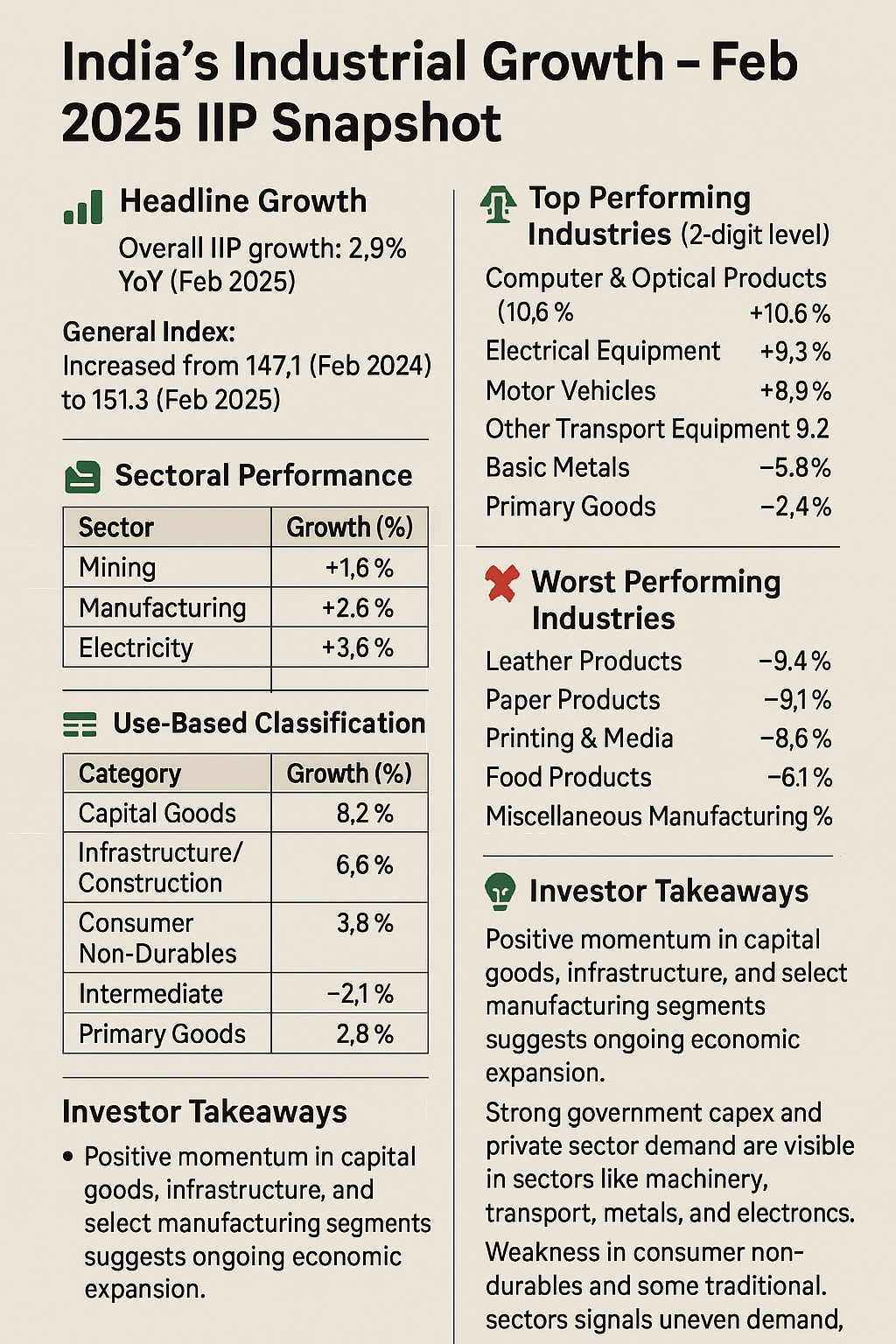

Overall IIP growth stood at 2.9% in February 2025 compared to 5.0% in January 2025.

The General Index rose to 151.3 in Feb 2025 from 147.1 in Feb 2024.

Sectoral growth:

Mining: +1.6%

Manufacturing: +2.9%

Electricity: +3.6%

📈 Sectoral Trend (YoY)

Manufacturing continues to dominate the IIP composition, with the highest weight (77.6%).

🏭 2-Digit Industry Growth – Top & Bottom Performers

🥇 Top Performing Industries (YoY Feb 2025):

❌ Worst Performing Industries:

🧰 Use-Based Classification – Growth Analysis

🧠 How Should Investors Interpret This?

Moderate IIP Growth: While Feb's IIP growth (2.9%) is lower than Jan's (5.0%), the trend still signals economic activity, especially in capital-intensive sectors.

Manufacturing Momentum: Key industrial sectors (autos, metals, electronics) show healthy momentum, indicating selective investment opportunities.

Infra Play: Capital goods and infrastructure goods categories grew over 6%, signaling government capex and housing boom are still strong levers.

Watch Consumer Non-Durables: A decline suggests cautious consumer sentiment or rural slowdown. FMCG investors should be watchful.

Look Beyond Headlines: Sectoral and 2-digit industry analysis is more important than the headline number. Investors can target outperforming micro-sectors.

📌 Conclusion

The IIP for February 2025 reinforces India's multi-speed industrial recovery. While headline growth is slower, the underlying strength in capital goods, infrastructure, and specific manufacturing segments is a bullish signal for long-term investors. Focus on sector rotation, align with government spending trends, and watch for cyclical plays in electronics, auto, and capital goods.